Nordic Banks: US dollar focus

Aug 30th, 2012

Nordic banks’ US dollar-denominated senior unsecured benchmarks have performed quite well so far this year and now seem to have won a status of “safe haven” in the Yankee universe, writes Jean-Marc Perrin, Head of US IG Credit Trading at CA-CIB.

Of course, US dollar investors’ aversion towards euro-zone banks played a role in this flight to quality but this year’s new deals’ secondary performance as well as a relatively benign newsflow has clearly contributed to the currently very positive sentiment from the US dollar investor base towards Nordic issuers.

Senior secondary performance

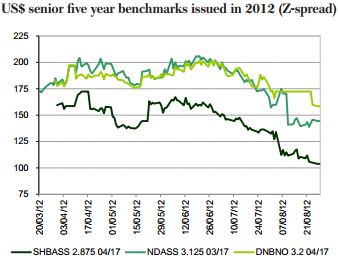

The few five year senior benchmarks issued by the leading Nordic banks this year — namely DNB 3.2% 2017, Nordea 3.125% 2017 and Svenska Handelsbanken 2.875% 2017 — have tightened by 25bp-55bp in Z-spread terms since their issue date. Interestingly enough, most of the year’s performance was realised during the summer (June to August) as the bonds initially remained easily available in the market — trading within a 25bp range for a few months — then slowly “seasoned” and ultimately became quite scarce in the street, causing the last leg of tightening in August (see graph).

Over the summer, the bonds also outperformed their respective five year senior CDS by 25bp-40bp, showing the strong technical backdrop behind Nordic US dollar cash and a relatively low correlation with the euro CDS market.

Source: CA-CIB

First, fundamentals have been quite supportive: the Nordic complex benefited from a mild newsflow and a resilient trend in earnings thanks to its economies’ relative strength and an historical focus on retail banking and traditional merchant banking. The signs of stress observed in shipping loan books were well flagged in the market but did not trigger any material or prolonged reaction from the US dollar investor base and this negative factor didn’t derail the strong technicals in the sector.

From a flow perspective, real money accounts have been net buyers of Nordic bank senior unsecured paper for most of the year, mainly via primary but also adding in secondary opportunistically. We found that the client mix has been increasingly geographically diverse (from the US, Asia, continental Europe to the Nordic countries) but also in terms of investor profile, with a growing population of private banks, family offices and other wealth management companies. Client inquiries and volumes traded on the trading platforms in the Nordic sector have grown materially this year, led by Nordea (the most active issuer in the Nordic US dollar spectrum) followed by Svenska Handelsbanken, DNB and Danske Bank.

US investors in particular have welcomed Nordic senior unsecured risk rather early this year as a great alternative to core euro-zone bank risk at a time when peripheral risk aversion started causing risk aversion towards French, Dutch or German names and subsequently greater volatility in the core Europe complex. Nordic banks then became attractive when looking at yields adjusted by its lower volatility factor.

From the issuers’ perspective, these strong secondary performances certainly confirm that the Nordic banks complex currently has a relatively deep and diverse US dollar investor base to tap into, should they wish to diversify further their funding sources.

Relative value vs euros

The EUR/USD cross-currency swap can explain some of the spread between US dollar and euro-denominated bonds but, most of the time, each currency’s specific technicals can cause the existence of a basis and this basis can persist over time. The basis also varies a lot from one issuer to another, depending on issuer-specific factors or more “technical” factors (a bond’s scarcity, repo costs, etc), but we can establish a pattern amongst European banks and, again, Nordic banks currently seem to benefit from a relatively low risk premium in the US dollar market.

Indeed, with an average differential of +30bp after cross-currency swap adjustment vs euro-denominated bonds, Nordic US dollar-denominated bonds compare quite favourably with Dutch, Belgian and French peers (with an average premium of +40bp to +70bp), and basically rank right next to Rabobank (Aa2/AA), whose US dollar and euro-denominated issues tend to trade flat to each other after cross-currency swap adjustment. This seems to suggest US dollar investors are currently asking for a fairly low risk premium in order to bear the incremental illiquidity of the US dollar market, confirming the Nordic status of relative “safe haven”.

Senior vs covered in US dollars

The relative value between senior unsecured and covered bond spreads is now being followed closely by both credit and AAA investors.

In the case of Nordic issuers that have liquid US dollar issues in both categories, current ratios point to the relative cheapness of senior unsecured vs covered. With senior-to-covered ratios of 2.75x for DNB or 2.32x for Nordea, this segment of the capital structure looks fairly “decompressed” judging by European bank standards, but these high ratios are also quite typical of high quality issuers, for whom covered bonds kept their status of a triple-A instrument with a minimal component of credit risk and a much lower correlation to senior spreads.