Nordic Banks: Successfully tapping into the latest Tier 2 trends

Sep 13th, 2012

Danske Bank is set to price a new US dollar-denominated 25 year non-call five Tier 2 issue today (Thursday), with a coupon said to be in the 7.125% area after the deal was heavily oversubscribed.

By Steve Sahara, Managing Director, Global Head of DCM Solutions & Hybrid Capital, Crédit Agricole CIB

The coupon is fixed to the first call date and then resets to the prevailing mid-swap rate every five years thereafter. Unusually for a Tier 2, interest payments are deferrable at the issuer’s option on a cumulative and compounding basis.

The deal adds to a recent string of new Tier 2 issues, in which Nordic banks have played a central role, with over Eu3.5bn equivalent of subordinated issues this year to date. The European callable Tier 2 market was reopened by Nordea Bank in February when the bank priced the first institutional issue since 2008. Out of a total of 26 subordinated issues from European banks in 2012, five have come from Nordic issuers.

Other recent T2 issues came from Rabobank and ABN Amro. Rabobank priced a euro and sterling denominated dual-tranche deal on September 4. While the Eu1bn tranche has a familiar 10 year bullet formula, the £500m tranche has a 25 year maturity.

While Rabobank tapped the European institutional market, ABN Amro’s new US dollar denominated T2 was mainly placed among the Asian retail private banks network. The deal followed a euro-denominated transaction distributed across institutional investors in July.

The recent wave of Tier 2 issues was possible on the back of the strong rally witnessed in the market over the course of the summer, with a significant risk-on mode among investors which allowed core and non-core issuers to tap the market. Yesterday, when the German Federal Constitutional Court allowed the ratification of the European Stability Mechanism, despite this being in line with expectations, the market rallied further.

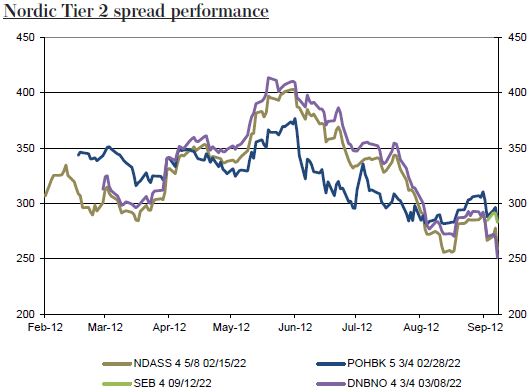

2012 subordinated issues from Nordea, Pohjola and DNB have also tightened considerably, currently pricing higher than par in all three cases. The latest SEB Tier 2, priced on September 5, has already moved to 100.7.

Source: Crédit Agricole CIB

The new Danske Bank Tier 2 is targeting the Asian retail private banks network. In contrast, recent Nordic Tier 2 issues were placed largely among institutional clients, with asset managers taking more than 50% of the outstanding in each of the four deals. By geography, while the Nordics contributed a large share, the deals met with considerable demand from the UK, Switzerland, Benelux and Germany.

As is often the case, Nordic issuers addressed the T2 structuring challenges in creative and practical ways that take advantage of their reputation as not only good strong credits but also fast movers in the capital markets. The scarcity of high credit quality and yield was the right mix to attract high demand from investors willing to move down the capital structure — at least for the best credit profile.

Structuring alternatives

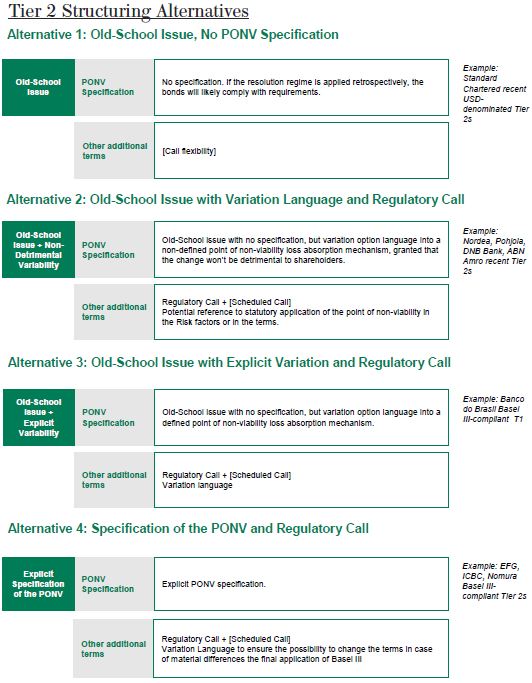

Alternatives that have been used so far for structuring Tier 2 are the following (accompanied by chart below):

