Negative yields and covered bonds: is the minus a problem?

Mar 13th, 2015

With an increasing share of the covered bond market trading at negative yields, Crédit Agricole CIB analysts Florian Eichert and Stephan Dorner explore the impact on issuers and investors.

For investors in Denmark or Switzerland, buying at negative rates is already a reality. Not only do covered bonds in Swiss francs and Danish kroner trade at deeply negative yields, but there have also been new issues below 0%.

In euros, where the -0.2% ECB deposit rate is still well above the -0.75% of Denmark and Switzerland, we have also seen the first euro benchmark covered bonds trade through 0% in secondary markets. But it has only happened in a few cases and we have yet to see the first covered bond new issue price through 0%.

Prevailing yields in euros

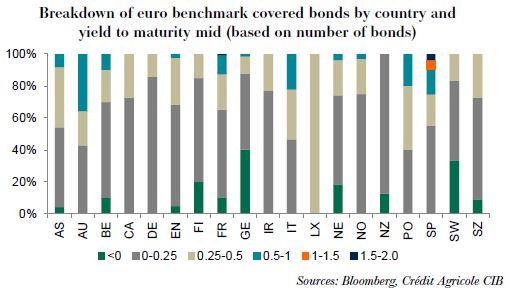

As mentioned above, we are not yet talking about yields in euro benchmark covered bond markets having gone below 0% across the board.

- Average five year Pfandbrief yields in Germany are, however, dangerously close to breaking through the barrier, coming in at just about +0.03%.

- In total, almost 15% of the euro benchmark covered bond market trades at a yield below 0% (mid basis), with the relevant covered bonds coming from Austria, Belgium, Finland, France, Germany, the Netherlands, Sweden, Switzerland and the UK.

- Looking at only the iBoxx EUR Covered Index (which excludes bonds with a residual maturity of less than one year), we are talking about 13%.

- The market with the highest share of bonds in negative territory is Germany, with around 40% of the German euro benchmark Pfandbrief market now trading at a yield below 0%.

Running a covered bond programme: What happens if rates become negative?

For issuers, rates in negative territory can have a number of consequences for how they manage their programmes.

- Depending on whether assets are predominantly fixed or floating rate, it can take more assets to cover the cash outflows of fixed rate covered bonds.

- OC levels on an NPV basis can become rather interesting when discounting with negative rates.

- Negative rates can also have an impact on issuers’ hedging arrangements.

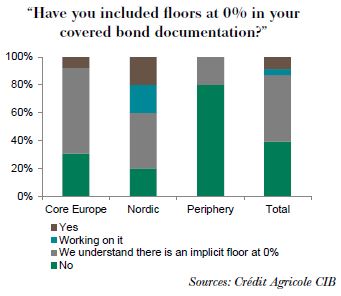

- When issuing FRN covered bonds there can be a documentation issue around floors at 0%.

- Most soft bullet covered bonds pay a spread vs. one or three month Euribor. Consequently negative rates can raise the same questions as for FRN covered bonds.

Below we will go into more detail on the technical aspects.

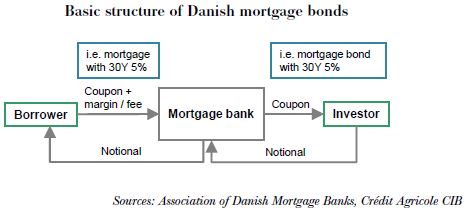

Special case: Denmark

The most extreme impact negative rates can have on covered bonds can be seen in Denmark. The country’s covered bond market operates with a pass-through system. Issuers have a number of large covered bond series outstanding in the market. If borrowers want to take out a mortgage they decide for a specific loan type/series that corresponds one-for-one to the existing Danish mortgage bond in the market when it comes to coupon and maturity. Other than in, for example, Germany, where loans are given out at par and the prevailing interest rate in the market is reflected in the coupon offered to the client, in Denmark it is the notional of the loan that changes based on the market rate while the coupon stays the same. The moment a borrower has borrowed from the bank, the latter taps the corresponding covered bond series in the market to refinance the loan. The interest rate charged to the client is effectively the corresponding mortgage bond’s yield plus an administration fee.

