Q1 Nordic FIG issuance review: safe haven status allows Nordics to cherry-pick

Apr 4th, 2013

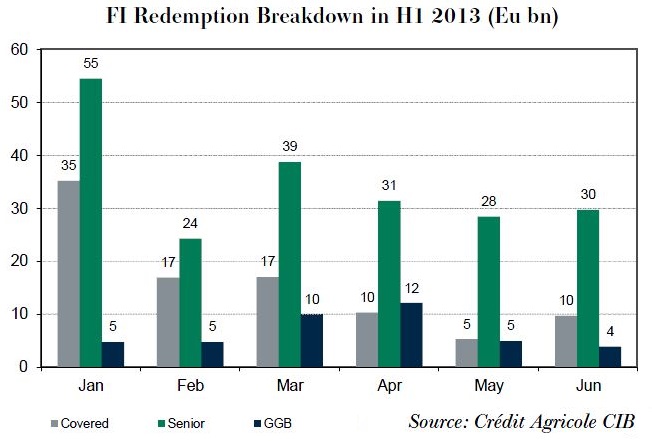

FIG supply fell sharply in February and March after January’s deluge of new issues. Euro benchmark volumes in February and March amounted to just Eu10.3bn and Eu18.1bn, respectively, while supply in January alone had reached Eu55.2bn.

The decline can in part be attributed to the return of volatility after the non-result of the Italian elections and the debacle in Cyprus. But another reason for the lower supply is simply that most borrowers have limited funding needs and there is no need to rush when market conditions are not optimal.

Q1 supply led by French and peripherals

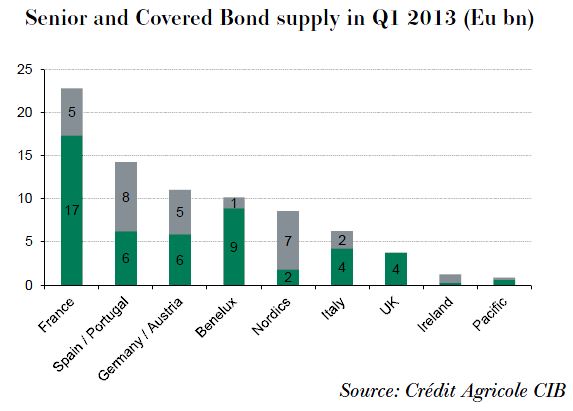

The contrast with 2012 is remarkable. Weaker markets and greater uncertainty forced issuers to frontload and borrow as much as they could during the first months of 2012. In Q1 2013 FIG issuers looked more relaxed and euro denominated FIG supply amounted to Eu83.5bn, a decrease of nearly 20% compared with Q1 2012’s total of Eu100bn. Year-to-date, supply has been led by French and peripheral issuers.

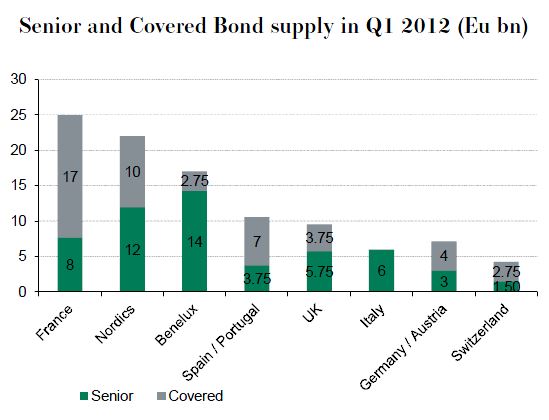

The charts below show how euro denominated FIG issuance was distributed by country in Q1 2013 and in Q1 2012.

The Nordic market grew significantly last year while most other European jurisdictions were taking supply out of the market. Euro supply of Nordic FI bonds was huge in Q1 2012, while since the beginning of this year it has been rather limited. It amounted to just Eu8.6bn in covered and senior, equivalent to only 37% of total Q1 2012 supply of Eu23.5bn.

The Nordic market grew significantly last year while most other European jurisdictions were taking supply out of the market. Euro supply of Nordic FI bonds was huge in Q1 2012, while since the beginning of this year it has been rather limited. It amounted to just Eu8.6bn in covered and senior, equivalent to only 37% of total Q1 2012 supply of Eu23.5bn.

Nordics prolific across currencies

Nordic issuers have been prolific across currencies and seized funding opportunities away from the euro market. In March — while euro FIG supply collapsed on the back of deteriorating market conditions, with Cyprus’s mess remaining unresolved — they took advantage of the deeper demand and opportunities for diversification the US dollar market continued to offer.

US dollar supply from Nordic issuers remained strong indeed. It reached a total of $7.25bn in Q1 2013, of which $4.25bn was in senior unsecured and $3bn in covered bond format. All of these Nordic US dollar deals were priced in March, when the cross-currency swap became very favourable and the spread situation was attractive.

Most of the US dollar Nordic benchmark trades were on the five year part of the curve, comprising issues from Swedbank, SEB, DNB and Svenska Handelsbanken. Staying with non-euro denominated deals, Nordea Bank AB issued Sfr225m of senior year paper at a very competitive all-in price at the end of February. And LF extended its curve at the end of March, pricing a tight 10 year Swiss franc covered bond through the curve of domestic Swiss covered bond issuers, providing further evidence that Nordic names continue to enjoy a special status.

