New LTV caps positive for Finnish covered bonds, says Moody’s

Jul 8th, 2016

New caps on LTV ratios that took effect in Finland last week are credit positive for Finnish covered bonds, according to Moody’s, reducing credit risk at the whole-loan level and adding to protections in the Finnish covered bond framework.

As part of wider efforts to tackle risks relating to housing credit, new maximum loan-to-value (LTV) ratios for residential mortgages were implemented in Finland last Friday (1 July). The caps, which apply only to new loans, set maximum LTVs at 95% for first-time borrowers and 90% for other loans.

As part of wider efforts to tackle risks relating to housing credit, new maximum loan-to-value (LTV) ratios for residential mortgages were implemented in Finland last Friday (1 July). The caps, which apply only to new loans, set maximum LTVs at 95% for first-time borrowers and 90% for other loans.

Under the legislation introducing the caps, the Finnish Financial Supervisory Authority (Finanssivalvonta Finansinspektionen, or FIN-FSA, (pictured)) may reduce the ratios by up to 10 percentage points, and limit the types of collateral that can be included in the calculation, which currently includes collateral other than the property being financed.

Moody’s said that the LTV caps will have only a limited effect on household indebtedness, but said the move, combined with Finnish mortgages’ typical 20-25 year amortisation schedules, is credit positive for Finnish banks and Finnish covered bonds.

The rating agency noted that the Finnish covered bond legislation already features LTV restrictions on the inclusion of eligible assets.

“For Finnish covered bonds, the LTV threshold under the covered bond law, which is tested against property values only, creates a buffer against house-price depreciation by excluding loan parts in excess of 70% LTV from the cover pools,” said Moody’s.

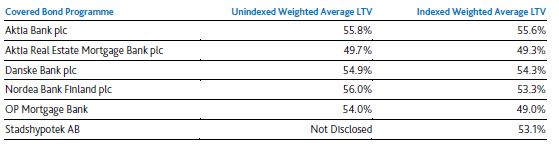

The rating agency said this is reflected in relatively low average LTVs for the residential loans in the Finnish covered bond programmes that it rates.

LTVs for mortgages in Finnish covered bond programmes

Source: Moody’s first-quarter 2016 performance overviews, pre-sale reports (Stadshypotek AB Finnish Cover Pool)

“By introducing a limited buffer against declines in house prices, the new LTV caps temper credit risk at the whole-loan level,” Moody’s said. “In addition, Finnish borrowers typically amortise their loans on a monthly basis over maturities of 20 to 25 years, further reducing the risk of having negative equity should house prices decline.”

Michael Spies, covered bond and SSA strategist at Citi, said the changes are unlikely to have any impact on Finnish covered bond spreads, as the ratios apply only to new loans and will therefore affect cover pool composition only very gradually.

“At the current stage, Finnish covered bonds are trading nearly flat to Pfandbriefe and offer a pick-up to Finnish sovereign bonds of around 25bp,” Spies added. “To us, however, the main RV opportunity is the relative cheapness of covered bonds versus senior bonds.

“With macro risks still elevated and EBA stress test results already looming, stepping up in quality seems sensible to us.”