Nordic banks Q4 and full year results

Jan 31st, 2013

Mats Anderson, Cheuvreux bank equity analyst, gives his take on a first round of fourth quarter and full year 2012 Nordic bank results, and says that Swedbank has fired the starting shot for a Nordic bank capital distribution “bonanza”.

Swedbank and Nordea announced better than expected earnings yesterday (Wednesday) morning and today it is SEB’s turn to shine as the Nordics continue to show strong Q4 and FY2012 financial results overall.

Swedbank’s fourth quarter 2012 pretax profit was 13% ahead of consensus expectations, which allows for raised expectations for 2013E and 2014E. However, the key message is not so much the earnings as the raised dividend policy. The starting shot for the Great Nordic Bank Capital Distribution Bonanza has been fired. The sound will ring out and the action will continue for many years to come, in our view, given the high and stable profitability. To quote Swedbank’s CEO – “the capital repatriation will be a multi-year process”.

Key features

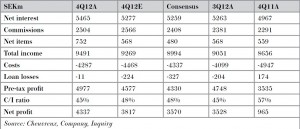

Swedbank reported a pretax profit of SEK5bn (Q4 2011: SEK1bn) in the 4th quarter 2012, 13% ahead of consensus expectations. Loan loss provisions totalled SEK-11m (SEK-687m), which is the net of continued writebacks in the Baltics and minor provisions in Sweden. Swedbank emphasises that it sees no overall deteriorating credit quality in its markets. On the contrary, the credit quality outlook remains benign.

The key message is Swedbank’s announcement of a new dividend policy of 75% (50%) of EPS paid out per year. The dividend for 2012 is aggressively suggested to be SEK9.90 (SEK5.30), equal to SEK11.2bn (SEK6bn). This, the Great Nordic Capital Distribution Bonanza, has been on the cards for some time, although we have argued that it was more likely to be a year later, after the regulatory and European macro situations had cleared. Apparently not; and political opposition is not an issue either. The Minister for Financial Markets has been quoted as saying that as long as regulatory requirements are fulfilled and the bank continues to build capital the authorities are content.

Revenues

Swedbank reported revenues of SEK9.5bn (SEK8.7bn), which was 6% ahead of consensus with net interest income (NII) of SEK5.5bn (SEK5.0bn) 4% ahead of consensus expectations. Apparently, Swedbank has been correctly positioned in the falling interest rate environment in the quarter and it is the Treasury that drove the NII. Commission generation amounted to SEK2.5bn (SEK2.3bn), likewise 4% ahead of expectations, with drivers being performance related fees in asset management and in payments, a Swedbank forte.

Costs

Costs amounted to SEK-4.5bn (SEK-4.9bn), including the write-off of tangible and intangible assets of SEK-216m while the loan losses amounted to SEK-11m (SEK-174m), reflecting continued write-backs in the Baltics and minor provisions in Sweden. Swedbank reiterates that it sees no deteriorating credit quality in its markets. CET 1 is reported to be 17.4% (15.7%) Basel II and 15.4% (14.3%), according to Basel III IAS19. The RoE is reported to be 14.4% for FY2012.

New targets

The group targets a CET1 in Basel III IAS19 of 13%-15% while delivering a RoE of 15% supported by the distribution policy of 75%.

The Nordic peers

Swedbank is the first and most distinct example of what the future for Nordic banks will look like. Hence it is the first down the capital distribution road. Following closely will be SEB (2/OP, TP SEK65) and SHB (3/UP, TP SEK225) (recommendations and targets do not reflect any changes similar to those we are now executing in Swedbank) as their capital situation is as good as Swedbank’s, although their business represents more growth opportunities over the coming year.

Taking longer to reach a position where they can return substantial capital to shareholders is Nordea (2/OP, TP SEK80), DnB (2/OP, TP NOK90) and Danske Bank (1/SL, TP DKK140), but we expect them to come into a similar cash rich position as their more cash rich and more pure Swedish peers within two years.

Commissions drive Nordea result

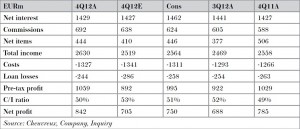

Nordea reported a pre-tax profit of EUR1059m (4Q2011A; EUR1029m), 8% ahead of consensus. The dividend is suggested to be EUR0.34 (EUR0.26) per share, 10% ahead of expectations, equal to 44% of EPS, in line with the group dividend policy. RWA including transitional rules amounts to EUR215bn (EUR224bn), compared with EUR223bn in 3Q 2012.

Revenues of EUR2.6bn (EUR2.6bn) are 3% ahead of consensus expectations although the NII of EUR1429m (EUR1427m) is -2% below consensus expectations and the net items of EUR444m (EUR506m) are in line. Driving the revenues are commissions at EUR692m (EUR588m) 11% better than expected and driven, in turn, by profit sharing asset management fees and payment fees. Costs amounted to EUR-1327m (EUR-1266m), which is a slight disappointment, 1% higher than expected, while loan loss provisioning amounted to EUR-244m (EUR-263m), basically in line with expectations.

SEB also ahead, dividend raised by 57%

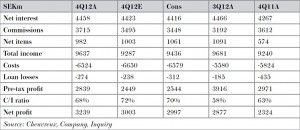

This (Thursday) morning SEB (2/UP, TP SEK65, +1%) reported a pretax profit of SEK2.8bn (4Q 2011A; SEK3.0bn), which was 12% ahead of consensus expectations in a quarter marked by a number of housekeeping measures as previously announced by the bank on 22 January. The dividend is suggested to be SEK 2.75 (SEK1.75) per share corresponding to a pay out ratio of 52 % (31%). Total sum amounts to SEK6bn (SEK3.8bn).

New targets

SEB also made public their new financial targets for the coming three years including: the Group will pay a yearly dividend that is 40% of EPS or above, the Group targets a CET1 ratio of 13% (Basel III) and generate a competitive return relative to peers, which means that in the long term the Group aspires to generate a RoE of 15%.

Apparently SEB wants to an increasing degree be measured against Swedish and Nordic peers in its operations despite the distinctly larger corporate bias in its business mix. Consequently the targets are ambitious and should be viewed positively.

The CET1 Basel III is reported to be 15.1% (13.7%), down from 16.5% in 3Q 2012, which reflects the inclusion of IAS19 as announced on January 22. The risk weighted assets excluding the transitional floor amount to SEK586bn (679bn), down SEK5bn in the quarter. SEB reports a RoE of 11.9% (8.9%) for continuing operations in the quarter and 11.5% (12.3%) for FY2012. Revenues amount to SEK9.6bn (SEK9.2bn), 2% ahead of consensus expectations.

The net interest income (NII) amounted to SEK4.5bn (SEK4.3bn), marginally ahead of expectations while commissions came in at SEK3.7bn (SEK3.6bn), which was 8% ahead of consensus expectations, a similar trend to Nordea and Swedbank’s reports yesterday. The net items amounted to SEK1bn (SEK1bn), marginally below expectations.

Costs

Costs amounted to SEK6.5bn (SEK5.8bn), including a one off write down of SEK0.8bn as previously announced. Costs were thus 1% better than expected by the consensus. Consequently, if adjusted for the one off of SEK0.8bn SEB continues to deliver on the stated Group target of a cost base of SEK23bn, which today was slightly revised downwards to SEK22.5bn to be kept up to and including 2014E. Loan losses amounted to SEK-274m (SEK-435m), 12% below consensus expectations and equal to 8bps (11bps) of the loan book annualised.

Research disclosures are available at www.cheuvreux.com

Mats Anderson,

Cheuvreux bank equity analyst