Negative yields, tight spreads push investor sentiment to new lows

Apr 24th, 2015

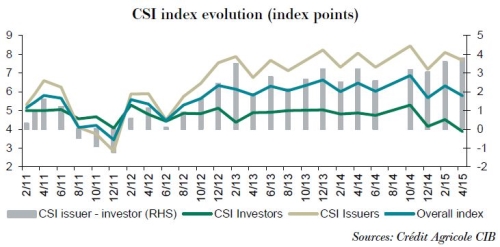

In the latest edition of their Covered bond Sentiment Index (CSI), Crédit Agricole CIB analysts Florian Eichert and Stephan Dorner found investor sentiment at an all-time low – although the issuer index is close to an all-time high.

After a rather short-lived recovery in sentiment in February, the headline CSI index score has dropped again in April, falling to 5.8 from 6.3 in February. We are thus back to the level of December 2014.

Just as a reminder, at that time we did not yet have the Public Sector Purchase Programme (PSPP), covered bonds were the only product being bought in size by the European Central Bank, and spread levels versus sovereign debt and SSA markets looked very unattractive for covered bonds.

The range of opinions among investors also remains remarkably wide: for almost every sector, we have answers ranging from 0 to 10.

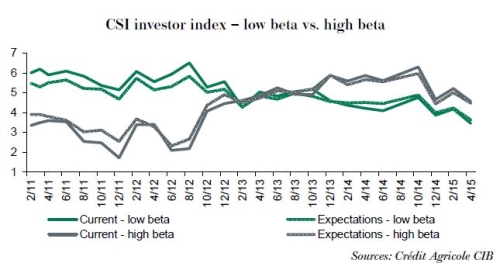

Some investors seem to expect the CBPP3 squeeze to push valuations even further and see the bigger spread difference to sovereign debt and SSA markets positively.

At the same time, the ever lower yields and ongoing grind tighter in covered bonds’ asset-swap spread levels have made many others score covered bond markets with 0s and 1s.

Issuers: close to an all-time high despite minor drop in April

Issuer sentiment remained close to its all-time high. There was a slight drop in the index, by only 0.4 index points, from 8.1 to 7.7.

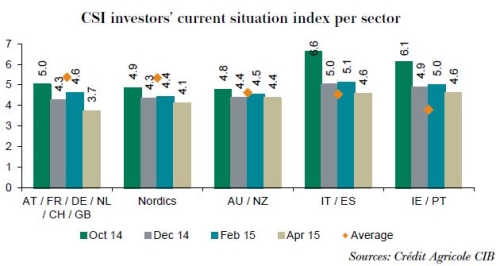

Differently to last time around, we have seen a slightly more diverse set of answers from the various regions. While the sentiment scores of peripheral issuer have increased slightly, those of issuers from core Europe have fallen. To some extent, the volatility in Austria around Heta and the unexpected split of Kommunalkredit Austria’s covered bond programme will have played a role, as Austrian and German banks are affected here.

The main problem for issuers from core European countries remains the situation in private placement markets. Sentiment looks distinctly different than in public markets – and not in a good way. Thanks to the very low interest rates, issuers seem to find it much harder to find as much private placement demand as in public markets.

Issuers’ sentiment from core continental European countries towards private placement markets is a full 2.3 index points below that for public markets.

Surprisingly, the difference for Nordic issuers who should be affected by the same low yield and low spread environment as core European issuers has improved compared with last time. Sentiment in private placement markets is only slightly below the level for public markets (8.0 index points vs. 8.2 for public markets).

Looking at peripheral issuers, the still slightly higher yields seem to put them in a better position for now. Similar to Nordic issuers, their sentiment towards private placement markets is at the same level as it is for public markets, only at a higher absolute level.

Investors: all-time low in April

The CSI investor sub-index has dropped to a record low. We had the investor sub-index at 4.1 twice before – in December 2011 when sentiment towards peripheral markets was below 2 and then again in December 2014. This time around sentiment has dropped by 0.6 index points to 3.9, the lowest reading of the index since we started it in 2011.

Even more than on the issuer side, Austrian volatility has led to lower scores for core European sectors. The overall lower yield environment, with even 10 year Bunds approaching negative yield territory, and the grinding tighter of asset-swap spreads of covered bonds has been another big factor driving sentiment lower.

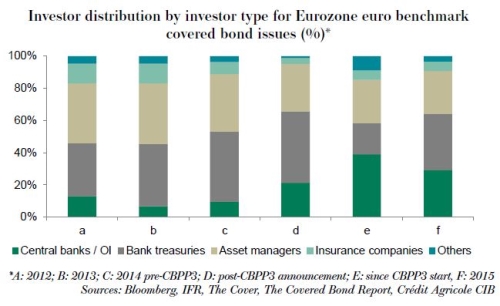

The main theme in almost every investor meeting these days continues to be the cash that is tied to the market/product being put to work in new issues as they come even if spread levels are extremely tight. After all, getting bonds in secondary markets is a very tough challenge with the CBPP3 buying around Eu500m every single day, and holding cash has started to cost as non-bank investors are starting to be charged negative interest rates, too. Also, the wider covered-govvie and covered-SSA spreads lead to a natural demand from bank treasuries who continue to buy despite showing fairly low sentiment scores.

In the current low yield environment, it has been all about carry, and peripheral markets were also able to profit from this in the past in our sentiment index. Considering how far they have come, however, the carry argument pro periphery has become decreasingly valid.

Consequently, sentiment towards peripheral markets is a good 2 index points below the level where it was in October 2014. It is still the highest out there, but non-CBPP3 eligible sectors such as Australia or New Zealand that by now trade at similar levels to some of the strong Spanish names, for example, has held up the best in the past months.

Bottom line

The drop in our CSI index matches the feeling we get when talking to investors: there is a lot of frustration about the impact QE in general has on yield levels as well as more specifically CBPP3 on the covered bond market.

However, there are still investors buying. Deutsche Hyp’s latest Eu500m mortgage Pfandbrief is the best example. Books were closed in a matter of a few minutes at Eu1.85bn and with 70 investors.

As we have written above, the range of answers we received is still very wide and despite a lot of investors giving us low scores there were also others with high figures. In an overall illiquid market with one big buyer and net negative issuance, it doesn’t need a large army of buyers to absorb new issues.

CBPP3 will in any case not stop buying at the current pace and will thus continue to squeeze the market. The only way settled volumes can come down is if the ECB stops finding investors willing to sell. Surprisingly, this does not seem to have happened yet, but it will at some point in the coming months. Rather than lead to more normal market, a lower CBPP3 number will in our view cause the opposite effect.

For us, the bottom line on covered bond markets at this point is, with sovereign and SSA markets being equally distorted, spread valuations of covered bonds vs. these two markets in fact look fair.

When it comes to sector allocations, our take is roughly unchanged to what we said in our covered bond outlook. CBPP3 is buying, but as Austria showed there can still be volatility in individual cases. It thus does not pay to chase the last basis point of carry by going into weaker qualities in CBPP3-land.

Focus on quality and then add risk by buying on dips, as a number of investors did in the case of Austria. The ongoing buying by CBPP3 will squeeze markets tighter again after a widening phase. We also still like the CBPP3-ineligible markets such as Australia or New Zealand, which at this point trade at similar levels to some of the stronger peripheral issuers. There are only a few exceptions to this where we feel noticeable further compression can still happen.

Last, but not least, keep an eye on other currencies. Depending on how the basis swaps to US dollars and sterling trade, they can be interesting. Besides, these markets have seen more issuance than in the past and have also grown in net terms.