SpareBank 1 bolsters commercial mortgage issuer, eyes dual benefits

Aug 8th, 2013

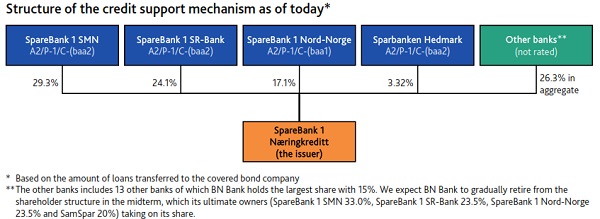

Norway’s SpareBank 1 alliance has strengthened liquidity and capital support of its commercial mortgage covered bond issuer, SpareBank 1 Næringskreditt, in a move recognised by Moody’s and which the issuer hopes could yield pricing benefits.

The SpareBank 1 alliance issues residential mortgage backed covered bonds internationally and domestically through SpareBank 1 Boligkreditt, but has issued commercial mortgage backed covered bonds domestically through SpareBank 1 Næringskreditt.

Arve Austestad, chief executive of SpareBank 1 Boligkreditt, told The Covered Bond Report that the changes to the Næringskreditt support mechanisms bring them into line with those of the Boligkreditt.

According to a Moody’s release, the members of the SpareBank 1 alliance that jointly own SpareBank 1 Næringskreditt have to ensure that the issuer has sufficient funds to repay covered bonds and any related swaps that mature within any ensuing 12 month period, on a rolling basis.

According to a Moody’s release, the members of the SpareBank 1 alliance that jointly own SpareBank 1 Næringskreditt have to ensure that the issuer has sufficient funds to repay covered bonds and any related swaps that mature within any ensuing 12 month period, on a rolling basis.

The issuer receives the necessary liquidity to repay maturity covered bonds by issuing covered bonds to the parent that it must repurchase at par.

“The parent banks may therefore be able to use the covered bonds as collateral in repo programmes with the Norwegian central bank,” said Alexander Zeidler, vice president, senior analyst at Moody’s, “which would mean that providing liquidity to the issuer is only a limited drain on the parents’ own liquidity profile.”

In addition, the parent banks must maintain a Tier 1 capital ratio of at least 9% and before transferring loans to the issuer a bank will provide equity and other subordinated capital equal to at least 12.5% of the transferred loan amount, according to Moody’s.

This compares favourably with a previous commitment to provide capital of at least 10%, said the rating agency, while the liquidity support is a strong improvement on the previous asset quality support.

“For both liquidity and capital support, the parents’ obligation is now up to twice a parent’s pro-rata shareholding in the issuer,” said Zeidler, “which creates some solidarity between the parents and mitigates the issue of having several credit-support providers, possibly of different credit strengths (some unrated).”

The strengthening of the credit support mechanism is credit positive for the commercial mortgage backed covered bonds, he said, with the Timely Payment Indicator (TPI) leeway and overcollateralisation requirements improving as a result.

The covered bonds are rated Aa3. Whereas they previously did not have any TPI leeway, this now stands at two notches. The TPI is “probable” – the issuer does not have a public rating. The OC commensurate with the covered bond rating has fallen from 20% to 10.5%.

Austestad said that in the Norwegian domestic market there is a pricing differential of around 20bp between SpareBank 1’s Aa3 Næringskreditt and Aaa Boligkreditt covered bonds as a result of a combination of the different cover pools and ratings. He said that he hopes the changes to the Næringskreditt support could reduce the differential.

Although SpareBank 1 has until now only issued Næringskreditt covered bonds domestically, Austestad said that it could issue the commercial mortgage backed covered bonds internationally.

“There are no limitations in this regard, but given that the Næringskreditt pool is pretty well known in Norway it made it easier to issue domestically initially,” he said.

Næringskreditt issues some Nkr5bn of covered bonds annually compared with some Nkr10bn of domestic Bolgikreditt issuance, according to Austestad.

Vest drops Fitch from covered

Sparebanken Vest plans to drop Fitch from rating its residential mortgage backed covered bond programme, the Norwegian bank announced on Tuesday.

Sparebanken Vest Bolikgreditt’s covered bonds have hitherto been rated triple-A by Fitch and Moody’s.

“As part of the Sparebanken Vest Group’s efforts to increase efficiency, simplify operations and reduce costs, Sparebanken Vest Boligkreditt has concluded that [a] rating from Moody’s is sufficient for residential mortgage covered bonds issued by the company,” it said. “One rating is also in line with most other covered bonds companies in Norway.

“Sparebanken Vest Boligkreditt has therefore requested for withdrawal of the ratings by Fitch Ratings of covered bonds issued under the Eu8bn EMTN Covered Bonds Programme.”

Fitch rates Sparebanken Vest A- and Moody’s, A2, with the two ratings on stable outlook.

Sparebanken Vest Bolikgreditt has issued three euro benchmark covered bonds and is also active in the domestic market.