Nordic Banks: Outperforming market expectations in Q2

Aug 16th, 2012

With a majority of European banks having reported second quarter results including the six major Nordic banks — Nordea, Danske Bank, Handelsbanken, Swedbank, SEB and DNB — the divergence between regions are apparent. The results from the Nordic banks surpass market expectations in general, while many continental European peers appear to struggle, writes Mats Anderson, Bank Equity Analyst at CA Cheuvreux.

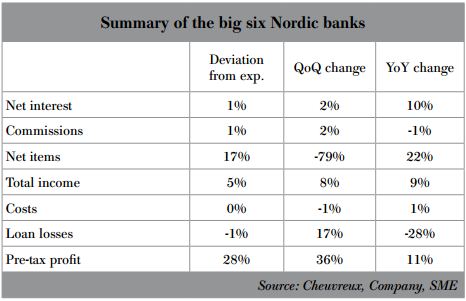

The table below depicts unweighted average line items of particular interest from the six Nordic banks. Pre-tax profit stands out as they exceeded expectations by 28%, while the results have increased on average 36% over the last quarter and 11% over the same period last year.

Looking beyond the numbers one finds that Danske Bank more than doubled its profits, albeit from a very low level, but still remains well below Nordic peers, driving the unweighted average up. The largest Danish bank gained considerably from financial transactions after the drop in interest rates during the quarter. Yet, what is most encouraging is the steady decline of loan loss provisions following the first quarter where especially Denmark and Northern Ireland appear to be in recovery mode.

Overall, our impression is that Danske Bank continues to be on the right path after some difficult years due to high losses in both Denmark and Ireland. The recovery which is now underway can be rightfully compared to Swedbank and SEB’s Baltic venture after the financial crisis.

However, even when excluding Danske Bank, the five other Nordic banks’ results came out ahead, all well above market expectations, with SEB, DNB and Nordea reporting pre-tax profits of 20%, 15% and 14%, respectively. Handelsbanken and Swedbank, being the more defensive banks in the region and thus with less volatility in revenues, delivered results more in line.

In general, net income from financial transactions was the main driver for the Q2 results compared with the previous year, with few exceptions. Simultaneously, banks show weak net commission income due to the subtle performance of capital markets. However, traditional retail banking revenues, such as payment commission, continue to grow on the back of increased card usage and declines in cash handling.

Loan loss provisions have differed greatly between the Nordic banks during the last years. The Swedish banks, Handelsbanken, Swedbank and SEB are characterized by very low loan loss provisions amounting to only a few basis points. All the other big Nordic banks report higher numbers, with Danske Bank heading for a notable improvement with 73bp reported in Q2 compared to 93bp in Q1 and 113bp in Q4 2011.

Loan loss provisions for DNB and Nordea are currently at 21bp and 26bp, respectively. Both national champions suffer from problems in the shipping industry but have recently managed to increase prices to customers in this segment. Hence, the shipping divisions remain profitable despite elevated levels of provisions. Nordea is also obliged to reserve capital for potential loans in arrears in the struggling Danish economy, which also holds true for Danske Bank.

Concluding this section, the single most important factor in the buoyant Nordic results stems from the positive development in net interest income, which was up by 10% YoY (unweighted average).

Nordic banks appear to successfully compensate for not only cyclical deposit

margin pressures due to falling interest rates, but also the increasing regulatory costs, with marginal increases in lending. However, “the jury is still out” with regards to the increasing cost of regulation.

Swedes lead on Basel III

Looking closer at capital adequacy requirements, Swedish regulators are at the forefront of implementing enhanced Basel III guidelines of a 10% Core Tier 1 ratio in 2013 and ultimately 12% in 2015. All four Swedish banks are well on track to meet the requirements stated above and we even believe that the 12%-mark will be accomplished by January 2013, i.e. two years ahead of schedule and well in advance of continental European peers.

Sweden’s neighbouring country in the west is lagging, though, but with Norwegian regulators speeding up the regulatory process DNB is improving its ratios at a much quicker pace than in previous years.

Sweden’s neighbouring country in the west is lagging, though, but with Norwegian regulators speeding up the regulatory process DNB is improving its ratios at a much quicker pace than in previous years.

We are working from the assumption that the Nordic regulators are well calibrated in their view of financial stability and the requirements that they impose on domestic banks. The Nordic countries’ banking sectors are highly integrated and each country’s banking system is dominated by a few large banks, implying they are systemically important. Bear in mind that current regulatory requirements and the banks’ capital situations in the Nordic region are well ahead of most of their continental peers, with Switzerland possibly being the only exception. The fact that the Nordic requirements are more stringent and combined with sound public finances will assist both banks and end customers to benefit from significantly lower funding costs than in many other countries and as a result stimulate their economies.

Not to forget, there is a great deal of uncertainty in terms of size for the future net interest income and thus the banks’ overall profitability. Meanwhile, I as a banking analyst have good faith that the capital requirements imposed to ensure financial stability can and will be combined with healthy profitability for the shareholders, as the two go hand in hand. Stable earnings are the first and most powerful line of defence against financial instability and all the negative consequences it may have on the broader economy.

Journey has only begun

The Nordic banks are unique in a European context. Overall, Swedish banks delivered resilient results in the second quarter of 2012, while at the same time operating with strong balance sheets.

Nevertheless, the journey has only begun in terms of balancing the costs of new capital requirements as well as navigating the uncertain economic outlook due to the European debt crisis. DNB appears to have responded quickly to its national regulator’s stricter requirements and we believe its capital ratios will soon match those of its Swedish neighbours.

On the other hand, Danske Bank continues to struggle due to its geographical diversification, exposures to Denmark and Ireland, with what turned out to be expensive acquisitions in the economic boom leading up to the financial crisis.

However, it appears that there is some light in the long tunnel, our assessment is that the recovery has started, and that Danske Bank with a new management team find themselves in a similar situation to Swedbank’s in the fall of 2009.