LCR Delegated Act: What do the final rules look like?

Oct 17th, 2014

The LCR Delegated Act from the European Commission is finally out. No, really, it is! Seriously, we are talking about the real thing, not just another leaked document but the final version, the one that will be relevant in the real world and not only talked about in Brussels and a number of European capitals.

OK, it’s taken them a little longer than anticipated, they’ve gone past a couple of hard to slightly softer deadlines without blinking once or bothering to mention it.

We have looked at the final version and tried to make as clear as possible what it means for covered bonds and how bank treasuries will react to the final piece. After all, there are still some uncertainties around the minimum rating for Level 2B as well as unclear wording on the treatment of overcollateralisation (it seems that only the calculation method has to be legal-based and not the minimum OC figure, but the wording is very counter-intuitive).

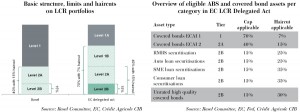

Overall composition, limits and haircuts of LCR portfolios

European regulators have moved away from global LCR standards by allowing covered bonds to be moved into a newly created Level 1B category. 1B assets can constitute up to 70% of the overall LCR portfolio and are subject to a haircut of 7%. Covered bonds that don’t qualify for Level 1B can also be part of Level 2A, which in its size and haircut is similar to Basel rules, as well as 2B in what is yet another difference to global rules favouring covered bonds.

Click charts to view full size

The implementation date of the LCR in Europe has been shifted to 1 October 2015, delaying it by 10 months.

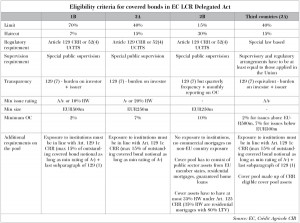

Eligibility criteria for EU covered bonds: 1B and 2A

Click table to view full size

The delegated act builds on UCITS and elements from Article 129 of the CRR. It is important to stress though that covered bonds do not have to be CRR-compliant to be eligible:

- Covered bonds have to be “bonds as referred to in Article 52(4) or Directive 2009/65/EC OR meet the requirements to be eligible for the treatment set out in Article 129 (4) or (5) or Regulation (EU) No 575/2013”.

What this means is that covered bonds with CRR-ineligible collateral can be LCR-compliant. This would include covered bonds from Luxembourg, NordLB’s aircraft Pfandbriefe, as well as potential SME backed OBC issuance from Italy if their covered bond-specific reporting is sufficient to be in line with 129 (7).

In addition to this, the Delegated Act adds three requirements for Level 1B and 2A covered bonds that go beyond the CRR:

- Level 1B assets require a minimum rating of AA-, a minimum issue size of Eu500m and a minimum legal OC of 2%

- Level 2A assets require a minimum rating of A-, a minimum size of Eu250m and a minimum OC of 7% (Level 1B assets that don’t have the sufficient size and thus fall into 2A only have to have 2% OC)

Eligibility criteria for EU covered bonds: 2B

While the overall treatment of covered bonds stayed unchanged since the first leaked documents, in a last minute move, certain covered bonds have also made it into Level 2B. There are, however, minimum requirements, which are even stricter than those for Level 1B or 2A and even the CRR.

When it comes to who could potentially populate this group we still have a big question mark for the time being, however:

- The actual Delegated Act doesn’t mention ratings for Level 2B-eligible covered bonds. Essentially this should mean that all covered bonds rated below A- could qualify for 2B if they comply with the other criteria mentioned above. We would thus be talking about lower rated OBGs and Portuguese covered bonds being eligible (cédulas would be out mostly because of their commercial mortgage exposure and low reporting frequency).

- However, the FAQ to the Delegated Act contains a table showing the Level 2B covered bonds as “unrated” covered bonds only. If this were the case, only some retained Italian covered bonds could be eligible while the remainder of the lower rated covered bonds would be out.

The bottom line is that we don’t have clarity on this for now, as two EC documents seem to contradict each other. We would tend to go with what we can read in the Delegated Act and say any rating below A- is good enough. But reading the wording has already led to misunderstandings on the minimum OC and we are aware that there is a big push in Brussels and some member states to reduce the reliance on rating agencies.

Eligibility criteria for covered bonds from third countries

Covered bonds from third countries are Level 2A-LCR eligible investments if they comply with certain criteria:

- Third country covered bonds have to be special law-based, adhere to a 15% limit on exposure to institutions, and will have to be in line with transparency requirements of 129(7)

- They will also have to be subject to special public supervision of their covered bonds that is at least equal to standards applied in the EU (we were not aware there are common standards on public special supervision within Europe, but the EC seems to think there are…)

There are, however, some differences compared with EU member states’ covered bonds:

- No minimum size requirement

- Despite being Level 2A assets, covered bonds from third countries have to have a rating of at least AA-

- 2% OC as long as the issue size is above Eu500m but 7% for those below Eu500m

- While covered bonds from EU member states can be backed by any collateral as long as they are part of a covered bond law, covered bonds from third countries have to have CRR compliant cover assets

The most striking difference in our view is that there is no minimum size requirement for third country covered bonds. Why issuers that tend to be amongst the biggest out there can actually issue a Eu50m bond that is then LCR-eligible while smaller issuers from member states have to scramble to get to at least Eu250m to get into Level 2A, we don’t know. It is probably one of those specificities of Brussels where a logical approach to trying to understand a certain situation fails miserably.

