New redemption model for Danish callable bonds

May 1st, 2015

Nykredit and other Danish covered bond issuers are introducing a new, simplified model to handle redemptions of callable bonds with annuity cashflows, writes Jørn Strunge, senior business analyst, Nykredit.

– Danish covered bond issuers are introducing a new, simplified model to handle redemptions of callable bonds

– The model will eliminate the so-called drawings

– First impact will be on 22 May 2015 when expected redemption rates are introduced

– Redemptions and payments will start from the due date on 1 October 2015

At the moment, Nykredit has bond issues denominated in Danish kroner, euros and Swedish kronor. Nykredit’s total outstanding amount is currently Dkr550bn or Eu74bn for bonds with partial redemptions.

The current model splits investor holdings into two separate holdings, so-called drawings, six weeks before the due date. This takes place on the publication date.

In the new model there will be no split of investor holdings. Redemption will take place on the due date when payments will also be processed as in the current model. Investors will no longer have to handle two separate holdings of the same bond at the same time. This will simplify the practical and technical handling of Danish covered bonds. Several international investment banks and ICSDs (International Central Securities Depositories) have already stated that the simplified redemption method will pave the way for more international investors.

The new model is based on the EU Corporate Actions standards and the fact that securities must comply with the EU Corporate Actions standards to be compatible with the coming pan-European settlement platform, TARGET2-Securities (T2S).

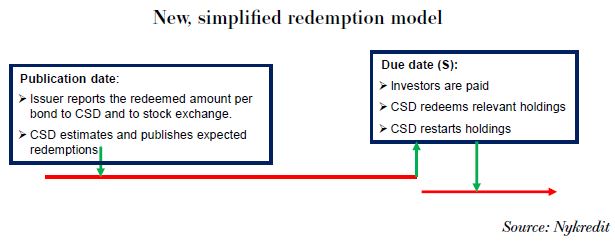

The new redemption model requires only one corporate action step. On the due date, which is the settlement date (S) of the corporate action, part of the holding will be redeemed, and investors will be paid at the same time, just like under delivery versus payment (DvP) settlement. It should be straightforward to handle this corporate action, even when omnibus accounts are used. Redemptions and payments can be distributed by the standard pro rata method. The accompanying diagram illustrates the new model.

From the publication date, it is possible for investors to make forecasts of redeemed holdings. Each day from the publication date to the due date, estimated redemption amounts are calculated by the issuer’s CSD and published by the stock exchange where the bonds are listed. All Nykredit’s callable bonds are currently listed on Nasdaq Copenhagen.

Since the so-called drawings disappear, we will also see that the ex-date will move to two (T+2) days before the due date. On and after the ex-date, trading prices will be without the redeemed part, and the price of the new holding will differ from that of the old holding in which the redeemed holding was included.