TLTROs and ABS purchase programme: Any ECB impact on covered bonds?

Jun 12th, 2014

Crédit Agricole covered bond analysts weigh the covered bond implications of extraordinary measures announced by the European Central Bank for covered bonds. The market will remain a seller’s market, but the impact on issuance volumes will not be as dramatic as some might expect, they say.

The European Central Bank last week announced measures to fight disinflation trends in the Eurozone. These measures range from two to four year targeted longer term refinancing operations (TLTROs) to preparatory work for a future ABS purchase programme.

The initial reaction from many investors that we have been confronted with has been the fear that issuers are now going to stop issuing altogether and that markets will remain as squeezed as they have been lately or get even worse. We give our thoughts on the matter below.

In short, while we agree that the ECB will support the ongoing squeezy feel in markets as well as an ongoing technical support for peripheral debt, we are not quite as apocalyptic regarding covered bond issuance as some might think. We just feel that two to four year funding from the ECB, even at very cost efficient rates, does not replace long term funding banks can get from covered bond markets, and we are already looking at very low issuance volumes. It will impact shorter dated funding products such as senior much more. The squeeze between these two product classes will thus continue to remain in place, even though based on fundamental considerations the difference between the two has, in our view, been mispriced for quite some time.

Main Features of upcoming TLTROs

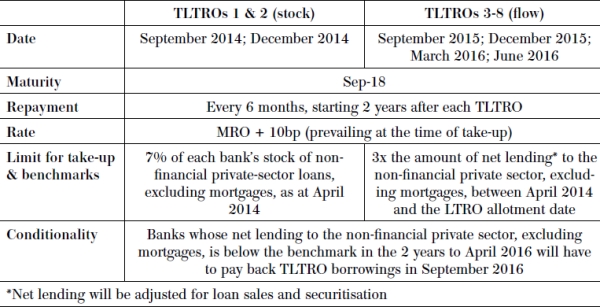

TLTRO details

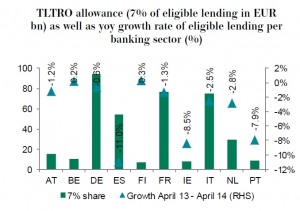

There will be two TLTRO operations, in September and December this year and both maturing in September 2018, where Eurosystem banks will be able to borrow up to 7% of their overall loans to the non-financial private sector excluding loans to households for house purchases. The total volume of these will amount to around Eu400bn based on the 7% figure mentioned above, and range from as little as Eu8bn in Ireland and Finland to as much as Eu95bn in Germany, Eu77bn in France, and Eu75bn in Spain.

And if banks’ net lending to these clients after April 2014 exceeds a benchmark set by the ECB they will be able to borrow up to three times the cumulative net lending above their bank-specific benchmark in six further TLTROs that will be conducted quarterly from March 2015 and June 2016.

The benchmark used for the additional TLTROs will be set specifically for each bank taking into account its net lending in the 12 months  to April 2014. According to our economists, net lending thus does not necessarily have to be positive. It could turn out to be sufficient if banks merely deleverage less or in other words shrink lending less aggressively than they have done in the last 12 months.

to April 2014. According to our economists, net lending thus does not necessarily have to be positive. It could turn out to be sufficient if banks merely deleverage less or in other words shrink lending less aggressively than they have done in the last 12 months.

Consequently, our economists expect TLTRO take-up to be sizeable, reaching up to Eu300bn in the first two TLTROs, and then continuing to grow in TLTROs three to eight. They also expect peripheral banks to more or less use up their full allowance as many institutions still holding on to three year LTRO money will likely use the new TLTROs to roll the remaining balance. Even if they don’t reach the net lending requirement and have to repay in September 2016, they will have extended their original LTRO maturities by an extra one and a half years without any penalties attached.

Impact of TLTROs on covered bond issuance volumes

Turning to covered bonds more specifically and what we expect for issuance:

- It is true that short term money can also be used to fund long term assets. And if non-mortgage assets are funded via the ECB, it leaves more room for deposits to fund mortgages and thus reduces overall covered bond funding needs even though residential mortgages are not part of the eligible lending.

- However, getting cheap funding for a period of up to four years does not fully replace the need to refinance long term assets with long term liabilities. In addition to this, TLTRO maturities will become shorter the further along the process we are (the last TLTRO in June 2016 will have a tenor of only 2.3 years).

- Consequently we don’t see why banks should all of a sudden stop using covered bonds to issue at the long end of the curve, especially in the current yield and spread environment. The TLTROs will rather be used to replace other shorter term funding tools, such as three year LTROs or maybe senior.

Issuance in the five year maturity that has been so prominent could initially move to the seven and 10 year tenors for Eurozone banks (at least for the remainder of 2014 and early 2015) as it only marginally extends the curve beyond the TLTRO terms while being significantly more expensive for issuers.

ABS purchase programmes

In spite of efforts to push SME secured debt structures such as the Bank de France model for SME funding, covered bonds are not part of the ECB’s plans. The central bank is, rather, focussing on the ABS market.

The way we read the ECB statement is that a wide range of securitisation types will be eligible, including RMBS. Consequently, the purchase programme could directly compete with covered bond funding and in theory take away some volumes from covered bond markets. However, as long as issuers have to retain mezzanine and equity pieces or don’t get any capital relief through other measures (maybe guarantees by the likes of the European Investment Bank or national agencies), RMBS are nothing but another funding tool that will compete with covered bonds on economic grounds.

Looking at the wider market, though, despite the tightening in RMBS space, we don’t think RMBS will be able to compete with traditional covered bonds and thus impact covered bond funding volumes.

Bottom line

The ECB announcement is in our view yet another element that adds to an already squeezed market. The option of going to the ECB means that issuers have less pressure to aggressively enter wholesale markets. They can wait and if they don’t like conditions at a certain point in time later this year they can still go for TLTRO funds if necessary. Covered bond markets, which have been issuer markets for a long time, will thus very likely remain issuer markets. The impact on issuance volumes will, however, not be as dramatic as some might think:

l We stick to our 2014 euro benchmark covered bond issuance forecast of Eu110bn as we have seen slightly more than Eu60bn of euro denominated benchmark covered bond issuance so far this year and are thus on target. In addition to this, 28% of 2014 issuance so far has come from non-Eurozone covered bond issuers (after 24% in 2013). These entities will not have access to ECB money and thus continue to operate as they have in the past. And covered bonds play a vital part in these banks’ funding plans.

- In the short term we might merely see a slight shift in country weights, as peripheral markets might put a bigger weight on the TLTROs than many core issuers, and banks from Austria and Germany might directly fund some of their commercial mortgage origination via the ECB rather than covered bond markets.

- Last but not least, we will probably see a maturity shift in the primary market away from five years to the seven to 10 year space, at least this year and early next.

The TLTROs will in our view have a bigger impact on shorter term funding products, including senior unsecured debt. The spread between covered bonds and senior unsecured will thus remain squeezed for even longer. Fundamental factors have long ceased to explain the relationship between the two and technicals will now continue to weigh heavily on the product pairs.

Florian Eichert

Senior Covered Bond Analyst

Stephan Dorner

Covered Bond Analyst

Crédit Agricole CIB

Chart sources: ECB, Crédit Agricole CIB