Until recently the fee charged by banks had protected them from having to pass on negative rates on the mortgage bonds to their borrowers. However, after the last central bank cut to -0.75% this ceased to work in some cases. Because of the pass-through nature and the lack of floors at 0% in the older loan documentation banks have had to start paying some borrowers for borrowing from them.

One-off question…

To get an idea how issuers deal with this situation we have used last month’s one-off question in our CSI index to ask the following question:

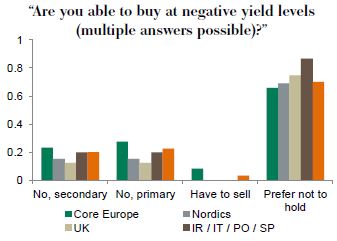

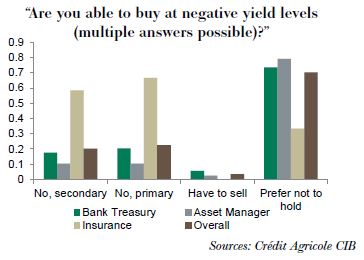

On the other side we’ve asked investors the one-off question if they’re allowed to buy below 0% or are they prevented from doing so?

Negative interest rates have had quite an impact on fixed income markets. And as these survey results have shown, investors have a clear preference against holding negative yielding securities.

Consequently we have seen a lot of trades with investors moving further out the curve and into more risk in an attempt to leave negative rates behind. Often these trades also involved switches from sovereign debt at negative yields into slightly longer covered bonds at positive yield levels. The actual levels vs. asset swaps didn’t matter all that much in some of these switches and neither did the spread to other covered bond sectors. The biggest focus was on the yields of the two securities and on finding the lowest level of additional risk to take one into positive yielding territory.

This trend can also be seen in new issue markets as well as investor distribution stats. The average tenor of euro benchmark covered bond new issuance has moved from 6.7 years in 2014 to 7.6 years in 2015. And where insurance companies have cleared the pitch, heading for other markets, other investors have picked up where they left off. Even bank treasuries have shown up in the 10 year and longer space in an attempt to find yield.

Bottom line

Negative yields are a phenomenon that has made the headlines in a number of markets lately (just think of an equity target price when calculating the terminal value of a cashflow stream with a negative interest rate – “To infinity and beyond!” is all we can say…).

On the issuer side, negative rates have raised a number of technical issues:

- For issuers with FRN assets and predominantly fixed rate liabilities, the lower and even negative rates can lower OC levels on a NPV basis. FRN pools become more risky in a low interest rate environment, especially if the hedging arrangements are not part of the cover pool. And should the European Banking Authority decide to count collateralised derivative exposure towards the 15% exposure to institutions limit (CRR Art. 129 1c) issuers could even be forced to keep more risk open or resort to more natural hedging.

- Hedging floating assets with floating covered bonds could, however, be made trickier given the ultra-low interest rates and the potential for FRN coupons to drop below 0%. Also for the time being, not many issuers have added floors at 0% into their FRN documentation, potentially raising problems when coupons drop below 0%.

Most investors don’t have a fundamental problem with buying at negative rates. It is mainly insurance companies that have come back to us in our survey saying they are not allowed to buy at these levels. At the same time, virtually all investors (including CBPP3) try to avoid having to do so with every fibre of their bodies.

Last, but not least:

- Investors who are concerned about the fundamental impact negative rates can have on cover pools should focus more on fixed rate-based pools as we have them in Belgium, France, Germany or the Netherlands.

- When it comes to soft bullet covered bonds, look at those that pay a fixed rate during the extension period.

- Buying FRN covered bonds that are floored at 0% while fixed rate bonds can move further below 0% is probably not the best idea at this time.

- Finally, given the unwillingness by many investors (including CBPP3) to buy below 0%, we would expect spread curves to further converge to 0% rather than parallel shift down in the event that sovereign yields were to go lower. Also, bid side liquidity for bonds below 0% should continue to be very limited.