Will euros see the Swedes again before year-end?

Oct 12th, 2012

Alex Sönnerberg, Nordic DCM Origination, Crédit Agricole CIB, looks at how the rest of the year might play out for Swedish covered bond issuers in euros in light of factors such as basis swap moves and funding needs.

Will Swedish covered bond issuers come back to the euro market in Q4?

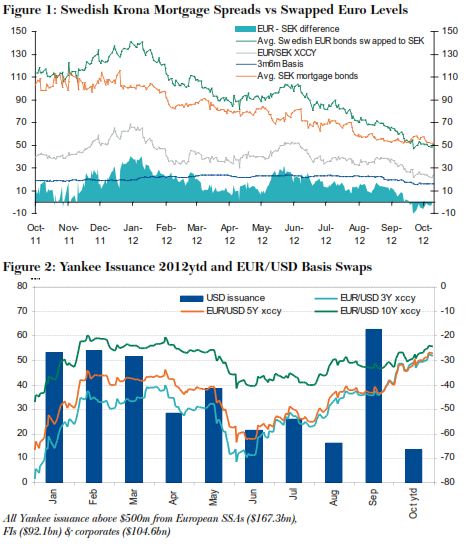

As of today (Thursday) SEB, Handelsbanken, Nordea and Swedbank are all in silent mode, but the euro market has rarely been more attractive for Swedish covered bond issuers. Indeed the euro market is now less expensive than the Swedish krona market as a result of credit spread tightening in euros and, most importantly, a large movement in the EUR/SEK cross-currency basis swap curve in favour of Swedish issuers, as illustrated in figure 1.

Why has the EUR/SEK basis swap tightened so much?

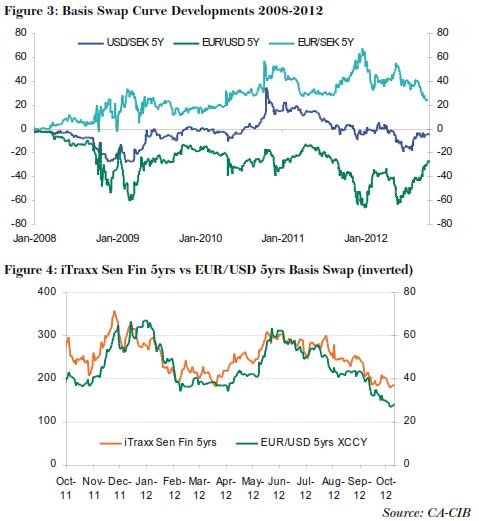

For a number of reasons, but a large volume of Yankee supply in 2012 is a key driving factor. As shown in figure 2, the EUR/USD basis swap curve is highly correlated with primary market supply from European issuers in US dollars. European SSA, FI and corporate issuers have printed $363bn in the Yankee market year-to-date, of which $60bn+ was issued in September alone. Most, but not all, of the proceeds should have been swapped back to euros, resulting in the EUR/USD basis being bid up. Since the USD/SEK basis has traded in a tight range in the medium and long end of the curve, the shift in EUR/USD upwards/less negative has indirectly tightened EUR/SEK basis spreads, as shown in figure 3 (see page 7).

For a number of reasons, but a large volume of Yankee supply in 2012 is a key driving factor. As shown in figure 2, the EUR/USD basis swap curve is highly correlated with primary market supply from European issuers in US dollars. European SSA, FI and corporate issuers have printed $363bn in the Yankee market year-to-date, of which $60bn+ was issued in September alone. Most, but not all, of the proceeds should have been swapped back to euros, resulting in the EUR/USD basis being bid up. Since the USD/SEK basis has traded in a tight range in the medium and long end of the curve, the shift in EUR/USD upwards/less negative has indirectly tightened EUR/SEK basis spreads, as shown in figure 3 (see page 7).

Usually Swedish banks would be on the other side of the trade, swapping euro covered bond proceeds to kronor as required by legislation, preventing the cross-currency basis swap from tightening as much on back of movement in the EUR/USD basis. The difference in 2012 has been that Handelsbanken was the only active Swedish bank in the euro market when it issued a five year Eu1.5bn deal in March (with CA-CIB as bookrunner), compared with last year when Swedish covered bond supply totalled Eu10bn courtesy of four issuers.

Other factors helping push the EUR/SEK basis tighter this year have been increased volumes of foreign borrowers, primarily SSA issuers, raising Swedish krona-denominated funding and more Swedish krona-based investors buying euro-denominated assets hedged with cross-currency basis swaps instead of FX forwards. In 2011 foreign issuers printed Eu6.3bn equivalent of Swedish krona-denominated bonds (SEK55bn) and total supply year-to-date 2012 equals Eu5.3bn (SEK46bn).

Which direction will the EUR/SEK basis swap curve go from here?

The basis swap market has been much more supply driven as opposed to sentiment driven lately and the large volumes of Yankee supply have definitely helped improve liquidity in the market. Now that the US earnings season has officially kicked off, CA-CIB’s New York syndicate desk expects less primary market supply overall as investors will turn their attention to results for an update on corporate health instead. As such, the basis market will be much more vulnerable to headline risks, especially stemming from the euro-zone in the coming weeks.

The iTraxx Senior Financials index is a good gauge for sentiment towards European banks that account for approximately $100bn of Yankee market issuance in 2012 year-to-date, and, as shown in figure 4, the index is closely correlated with the five year EUR/USD basis. In other words, if market sentiment deteriorates then credit spreads will widen, the basis swap spread will move down/more negative, and liquidity will evaporate from the cross-currency basis market as the Yankee issuance stops.

Consequently, the downside risk of EUR/SEK widening again is greater than continued tightening in the basis swap for Swedish issuers as a result of the volatile situation in the euro-zone.

Does it mean that Swedish banks will print euro covered bonds after Q3 earnings?

First and foremost it depends on the funding requirements of Swedish banks. Most report that they are fully funded for 2012 so it will likely depend on funding demand next year when Eu4bn of euro-denominated covered bonds from Swedish issuers are maturing.

Therefore the negative cost of carry from pre-funding must be taken into consideration and weighed up against the importance of being a frequent issuer in the euro market — the largest market for Swedish issuers after the domestic — and looking after the continental investor base.

As such, there is some chance that we’ll see opportunistic covered bond issuance from Swedish banks in Q4, but odds are that we’ll have to wait until the first quarter next year before supply resumes properly.

Swedish banks will start reporting third quarter results in the week commencing 22 October, with Svenska Handelsbanken first out, followed by Swedbank (23rd), Nordea (24th) and SEB (25th).