Safe haven status maintained in a risk-on market environment?

Sep 20th, 2012

Alex Sönnerberg, Nordic DCM Origination at Crédit Agricole CIB, explores trends in the performance of Nordic financial institutions’ issuance this year and makes predictions for a post-OMT market.

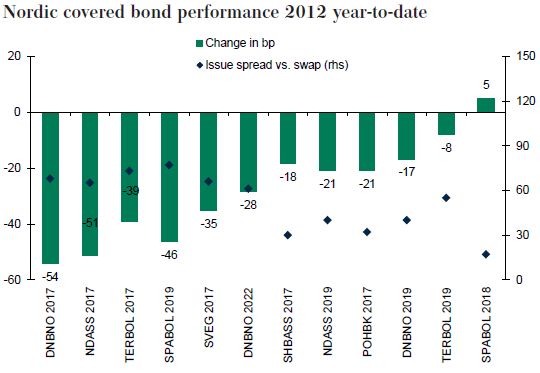

Buying bonds issued by Nordic banks rather than their euro-zone exposed peers on the continent has proven to be a good investment.

Buying bonds issued by Nordic banks rather than their euro-zone exposed peers on the continent has proven to be a good investment.

It’s easy to understand why highly capitalised banks that generate stable earnings and operate in triple-A rated countries became regarded as a safe-haven for many investors in 2012.

Divergence between the regions was particularly large during the beginning of the year when Nordic national champions were among a small group of banks with access to the euro primary market while others relied on the ECB for funding.

It wasn’t until a few weeks ago that investors became more comfortable buying bonds from peripheral banks again, but only after Mr Draghi pledged unlimited sovereign debt purchases and outlined the “Outright Monetary Transactions” programme. Therefore, it’s understandable that we have seen some investors taking profits on their safe haven Nordic investments lately — but given the many uncertainties ahead for the euro-zone we think Nordic banks will maintain their popularity amongst investors going forward.

Swedish banks have predominately utilised the euro primary market for senior unsecured funding this year while the well functioning domestic market has offered attractive pricing and sufficient depth to satisfy their covered bond funding requirements. Year-to-date senior bond supply totals Eu14.1bn from 13 deals, while Handelsbanken remains the only Swedish borrower to have printed a euro-denominated covered bond, primarily due to the expensive EUR/SEK cross-currency basis swap.

After a tough year for Danish banks in 2011, bank package IV helped to restore investors’ confidence in the Danish banking sector, which enabled Danske Bank, Nykredit Bank and Sydbank to access long term senior unsecured funding in the euro market. So far we’ve seen six deals from Denmark this year, including one Junior Covered Bond issued by Nykredit Realkredit, totalling Eu4.5bn.

Although Finland is part of the EMU, Finish banks have not suffered from the euro-zone crisis. Pohjola has visited the market three times this year with covered, senior and subordinated bond issues, while Nordea continues to use its Finish bank for covered bond funding in the euro market. Together they have issued Eu6.25bn year-to-date and Sampo Bank has been in the market today (Thursday) with a seven year benchmark sized covered bond.

Norwegian banks are the second most active Nordic issuers in the Euro primary market after the Swedes, having printed 10 deals totaling Eu10.9bn in 2012. DNB, Norway’s largest bank, has accounted for Eu6.5bn after printing one senior unsecured and three covered bonds this year. Smaller Norwegian banks such as Terra BoligKreditt, Sparebank 1 and Sparebanken Vest have also issued euro covered bonds. Even though Norwegian households are more indebted now than before the financial crisis, strong growth in real disposable income is supporting rising property prices and investors show no signs of worry for the future of Norway with its Oil Fund.

Nordic banks have issued Eu37bn of senior and covered bonds in total year-to-date, which is equivalent to 20% of total supply in the euro primary market. Net supply from Nordic banks now stands at Eu19bn and we expect further issuance before year-end as banks continue to pre-fund 2013 redemptions, which total Eu22.5bn.

After a surge in covered bond issuance in 2010 and 2011, Nordic banks have predominately used the euro market for senior unsecured funding, having issued more than Eu20bn in 2012 compared with Eu16.5bn of covered bonds.

Benefiting from strong credit stories, Nordic banks have also been able to issue subordinated debt to build capital buffers in 2012 ahead of the expected bail-in regime. National champions Nordea, DNB and Pohjola reopened the market in the first quarter and more recently SEB also printed a Tier 2 deal that brought total subordinated issuance from Nordic banks to Eu4.2bn. Danske Bank opted for the Eurodollar market when it sold a $1bn callable Tier 2 bond that was heavily oversubscribed last week.

The German and Nordic investor bases continues to be the largest buyers of Euro-denominated Nordic bonds, but with the compression of spreads between the Nordics and continental Europe, other jurisdictions are increasing their share.

For example, French investors that are heavily exposed to domestic issuers are buying more Nordic bonds now following the rally and spread compression between OAT/French banks and the Nordics. As Nordic primary market supply has been limited in the third quarter, French insurers and asset managers have been very active buyers of Nordic paper in the secondary market lately.

Spreads between the banks within the Nordic region are also converging as more investors compete for limited amounts of high quality assets. For example, spreads of Danish banks have tightened considerably to their Nordic peers: on 2 July Danske Bank and Handelsbanken both printed three year senior unsecured deals, at mid-swaps plus 168bp and plus 60bp, respectively. Today, Danske’s bond is trading 31bp tighter than re-offer while Handelsbanken is 13bp tighter.

Despite the strong rally in Nordic bonds year-to-date, they still offer relative value compared with continental peers, such as German banks, and Nordic paper remains scarce in the secondary market so new issue supply will also be well received in the euro primary market going forward.