Nordic covered bond outlook: What is 2014 issuance going to look like?

Nov 28th, 2013

The Nordic region is one of few exceptions this year in euro benchmark covered bonds in that overall net issuance is positive. Crédit Agricole CIB’s Florian Eichert looks ahead to assess what lies in store for Nordic supply in 2014.

In November last year, we had predicted around Eu105bn in total euro benchmark covered bond issuance for 2013. At the moment we are at Eu94bn, which compared with last year’s Eu106bn is a drop of around 11%. We have maybe another two weeks to go in 2013, which makes it highly likely that we are going to be around 10% shy of our initial 2013 forecast.

The main reason for the shortfall is that back in 2012 we had still factored in at least some euro covered bond issuance from the UK (we had expected Eu4bn) and Swiss banks (with Eu3bn) staying active in the covered bond market. Until today, with the sole exception of a Eu1bn euro benchmark from Abbey, none of the issuers from these countries has even started making an attempt to meet our expectations. Apart from Abbey it has been eerily quiet, as banks from the two countries have focussed more on deleveraging, capital deals and senior unsecured issuance.

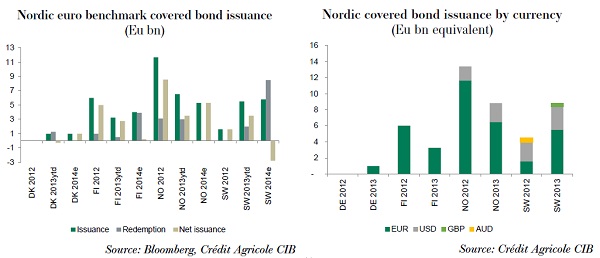

Looking to the Nordic space, 2013 issuance stands at Eu16.25bn so far, while in November last year we had predicted euro benchmark covered bond issuance of Eu18bn. Looking at individual countries, issuance has reached 50% of our initial forecast in Denmark (which sounds dramatic, but we had simply assumed two benchmarks from Danske while the issuer printed only one), 65% in Finland (we would have expected Danske to be active from Finland as well, which didn’t turn out to be the case), we are almost spot on in Sweden with 92%, and, last but not least, Norway has exceeded our expectations by around one-third.

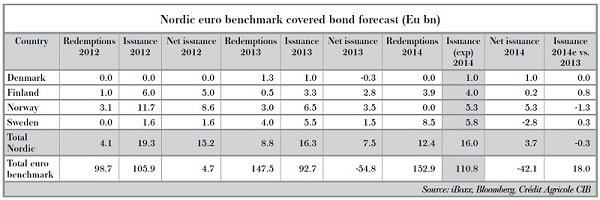

Because redemptions in the overall euro benchmark covered bond market surged from Eu99bn in 2012 to Eu149bn in 2013, overall net issuance this year is going to be deeply negative, by almost Eu60bn. The Nordic region is one of the few exceptions as it managed to achieve net positive issuance of Eu7.5bn, with Eu3.5bn, Eu2.8bn and Eu1.5bn in Norway, Finland and Sweden, respectively. Only Denmark ended up with a small net negative issuance, of Eu0.3bn.

Despite having become a global product, international covered bond markets are still a euro dominated space. This is where most of the issuance takes place (82% of year-to-date benchmark covered bond issuance was in euros after merely 65% in 2012) and also where most investors sit. Looking at 2013 issuance, the relative position of euro markets has been reinforced as, at -11%, the fall in gross issuance was far less pronounced in euros than was the case in other currency areas. US dollar benchmark covered bond issuance currently stands at less than half of 2012’s volumes (down 53% to Eu15.6bn equivalent, or $21.0bn), while sterling issuance has almost entirely collapsed (down 81% to Eu2.7bn equivalent, or £2.25bn).

Nordic issuers have featured very prominently in the non-euro markets, though, accounting for over one-third of US dollar issuance, for example. However, the share of US dollar-denominated covered bond issuance only increased in Norway, from 13% to 26%, in 2013, while it dropped from 51% to 33% in Sweden. In Finland and Denmark US dollar issuance has virtually no importance. Swedish banks were the only Nordic-based credit institutions who participated in the sterling market in 2013 by issuing £250m in February, before tapping them by £100m around a week later.

Last but not least, issuers have been able to further extend the average maturity from 6.6 years in 2012 to 6.9 years in 2013. On the one hand the share of 10 year issuance fell from 16% in 2012 to 6% in 2013 as investors were reluctant to buy duration at current low yield levels. However, these same low yield levels did push much of the five year issuance into the seven year bucket (48% of issuance after 31% in 2012). Many bank treasuries, who had previously been buying out to five years but no longer, in 2013 started looking at seven years as being the new five years in their quest to find yield. Nordic banks, on the other hand, had an average initial term to maturity of 6.3 years in 2013 after 6.4 years in 2012.

