What ECBC stats tells us about Nordic markets

Aug 22nd, 2013

The ECBC has this week released 2012 covered bond market statistics. The numbers are the most comprehensive set of covered bond figures available as they include both public and private placements and retained bonds, and Florian Eichert, Crédit Agricole CIB senior covered bond analyst, looks at what they tells us about Nordic markets.

The covered bond market has continued to grow in 2012, albeit at a slower pace than the year before. Outstanding covered bond volumes worldwide grew by 5.2% to reach Eu2.813tr after Eu2.674tr in 2011. The market had still been growing by 6.8% in 2011. Bank deleveraging, stronger reliance on central bank funding and stable to shrinking asset markets in a number of countries all contributed to this slowdown. What kept the market in growth territory was on the one hand a significant increase in the issuance activity of non-European countries, such as Australia or New Zealand. On the other hand banks especially from countries like Italy or Spain used newly issued and retained covered bonds as collateral for central bank repo operations. Overall new issuance increased slightly by 1.5% to Eu707bn.

After Belgium and Panama joined the market in 2012 and the last covered bonds from Latvia matured, at the end of the year the market comprised a total of 29 different countries and a total of 306 issuers. In 2011 we still had covered bonds from 28 countries and 321 issuers.

Despite shrinking by 10%, the Pfandbrief market is still the biggest sector, amounting to Eu525bn or 19% of the overall covered bond market. Looking at mortgage backed covered bonds only — the collateral type where the biggest issuance has been taking place in recent years — Spain is the biggest market with Eu407bn followed by Denmark with Eu360bn. The covered bond market is still a predominantly European one. Covered bonds issued by countries from outside Europe, such as Australia, Canada, New Zealand or South Korea, only account for 3.5% of all covered bonds outstanding worldwide.

Closer look at the Nordics

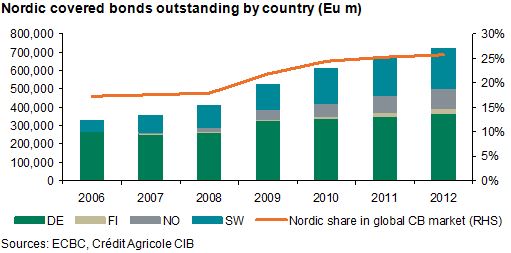

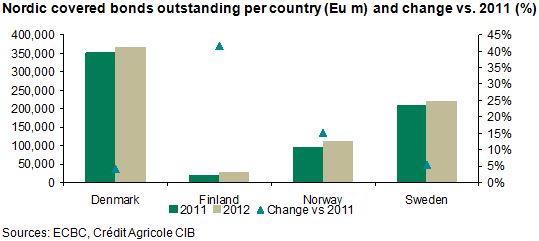

Historically, Nordic covered bond markets had been mainly made up of Danish and Swedish covered bond markets. Only in the last five years did Finland as well as Norway start contributing in meaningful size. By now, Nordic covered bond markets, which totalled Eu723bn (based on end 2012 ECB exchange rates), make up 26% of the global covered bond market (up from 25% in 2011). The two oldest countries still are the ones with the biggest volumes. The Danish market amounted to Eu366bn, with the Swedish market coming in at Eu220bn. Norway (Eu110bn) as well as Finland (Eu27bn) are well behind that.

When it comes to dynamics and growth rates, though, it is above all the Finnish (+42%) as well as the Norwegians (+15.3%) that clearly steal the show. Especially the Norwegian issuers (there were 22 of them at end-2012) have been playing catch up with the other two big markets also in absolute terms after having been the last to start issuing out of the four countries.

Despite the highest growth rate, Finland is still a relatively small market both in absolute terms as well as in terms of the number of issuers (five at the end of last year). In terms of new Finnish entrants into the covered bond market so far this year we can only mention Aktia Bank plc. Since the new programme is, however, merely replacing the old Aktia Real Estate Mortgage Bank covered bond programmes it is per se not necessarily going to add to further significant growth.

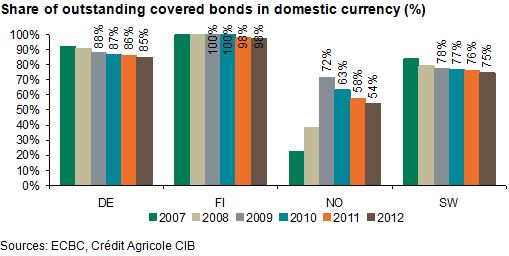

Denmark and Sweden in particular have always had very strong and deep domestic markets they could fall back onto in times of stress in international covered bond markets. As a result the share of issuance in domestic currencies has always been high for the two sectors. In recent years, issuers from both countries had started to make more use of international markets, actively tapping into euro as well as, increasingly, the US dollar markets. This trend has continued in 2012. The share of Swedish krona covered bonds for Swedish issuers has fallen to 75% of total outstanding at the end of last year; in Denmark it is still higher at 85% but also coming down continuously.

The big exception to this pattern has been Norway. The big spike in Norwegian krone issuance in 2009 was, however, mainly due to central bank support during the crisis as the Norwegian government exchanged Treasury Bills for Norwegian covered bonds in an attempt to support Norwegian banks’ liquidity during the crisis. It had nothing to do with a sudden surge in publicly placed funding or major investor demand for Norwegian krone assets. As more and more swaps have been terminated, euro and US dollar issuance have taken over. Since 2009 the share of domestic currency covered bonds has come down significantly and at the end of 2012 stood slightly above half of the outstanding volume.

Going forward

Many of the themes of 2012 still continue to be major factors in 2013. Issuance across the board from European issuers in H1 2013 was muted, especially in public benchmark covered bonds. Banks are still reducing balance sheet while there are still banks that continue to rely on central bank funding. This is probably somewhat less of a factor up in the Nordics than in other parts of Europe, but we are still a long way away from historical euro benchmark covered bond issuance volumes from Sweden, for example.

Back in November last year we came out with a euro benchmark covered bond issuance forecast for Nordic issuers of Eu18bn. We have reached Eu11.3bn or 63% of the forecast. We are fairly confident that we will get at least pretty close to this forecast before year end. Nordea Bank Finland was the first issuer to tap the market after a short summer break, issuing a Eu1.5bn five year bond on the back of a book twice the size. The demand is there even at the tight spread levels; it is up to the issuers to make use of it.

Overall the globalisation of the covered bond product will continue, with the first covered bond from Chile having been sold and Singapore potentially joining the covered bond club this year. However, it will take a bit longer before these new countries can add sizable volumes that drive the overall statistic.

Looking at the Nordics again, the collateral markets there have been among the very few to still be growing in recent months. One could thus assume that banks from the Nordic region have natural needs in covered bond funding going forward and will be much more active than before. Unfortunately house price growth is slowing (with the exception of Norway) and governments are trying to rein in mortgage market activity, for example by increasing mortgage risk weights and introducing LTV limits for new lending. On top of that banks from the region have had very cheap access to senior markets.

Ultimately 2013 will be another slow year for covered bonds at the global level as well as for Nordic sectors and much of the same could be on the menu for 2014, we’re afraid. Widening, if it happens, will be relatively short lived as investors are still in the mood to buy at wider levels rather than fear a major sell-off and offload further bonds into a widening move. Squeeze time is here and it looks like it is here to stay.