Moody’s anchor move and sovereign ceilings: positive across the board

Jan 23rd, 2015

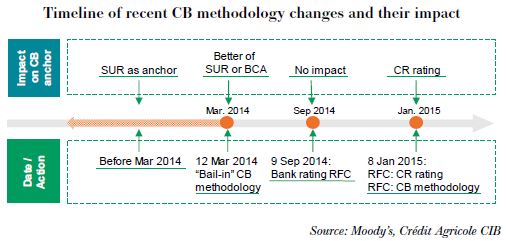

Moody’s has kicked off the new year with yet another significant change to its covered bond methodology, as the rating agency intends to change its anchor point for the second time in less than 12 months to incorporate the Bank Recovery & Resolution Directive (BRRD).

While the first adjustment last year meant changing the anchor from the senior unsecured rating (SUR) to either the SUR plus one notch or the adjusted baseline credit assessment (BCA) plus up to two notches, this time Moody’s is proposing to begin at a newly created starting point: the counterparty risk rating (CR).

The request for comment was published on 8 January together with a request for comment (RFC) on the proposed new counterparty risk rating (CR) and after an RFC on proposed changes to its bank rating methodology earlier in September 2014. Market participants are able to submit comments until 9 February.

The CR rating depends on how a bank is capitalised (with senior, subordinated debt, and also junior deposits). The CR rating can be up to three notches above the issuer’s adjusted BCA. Moody’s will also look at the government support and to our understanding will add an additional notch if it considers this sufficient.

For covered bonds, on top of that, the rating agency intends to add an additional notch of uplift to the CR rating for covered bond programmes located in a country where the BRRD or an equivalent regime, such as those of Norway and Switzerland, are applicable as they protect against “cancellation, modification or partial transfer of assets, rights and liabilities that form part of the covered bond (or structured finance) arrangement”. Thus a covered bond anchor may be up to four notches above the adjusted BCA, while previously it was capped at either one notch above the SUR or two notches above the adjusted BCA.

In addition to having a higher absolute uplift, it appears that it will also be easier to get the extra uplift. Under the old methodology, issuers had to reach certain levels of bail-in-able debt and only if they had above 10% of bail-in-able senior and sub debt to total liabilities did they profit from the full extra uplift. And even though Moody’s never officially stated what exactly it counted towards the 5% limit, retail bonds and uninsured deposits didn’t seem to be included.

This time around even junior deposits are explicitly mentioned. So anything that doesn’t fall under the deposit protection limits should be factored in by Moody’s and retail placed bonds by, let’s say, Italian banks should qualify as well.

More to come from Moody’s: changing TPIs?

In addition to the proposed new anchor point, at the very end of the RFC Moody’s notes that it might amend its Timely Payment Indicator (TPI) analysis as well to reflect recent changes made by regulators to their covered bond legislations, such as the incorporation of liquidity buffers. This is, however, only an initial thought for now.

Last but not least: Moody’s increases sovereign ceilings from four to six

Moody’s finalised its new sovereign ceiling methodology on Tuesday. It intends to increase the sovereign ceiling uplift from four notches to six notches going forward.

Even more notably, Moody’s doesn’t seem to be differentiating between mortgage and public sector-backed covered bonds. So what is limited at two notches above the sovereign at Standard & Poor’s can be up to six notches above the sovereign at Moody’s (overcollateralisation (OC) requirements do go through the roof to get there, though).

Thus we could see stronger issuers from the periphery go into double-A space, which would enable them to make it into LCR level 1B even without making use of conditional pass-through structures. And should Moody’s new covered bond anchor be implemented as proposed, we could even see some second tier names benefiting from a higher country ceiling.

Just a day after the official release Moody’s acted on the ratings of 13 Italian and Spanish covered bond programmes, lifting 11 to Aa2, the new sovereign ceiling in those countries, one to Aa3, and one to A1, while Intesa Sanpaolo’s public sector programme was affirmed at A2. Regarding the latter, Moody’s stated that it is in discussion with the issuer about the committed OC of the programme. As stated, the rating agency grants for both the mortgage-backed as well as public sector programmes up to six notches of uplift. For public sector programmes the committed OC has to be significantly higher, though, than is the case for mortgage programmes as Moody’s stresses the pool losses with much higher levels.

In terms of regulatory treatment, most of the programmes that Moody’s has upgraded have now a rating in the double A space. In case they have more than one rating, the second best rating counts, and if this is also in the double A space risk weights should come down from 20% to 10%. In addition, these programmes should have the possibility of reaching LCR Level 1B.

Bottom line

It seems that Moody’s is focussing more on methodological changes in 2015, which on balance should be quite positive for covered bond ratings across the board, or at least increase the leeway built in for issuer rating downgrades. And the fact that the agency is also contemplating improving TPIs in some cases and has just published its new sovereign ceiling methodology — which increases sovereign ceilings from four to six notches (funnily enough S&P just recently went from six to four) — should help the periphery especially and compress the rating universe again from the bottom up.

For us the bottom line is therefore that the covered bond analysts at the rating agency with the largest market share are trying to regain some of their independence in setting ratings after they were dragged down alongside sovereign and bank ratings. The result should be positive overall and help those countries that had suffered most in the last few years to in some cases even make it back to the double-A space and regain the best regulatory treatment possible (risk weights, LCR).

Florian Eichert and Stephan Dorner, Crédit Agricole CIB