Nordic banks’ third quarter results: first impressions

Oct 25th, 2012

Mats Anderson, Cheuvreux bank equity analyst, gives a first take on third quarter results announced by some of the largest Nordic banks this week.

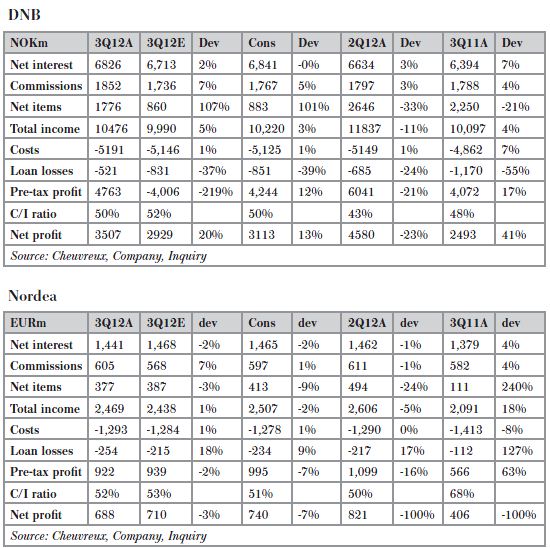

DNB: 12% ahead on better credit quality and trading gains

DNB (2/OP, TP NOK90, +28%) reported a 3Q 2012A pre-tax profit of NOK4.8bn (Q3-11: NOK4.1bn), which was 12% ahead of consensus expectations. The drivers were not only the notoriously volatile net result of financial transactions but also much lower loan loss provisions than expected, of 16bp (Q3-11: 38bp).

DNB reported net interest income of NOK6.8bn (Q3-11: NOK6.4bn), in line with expectations, while commissions were 5% ahead of expectations at NOK1.9bn (Q3-11: NOK1.8bn), showing the impact of economic activity in Norway on the back of high investment activity in the offshore sector.

The notoriously volatile net items of financial transactions (trading gains) was reported at NOK1.8bn (NOK2.2bn), which is considerably above consensus expectations. Costs of NOK-5.2bn (Q3-11: NOK-4.9bn) were in line, leaving the cost/income ratio at 50% (Q3-11: 48%) compared with an expected 52%.

A loan loss ratio of 16bp (Q3-11: 38bp), compared with an expected 26bp, on the back of provisions of NOK-521m (Q3-11: NOK-1.2bn) augurs well for the remainder of the year and 2013E.

RoE was reported at 11.4% (Q3-11: 8.8%).

NORDEA: weak, reflecting weak NII as falling rates eats into deposit margins

Nordea (2/OP, TP SEK80, +29%) reported a Q3-12 pre-tax profit of EUR922m (EUR566m), which was 7% below consensus expectations. The result was affected by the deposit margin squeeze in the quarter and adverse currency movements versus its reporting currency, the euro.

Nordea reported a NII of EUR1441m (Q3-11: EUR1379m), which was 2% below consensus expectations. The net items of financial transactions (trading gains) of EUR377m (EUR111m) were 9% below consensus forecasts. Net commissions of EUR605m (Q3-11: EUR582m) were, on the other hand, slightly ahead.

Costs amounted to EUR1,293m (EUR1,413m), 1% higher than expected and reflecting currency issues with the weakening reporting currency versus Nordea’s other main operating currencies, the Swedish krona and Norwegian krone. Underlying costs were down 2% in local currencies. The cost/income ratio came in at 52% (63%) compared with an expected 51%. Credit quality remains reasonably high.

Loan loss provisions were reported at EUR254m (EUR112m), equal to 30bp (14bp), compared with 26bp in Q2-12, reflecting Nordea’s exposure to Denmark and its Oslo based international shipping division. The raised provisions reflect increased collective provisions, while individual provisions were down.

RoE was reported at 10.1% (6.5%) compared with 12.5% in Q2-12A.

