Nordic banks: Q1 Results

Apr 25th, 2013

Mats Anderson, Cheuvreux bank equity analyst, reviews the first round of Nordic Q1 results.

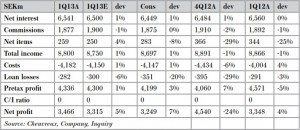

SEB

SEB disappointed in Q1 2013, stemming from weak corporate activity being translated into weak commission generation. However, the group is well placed to benefit from growing business activity from here on while continuing to show cost discipline. The bank has the business mix to be a relative winner over the coming two years.

Revenues

Revenues amounted to SEK9.6bn (SEK9.6bn), which was 3% below consensus expectations. Net interest income (NII) amounted to SEK4.5bn (SEK4.2bn), which was marginally ahead of expectations. The growth in the quarter was derived from volumes rather than margins, particularly as the quarter was marked by declining interest rates and hence increased pressure on deposit margins. Commissions came in at SEK3.2bn (SEK3.3bn), which was 5% below consensus expectations — a disappointment, but a similar trend to that seen with Swedbank. In contrast to Swedbank, SEB’s net items amounted to SEK1bn (SEK1.4bn), 13% below consensus expectations. Apparently Swedbank’s Treasury was more successful than SEB’s in its ALM in the quarter.

Costs and loan loss provisioning

Costs amounted to SEK-5.6bn (SEK-5.7bn). These were thus in line with expectations and this bodes well for the FY 2013E target of SEK-22.5bn. Loan losses amounted to SEK-256m (SEK-206m), 14% below consensus expectations and equal to 8bp (7bp) of the loan book annualised.

Capital

The CET1 Basel III is reported to be 13.4% (13.1%), reflecting the inclusion of IAS19 and deducting half the insurance operations from the core equity and half from the secondary, compared with previously when it was deducted from total capital in full. Clearly the required rate of return for the insurance operation is rising. The risk weighted assets excluding the transitional floor amounts to SEK583bn (SEK675bn), down SEK3bn in the quarter.

Profitability

Furthermore SEB reported a RoE of 11.0% (11.0%) in the relatively weak Q1 2013. SEB targets a RoE of 13% in the present difficult interest rate environment and in the longer term 15%.

Focus on the Merchant division

Looking into the separate divisions, an interesting feature is the large and important merchant banking division’s profitability now that the group increasingly allocates group capital on the divisions. In the quarter the merchant banking division has been allocated SEK48.5bn, basically half the group’s equity, compared with SEK36.3bn in Q4 2012. The profitability of the division, in the admittedly weak quarter, stood at 10.1% compared with 13.9% in the previous quarter. A key area to follow going forward will be not only the C/I-ratio of the division, presently unchanged at 56%, but also how increasing revenues and profitability affect the variable remuneration of the division and to what extent the low profitability in the division affects the bonus pools. At present, the low commission generation in this division has a significant positive impact on the group’s cost base.

Svenska Handelsbanken

SHB is one of the world’s top performing banks, to judge from its track record over the past four decades. That consistent operational performance has come hand in hand with share price performance.

Blue chip Handelsbanken reported a pre-tax profit of SEK4.3bn (SEK4.6bn), which was 3% ahead of consensus expectations. The result is derived from small but basically all positive deviations from consensus expectations, in all P&L lines.

Income

Total income was 1% ahead of expectations at SEK8.8bn (SEK8.9bn), which in turn was derived from the net interest, which was also 1% ahead of expectations at SEK6.5bn (SEK6.6bn). The strong performance comes despite the important Swedish branch operations having absorbed a substantial deposit margin squeeze and consequently seen NII in the division decrease by -4% YOY and -1% QOQ to SEK4.1bn (SEK4.3bn).

Unlike SEB and Swedbank, who reported on Tuesday, Handelsbanken delivered commission generation in line with consensus of SEK1.9bn (SEK1.9bn), despite the claimed weak corporate activity in the usually seasonally weak quarter. Nevertheless, Handelsbanken reports a doubling in advising fees to SEK104m QOQ and a 12% increase in equity commissions to SEK306m in the quarter.

Costs

Costs were up 4% YOY to SEK-4.2bn (SEK-4.0bn), reflecting the group’s organic growth in the UK and also in the Netherlands, combined with higher salaries from the general wage agreement in the sector. In a rare development in the banking sector these days, Handelsbanken’s headcount actually rose to 11,242 (11,156), mainly as a result of the above-mentioned UK expansion. Credit quality remains high, and loan loss provisioning amounted to 6bp (7bp).

Capital

The bank reports a RoE of 13.8% (14.1%) on a CET1 of 17.5% (14.6%), according to its interpretation of Basel III/CRD IV. The adopted CRD IV proposal gives the bank an advantage of 1.1% compared with the proposal at the time of reporting Q4 2012.

Swedbank

Swedbank reported a pre-tax profit of SEK4.9bn (Q1 2012A; SEK4.5bn), which was 5% ahead of consensus expectations, driven by NII of SEK5.4bn (SEK5.2bn) and loan loss provisions. Loan loss provisions at SEK-60m (SEK-172m), equal to 2bp (6bp) improved by the accounting change reporting Ukraine on one line discontinued operation with a negative impact of SEK-390m after the announced sale with closing in 2Q 2013E.

Revenues

Revenues amounted to SEK9.1bn (SEK9.2bn) and were 1% ahead of consensus with the NII of SEK5.4bn (SEK5.2bn) being 4% ahead of consensus expectations. Again Treasury drove the NII, supported by the continued falling interest rates in the quarter. Commission generation amounted to SEK2.4bn (SEK2.4bn), 3% below consensus expectations, with the expected drivers in asset management being slow and payments being seasonally slow.

Costs

Costs amounted to SEK-4.0bn (SEK-4.4bn) driven by lower IT costs and lower fixed staff costs while variable staff costs increased somewhat, reflecting the strong start of the quarter in markets, in January and February. The C/I-ratio improved to 45% (48%), partially reflecting the discontinuity of Ukraine but also the lower IT expenditure.

Capital

CET 1 is reported to be 16.4% (14.5%) according to Basel III IAS19. The RoE is reported to be 15.3% for Q1 2013A.

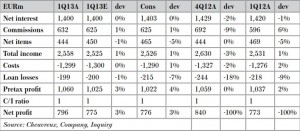

Nordea

Nordea reported a Q1-13 Pretax profit of EUR1,060m (Q1 2012 EUR1,037m), 4% ahead of consensus expectations.

The driver for the 1% better than expected total revenues of EUR2,558m (EUR2531m) is other income. NII was in line at EUR1,400m (Q1 2012: EUR1,420m) while commission income was marginally stronger at EUR632m (Q1 2012: EUR596m). Net items slightly below at EUR444m (EUR469m) due to a weak result in Treasury.

Costs amounted to EUR-1,299m (Q1 2012: EUR-1276m), 1% above expectations, and the cost income amounted to 51%, in line.

Loan losses in aggregate amounted to 23bp (29bp). Loan losses in Banking Denmark were down to 47bp (vs. Q1 2012 55bp). Loan losses in Shipping, Offshore and Oil Services were down to 123bp (185bp). Elsewhere loan losses were very low.

The RoE amounted to 11.3% (Q1 2012: 12.3%) with a CET1 of 13.2% (Q1 2012: 13.1%).

Research disclosures are available at www.cheuvreux.com