Nordic US dollar covered bonds

Sep 7th, 2012

Nordic US dollar denominated covered bond issuance emerged in the middle of the crisis (Q4 2010) because of strong investor interest in diversifying risk through non-euro/non-eurozone assets, writes Nicolas Poli, Global Head of Covered Bond & SSA Trading at CA-CIB. Last year saw the pick of Nordic supply, with six new syndicated dollar benchmark transactions.

Borrowers took advantage of strong demand and favourable cross-currency basis levels to print opportunistic funding. US investor demand intensified this year and contributed significantly to very positive sentiment towards Nordic issuers in the flight to quality environment.

Secondary performance catches up

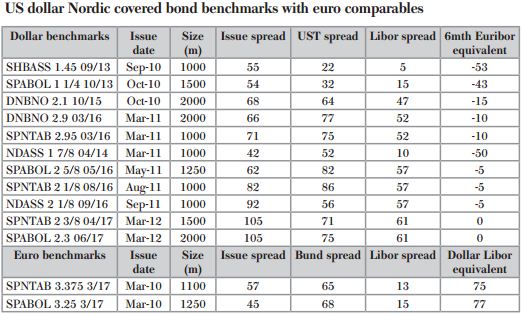

The covered bond market has experienced only two new US dollar Nordic benchmarks this year: Swedbank Hypotek and SpareBank 1 Boligkreditt issued 2.375% April 2017s and 2.3% June 2017s, respectively, each at mid-swaps plus 105bp. The deals have tightened by 40bp-45bp against Libor, especially during the summer break, following the credit rally and rising stocks.

After first ECB LTROs in December 2011 to restore confidence, investors’ focus has shifted back to the euro market. Nordic borrowers took advantage of the mood to feed investors’ appetite with several euro benchmarks. Nordic covered bond issuance increased dramatically, with six euro deals in the first quarter of the year. Spreads have compressed significantly, benefiting from the spill-over effect of excess liquidity forcing investors to put money to work.

After first ECB LTROs in December 2011 to restore confidence, investors’ focus has shifted back to the euro market. Nordic borrowers took advantage of the mood to feed investors’ appetite with several euro benchmarks. Nordic covered bond issuance increased dramatically, with six euro deals in the first quarter of the year. Spreads have compressed significantly, benefiting from the spill-over effect of excess liquidity forcing investors to put money to work.

However, investors’ interest in dollar Nordic paper has been growing, at the end of the first quarter leading to the two new five year dollar covered bond transactions in the course of March. This resulted from recent strong US investor demand creeping in for dollar Nordic bonds.

US investors have particularly welcomed Nordic covered bond risk as an alternative to core and peripheral European risk. US investors have considerably rebalanced portfolios, switching out of European risk into Nordic covered bonds risk.

US dollar spread compression was late to materialise, but the limited supply combined with strong demand has eventually driven spreads tighter. Paper became quite scarce, causing the last wave of tightening observed in August.

Dollars outperform euros

The correlation between US dollar and euro spreads is very low and very tough to arbitrage. The dollar market lagged the euro rally for a long time before catching up. Dollar covered bonds spreads traded 25bp-30bp cheaper than euro levels after cross-currency swap adjustment during the first six months of the year.

But dollar Nordic, Swiss, UK and Canadian issues have eventually outperformed other sectors this year as dollar spreads are now trading 10bp-15bp through euro levels after adjustment.

For instance, SpareBank 1 Boligkreditt 3.25% March 2017 euros are currently trading at Euribor plus 13bp whereas SpareBank 1 Boligkreditt 2.3% June 2017 dollars are trading at Libor plus 61bp, which is equivalent to Euribor flat. At a premium of 15bp, euro Nordic levels now look relatively cheap, compared to equivalent dollar covered bond levels in the five year space.

Source: CA-CIB

Flows have been skewed towards better buying across the curve, thereby drying up the secondary market. Nordic supply surely would be welcomed by all type of investors around the world.

On that front, the US dollar customer base is still limited in terms of the number of participating accounts when compared with the euro base, but it keeps growing at a fast pace. The emergence of a US covered bond law will obviously open up the door to US issuers and contribute to an explosion in the investor base.

Most investors closely track and monitor covered bonds against senior unsecured spreads. In the case of Nordics, there are liquid benchmarks in both sectors. The Nordic five year dollar senior-covered spread is currently in the region of 85bp (Libor plus 55bp vs Libor plus 140bp).

If you compare this with the euro senior-covered spread, which is more like 42bp-45bp, it confirms the strong outperformance of dollar covered bonds and explains the complexity of sourcing paper in the market.