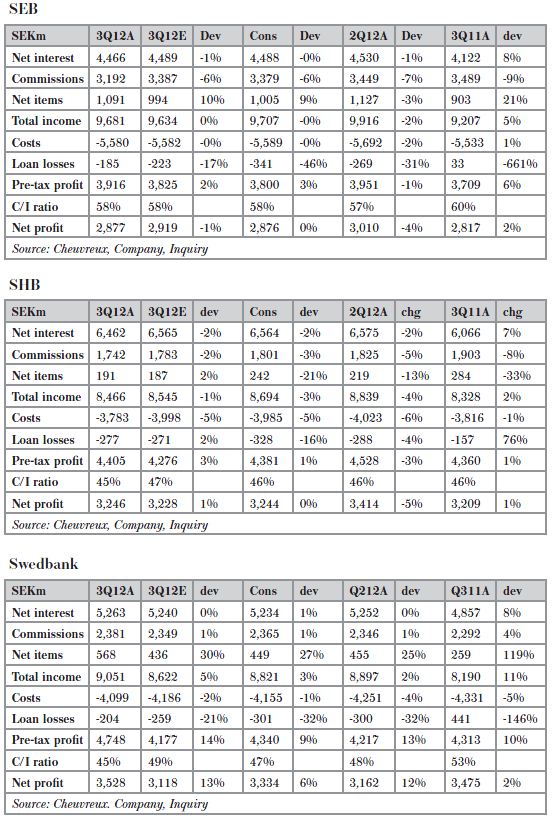

SEB: 3% ahead, with NII defended by repricing of corporate lending

SEB (2/OP, TP SEK65, +21%) reported a Q3-12 pre-tax profit of SEK3.9bn (SEK3.7bn), which was 3% ahead of consensus expectations. The driver was a loan loss level of 11bp (Q3-11: write-back of -1bp) that was half that of consensus expectations. NII was in line with expectations, enabling total income to meet expectations as well, while costs did not exceed the long term target. All in all good numbers from SEB, which is less hurt by the deposit margin squeeze than peers previously reporting this week.

Total income was in line with expectations at SEK9.7bn (Q3-11: SEK9.2bn), with net interest income of SEK4.5bn (Q3-11: SEK4.1bn) being in line with expectations, supported by lower funding costs, and SEB also reported lending NII up 4% q-o-q, reflecting repricing of corporate loans.

A shortfall in commission generation of 6% compared with expectations brought commission income to SEK3.2bn (Q3-11: SEK3.5bn) after a very difficult summer but compensated for by strong net items of financial transactions (trading gains) coming in 9% ahead of expectations, at a reported SEK 1.1bn (Q3-11: SEK0.9bn). Also, costs of SEK-5.6bn (Q3-11: SEK-5.5bn) were in line with expectations.

The RoE achieved was 10.8% (10.8%) while CET1 was 16.5%, and the LCR at 154%.

SHB disappoints on revenues

Blue chip Svenska Handelsbanken (3/UP, TP SEK210, -10%) reported a pre-tax profit of SEK4.4bn (Q3-11 SEK4.4bn), which was 1% ahead of consensus expectations.

However, the result was marked by weak revenues, as revenues came in 4% below the previous quarter, of which 1% was derived from the strength of the SEK. NII of SEK6.5bn (Q3-11 SEK6.1bn) was 2% below consensus expectations while commission generation was 3% below, with Handelsbanken reporting a commission net of SEK1.8bn (Q3-11 SEK1.8bn).

Handelsbanken showed its quality by compensating for the revenue shortfall by stellar cost control, with costs 5% better than expected, at SEK3.8bn (Q3-11 SEK3.8bn), and thus reporting the better than expected bottom line. However, we find the impact of deposit margin pressure in the quarter, derived from the rapid fall in the Swedish interest rate, hurting the revenue side too much.

Credit quality remains stellar at 5bp (Q3-11 7bp).

Our conclusion is that Handelsbanken again showed its quality in the quarter, a quality we acknowledge. However, the focus will be on the weak revenue side and we expect the share to show some weakness.

SWEDBANK: PBT 9% ahead of expectations, good throughout

Swedbank (3/UP, TP SEK115, -2%) reported a Q3 12 pre-tax profit of SEK4.7bn (SEK4.3bn), which was 9% ahead of consensus expectations. The company reported slightly better revenues, costs, and loan loss provisions, all adding up to the 9% ahead.

Net interest income of SEK5.3bn (SEK4.9bn) was 1% ahead of expectations. Swedbank has apparently managed to fend off part of the deposit margin squeeze experienced during Q3. Also, net commissions of SEK2.4bn (SEK2.3bn) were 1% ahead. The main driver, which brought total revenues of SEK9.1bn (SEK8.2bn) 3% ahead of expectations, was the net items line (trading gains), which came out 27% ahead of expectations at SEK0.6bn (SEK0.3bn).

Costs seems well under control at SEK-4.1bn (SEK-4.3bn), including an impairment of tangible assets of SEK0.1bn. Swedbank said it has year-to-date reduced its cost base by the SEK1bn management committed to for the full year, but excluding variable pay, fees to savings banks, FX and SEK100m in restructuring costs for Ukraine in Q3 2011.

Credit quality remains stellar at 7bp, equal to a charge of SEK-0.2bn (write-backs of SEK1.7bn). Swedbank sees no deterioration in the credit quality of its client base.

Cheuvreux recommendations guide:

- 1 Selected list

- 2 Outperform (OP)

- 3 Underperform (UP)

- 4 Sell