Norwegian covered bonds and oil prices: cause for concern?

Jan 16th, 2015

Lately some investors have become a little concerned about Canadian and Norwegian covered bonds on the back of the major oil price drop of the last few months, write Crédit Agricole CIB covered bond analysts Florian Eichert and Stephan Dorner.

We have therefore looked at correlations between oil price and asset-swap spreads of Canadian and Norwegian covered bonds.

One would not necessarily expect the price of oil to be a big topic in the covered bond space — at least away from the small-talk of those with a daily 100km drive to work. Yet we have spoken to investors who wanted to discuss oil prices in the context of Norwegian and Canadian covered bonds.

It is clear that these two economies are probably those in the covered bond space for whom oil plays the biggest role. Consequently, a drop in oil-related revenues is negative for these economies and to some extent perhaps also for their banks.

However, we are still talking about some of the stronger economies overall and the strongest banks out there, so we wouldn’t have expected it to be much of a driver. We have nonetheless looked at whether there is any noticeable correlation between the oil price and covered bond spreads.

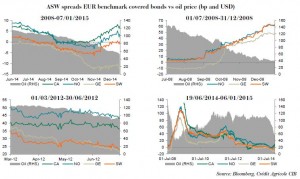

For this purpose we have looked at iBoxx EUR covered index ASW spread data for Canadian, German, Norwegian and Swedish spreads between 2008 and today, and in particular at those periods when the oil price dropped significantly. Germany is in there as a proxy to see if widening was due to an overall market move. We used Sweden as another Nordic non-Eurozone country to get a feeling for how much was related to Norway (and thus maybe to oil). (Click graphic to view full size.)

Looking at the overall period, one can see that the correlations between oil prices and covered bond spreads are negative. Initially, in 2008, covered bond spreads blew out while oil prices tumbled from $140 per barrel to $40. Covered bonds have then been on a one-way street tighter since mid-2009 while, until the most recent slide, oil prices have risen.

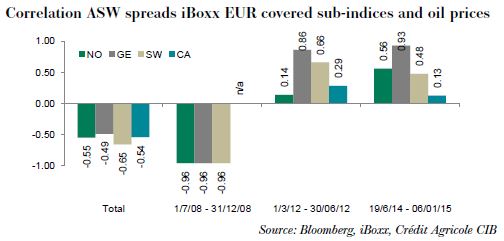

But there are no clear differences across the four countries. We are talking about a range between the -0.65 of Sweden and the -0.49 of Germany.

And even during the most significant fall in oil prices in our sample (during 2008) it didn’t matter whether a country was a big oil producer or not. Correlations were close to -1 as investors turned negative on anything banking-related.

Whether a country is oil-producing or not does seem to have gained a bit of importance during spring 2012: Canadian and Norwegian covered bonds had a lower positive correlation to the falling oil price and their spreads tightened by only 7bp and 4bp, respectively, while German and Swedish covered bonds came in by 17bp and 12bp.

However, during the most recent period of oil price falls, we are back to there being no real oil price-related link, in our view. Especially Canadian but also Norwegian covered bonds did have a lower positive correlation to the falling oil price and they did tighten less than Pfandbriefe (-5bp for Norway, 0bp for Canada), but so did Sweden. The latest moves are driven much more by CBPP3 buying the covered bonds of only Germany out of those four countries. It does not have much to do with oil prices.

In our view, oil prices in the covered bond market will remain a subject for those poor commuters among you who use the car for your daily journey (you could, of course, make the point that the British tube and train system isn’t a more attractive alternative to the daily congestion on the roads — and you would probably be right).

Anyone citing a risk to covered bond spreads posed by oil prices pose is probably looking for an easy excuse not to buy at these levels rather than expressing a real concern.