Redemptions in 2014 and beyond

2013 marks the first of a series of years that lie ahead featuring sizeable redemption volumes in the euro benchmark covered bond space. In essence, we have already reached a redemption plateau where longer dated issuance from the boom years up to 2006 (Eu179bn in issuance) and 2007 (Eu168bn in issuance) falls together with the predominantly five year deals from 2010 (Eu182bn in total issuance) and 2011 (Eu178bn in total issuance).

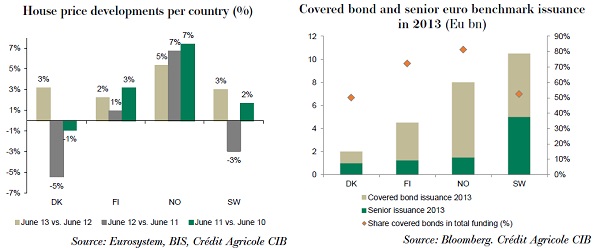

Looking in more detail at next year, euro benchmark covered bond redemptions will amount to Eu152.9bn. In the Nordic area, Sweden leads the way with Eu8.5bn in redemptions, followed by Finland with Eu3.9bn. On the contrary, Denmark and Norway do not have any covered bond redemptions in 2014.

Asset growth

Asset growth in many mortgage markets across the covered bond space has been very muted of late. Growth is negative in countries like Spain, Italy, the Netherlands and Portugal, while it has come down in Austria, Finland or France. And in countries such as Norway and Sweden, which have enjoyed significant growth rates in recent years, supervisors and governments are trying hard to slow it down through higher capital requirements and risk weights for mortgages. For Nordic countries asset growth will not push banks into issuing more covered bonds; rather the opposite.

Funding structure

Even if we had significant asset growth across the board, issuers still need to decide which product to use for refinancing. As of late attention has been placed on other products away from covered bonds, such as senior unsecured (Lloyds Bank, for example, chose senior unsecured to re-enter the euro market this autumn and not covered bonds) or capital deals (Barclays has not issued a covered bond in over a year-and-a-half now, but has been busy in the AT1 space). Many issuers have made the decision to go for the more complex transactions while markets are benign and spreads are tight across the board.

We would expect to see this trend continuing next year. We will have the asset quality review (AQR) by the ECB, which could lead to additional capital needs for some banks and as long as they can access markets with capital or sub debt deals while demand is there, this is where priorities will lie. To find the two words covered and bonds written right next to each other on that priority list for bigger banks, one will have to look towards the very bottom. There are, however, a number of smaller issuers in, for example, Norway for whom covered bonds will remain a central pillar of their wholesale funding strategy.

Bottom line: another net negative year

In our view euro benchmark covered bond markets will continue to shrink in 2014. After close to Eu60bn net negative issuance in 2013 we estimate the market will shrink by some Eu40bn more. As was the case last year, net negative issuance will be a broadly-based phenomenon as markets in nine countries see their outstanding euro benchmark volumes go down in our view. Gross issuance should come in at Eu111bn.

Looking more specifically at Nordic countries, we expect euro covered bond issuance to come in at Eu16bn for 2014 after Eu16.3bn in 2013. Overall redemptions will grow by almost Eu4bn to Eu12.4bn across the region. While Denmark and Norway will not have any euro benchmark redemptions in 2014, the figure jumps from Eu5.5bn to Eu8.5bn in Sweden and from Eu0.5bn to Eu3.9bn in Finland.

Norway will be the fastest growing market in net terms with gross as well as net issuance at Eu5.3bn in the euro benchmark space. We expect Sweden to be the most active country from the region, with euro benchmark issuance of Eu5.8bn expected. Thanks to redemptions, net issuance will, however, be almost Eu3bn negative.

With issuance of Eu4bn expected from Finland, net issuance is virtually flat. In Denmark we are going for Eu1bn in expected issuance but wouldn’t be surprised if the issuer goes for a second deal just to prove us wrong again.

US dollar issuance is going to be the domain of Swedish and Norwegian issuers again. We would expect banks such as DNB or some of the Swedes to be active in that space as well in 2014, but given the overall backdrop would be surprised if issuance exceeds the $3bn and $3.8bn from Norway and Sweden.

Florian Eichert

Senior Covered Bond Analyst

Crédit Agricole CIB