Nordic spreads at long time lows

Nordic senior unsecured spreads have tightened to similar levels to where covered bonds were two years ago. One might have thought that this would have pushed issuers to prefer senior rather than covered, particularly since the Swedish and Norwegian regulators became more concerned over asset encumbrance. Not at all! Since covered bond spreads reached long time lows on negative net supply and limited issuance out of the other core jurisdictions, secured funding remained by far the most efficient and economical funding tool. With the potential for further spread tightening looking very limited in euro covered bonds, Nordic issuers had an additional incentive to favour secured funding while they had ample overcollateralisation.

Rare Nordic names returned

Q1 2013 also saw jumbo covered and senior unsecured bonds issued by rare Scandinavian issuers like BRFkredit, SEB, Danske and Stadshypotek.

Mid-February SEB raised Eu1bn with a seven year covered bond issue priced at mid-swaps plus 15bp (with CA-CIB as joint lead). It was SEB’s first covered bond for almost two years and the tightest seven year covered bond since the collapse of Lehman. Danske followed quickly, tapping the covered bond market with a deal in a similar tenor, which was priced at mid-swaps plus 30bp (CA-CIB JLM). It was Danske’s first trade for almost a year.

After more than a year of absence, Stadshypotek returned at the shorter end, pricing a five year jumbo covered bond at mid-swaps plus 14bp after revising upwards IPTs sharply, from the high single-digits to the 15bp area in response to investor pushback.

It will be no surprise if new issue premiums rise a little after the issuer’s misfortune, with issuers and their lead managers keen to avoid a repeat of this. The deal — which was the last Eu1bn-plus euro benchmark to price in the primary market — provided further evidence that pricing power is still in investors’ hands, and that low beta names are likely to face some pressure in the short term. The pricing paradigm for the Nordics is likely to change, with less ambitious pricing, although we don’t expect anything dramatic — maybe an adjustment of a couple of basis points upwards.

Nordic covered spreads set to remain tight

In spite of the prevailing historically low yield environment, covered bond spreads should remain low as long as Nordic borrowers continue to enjoy a safe haven status. Tight spreads in the region reflect the relative good health of the banking sector and the economy as well as the high quality of cover pools.

In addition, the imbalance in the demand/supply/redemption dynamic should continue to offer a natural back-stop bid to holders of Nordic covered bonds and encourage spread compression and convergence across the four Nordic countries. In Q1 2013 nearly Eu70bn of covered bonds were redeemed while gross issuance volumes reached only Eu30bn, which is a historically low amount of net covered bond supply for a first quarter.

The chart below displays how euro denominated FIG redemptions are divided up in 2013.

Elsewhere, permanent access to an efficient domestic market and funding in local currencies along with international issuance in multiple currencies and the use of the registered covered bond platform — for the bigger borrowers — will continue to provide additional strong support to Nordic spread stability.

Lastly, Nordic issuers enjoy the situation of strong triple-A sovereigns, which is becoming a rare situation in Europe.

Senior potentially challenged by bail-in and ongoing euro crisis?

The evolution of spreads in euro denominated senior unsecured bonds is less predictable. They are more dependent on the global market backdrop and the volatility in euro-zone FI credit spreads. More and more investors also believe that senior bonds are too tight in the uncertain context of the bail-in directive, while in the meantime they are inclined to go down the credit curve in search of spreads and yield.

Nevertheless, as in covered, the mismatch in demand and net supply should support stability in euro senior unsecured spreads as well. In general, Nordic issuers will be less present in the euro market while they enjoy a very broad and diversified set of funding tools. An issuer like Nordea can easily raise funds in size in the Danish, Norwegian and Swedish currencies, in euros and in US dollars, in addition to all the exotic currency markets it has access to. Lastly, higher deposit growth in some Nordic countries like Norway should limit further the needs for funding in senior unsecured format.

Still immune!

The most notable event among the developments with Nordics in Q1 certainly came from Stadshypotek’s recent five year covered bond transaction and the reluctance of investors to pay up for quality. It dashed some ambitions, but Nordic names continue to enjoy a safe haven status with stronger fundamentals than anywhere else in Europe.

The bigger names sent a smart response to euro investors mid-March when they enjoyed strong success in the US dollar market. Even Svenska Handelsbanken brilliantly printed a three year FRN and five year fixed rate dual tranche senior unsecured trade in the US dollar market just after the reverse euro experience of its covered bond funding arm.

Elsewhere, the Cypriot debacle and bail-in speculation weighed massively on senior unsecured spreads in core FI, but so far Nordic spreads remain unmoved.

The senior curves of BNP Paribas or Crédit Agricole, for example, widened more than 25bp on a monthly basis, while euro-zone but Finnish Pohjola has not been affected by the overall credit spread widening. In covered, Stadshypotek’s recently launched 1% June 2018 has already tightened: priced at mid-swaps plus 14bp, it is now offered in the high single-digits.

So, a wealth of evidence that Nordic immunity remains intact!

Vincent Hoarau

Head of FIs, covered bond and ABS syndicate

Crédit Agricole CIB