(1) Old School

For some time in early 2012 the use of Basel 2 “Old School” dated subordinated debt with mandatory coupon payments (i.e. no loss absorption through payment deferral flexibility) and no specified principal loss absorption (i.e. going concern principal write-off or principal conversion to equity) beyond the lower expected recovery rates if ever subjected to a liquidation via subordination. Thus Old School T2 Basel 2-compliant and with no step-up in interest rate could be expected to at least be Grandfathered beyond 2013 in either 10 year bullet or 10 non-call five formats. This was deemed the most effective way to tap market windows, lock in attractive coupon/spread and reduce execution risk while providing investors a tested structure with more liquid secondary benchmarks.

As greater uncertainty emerged regarding the need to provide Going Concern loss absorption in addition to the Old School features, the market paused briefly but contemplatively and subsequently resumed with a variety of alternative structures to address regulatory uncertainty, while also providing issuers the lowest possible cost and investors the highest possible certainty as to what investment risks they were exposed to despite the open regulatory issues.

One simple approach was to add Regulatory calls in case T2 capital treatment was lost (at par or at a premium of 101% of par). Such regulatory calls could enhance either a 10 year bullet or 10NC5 but of course the NC5 structure already has the optionally shorter duration at year five.

As is often the case, Nordic issuers addressed the challenges in creative and practical ways that take advantage of their reputation as not only good strong credits, but also fast-movers in the capital markets. The scarcity of high credit quality and yield was the right mix to attract high demand from investors willing to move down the capital structure — at least for the best credit profile. Until recently this was the main approach.

(2) Old School + Non-Detrimental Variability

Issuers attempting to comply but grappling with the lack of specificity in regulations regarding Point of Non Viability (PONV) Loss Absorption sometimes took an approach of including language in the documentation that allows the issuer to Vary terms of the securities or Substitute new securities with different terms in order to be more compliant with the future specificity of the regulations without the risk and potential increased cost of calling, buying back and re-issuing.

To protect investors, increase investor demand and keep issuer cost lower these securities limited the range of contemplated substitution/variation changes that could be inflicted upon investors by stating that changes could not be materially adverse to investors.

This approach was considered cheaper for issuers since no explicit PONV loss absorption was included, but the flexibility could benefit regulatory evaluation of the instruments. Some commentators noted that such flexibility might actually prove hard to use since most imagined increases in Loss Absorption would arguably put investors in a materially worse position.

The analysis is not black and white, however, if similar loss absorption is retroactively applied (statutory regime) to all similar pari passu outstanding subordinated debt, in which case the Loss Absorption inserted via substitution and variation is no worse than the loss absorption resulting from the retroactive application.

The lack of specificity on the Sub/Var language has knock-on effects for ratings since Moody’s found such open-endedness too uncertain to rate within a normal notching paradigm. As a result some of the issues do not carry a Moody’s rating.

(3) Old School + Explicit Variability

Another alternative is to specify more boundaries for the range of changes that might be imposed on investors by spelling out what might and will not be changed to rein in concerns about the most detrimental changes (payment rate, nominal, duration, etc).

(4) Old School + Explicit PONV

The most explicit PONV format is to include the PONV in the terms and conditions and not just in risk factors or risk factors plus a mention in the terms. Some issuers have already taken the approach to explicitly mention the PONV loss absorption in the Terms and Conditions.

CRD IV/CRR I are currently being finalised by the “trialogue” among the Commission, the European Council and European Parliament. The indicative plenary sitting date for the Parliament has been set for 21 November.

Source: Crédit Agricole CIB