Covered bonds & LCR FAQ

OC: legal, contractual, voluntary?

The Delegated Act talks about a minimum asset coverage requirement at all times of at least 2%/7% /10%:

- “Asset coverage requirement means ratio of assets to liabilities as determined for credit enhancement purposes in relation to covered bonds by the national law of a member state or a third country.”

This wording has led to a lot of confusion. Reading the wording, we would have guessed that the LCR requires a legal minimum OC requirement of 2%/7%/10%. Countries such as the Netherlands, Norway and Sweden would have had to change their covered bond laws to raise minimum OC to at least 2% (to be eligible for 1B) while Italy, Ireland and Portugal would have had to increase theirs to 7% for 2A or even 10% had they wanted their issuers to have a shot at 2B as well. The only country eligible with a legal minimum OC level in line with 2A currently would have been Spain, with a 25% legal minimum.

According to the ECBC, however, the only thing that has to be legal-based is the process by which issuers calculate their OC levels; the number itself can be held on a voluntary basis. The actual legal limit in that country doesn’t matter. It can in fact be 0%.

What is the minimum rating in case of split ratings?

To determine which ratings are relevant here and what happens in case of split ratings, the delegated act refers to Art. 129(4) CRR:

- If covered bonds have two or three ratings the second best is being used to determine the risk weight while the second worst applies in case there are four ratings available

What happens to tap issues that start out below the thresholds?

In our view it is more the status quo that counts than anything else. So a bond that started out as a Eu100m issue and was subsequently tapped to Eu250m and then at a later stage to Eu500m should start out being LCR-ineligible, then move into Level 2A, and finally end up in 1B.

Do coupon structures play a role in LCR eligibility?

In short: they don’t. At least we couldn’t find anything mentioning coupon structures in the Delegated Act. In essence, a Eu500m FRN covered bond should be equally eligible as a Eu500m fixed rate benchmark.

Do currencies play a role in eligibility?

No, they don’t. Whether a bank is willing and able to buy, for example, a US dollar benchmark into its LCR portfolio depends on its need for US dollar assets. If they have US dollar cash outflows that need to be covered, US dollar bonds are the best instrument to deal with this. There is no hard limit on currencies; it all depends on a bank’s individual situation.

How is Norway treated? Can they get into Level 1B or are they considered a third country?

Norway has always been a somewhat tricky story. They are part of the EEA but not a full EU member state. The wording of the LCR says, however, that only covered bonds from member states can be Level 1B assets. Third countries can only be part of level 2A.

At this stage there is no final clarity on this item, in our view. We do, however, have a similar situation with risk weights. Technically speaking, Norwegian covered bonds shouldn’t get a preferential risk weight, as their location outside the EU should prevent them from being UCITS and thus CRR-compliant. The Norwegian regulator incorporated EU financial regulation, however, and Norwegian banks are regulated under this set of rules.

We would thus strongly think that Norwegian covered bonds are Level 1B-eligible but can’t be 100% sure at this stage.

So who is in and who is out?

Assuming that the Delegated Act does not in fact require minimum legal OC levels, a large chunk of the benchmark covered bond market will essentially be eligible with only a few being left out:

- There are a number of wind-down programmes that are not UCITS/CRR-compliant.

- There are a few issuers that don’t seem to be in line with 129(7) transparency requirements.

- Depending on whether 2B is open for unrated covered bonds only or for those rated below A-, either all covered bonds rated below A- are out or only those rated lower that don’t fulfil the 2B requirements (lower rated cédulas).

Looking at covered bonds from third countries, there are only UBS and Credit Suisse as well as the old legacy Canadian structured covered bond programmes (the new legislative ones are fine) that fail on the legal framework criteria. In addition to this, covered bonds from New Zealand fail on the special public supervision criterion.

Behaviour of bank treasuries

A big part of bank treasuries’ purchases were in the past in highly rated covered bonds as the LCR discussions at the Basel level focussed on AA- as the minimum rating for covered bonds.

Click charts to view full sized

The single-A category has, however, been slowly going up in 2014 as it has become more and more clear that this rating category will be eligible in Europe after all. We are not talking about a sudden change in behaviour, but a more long term, slow shift.

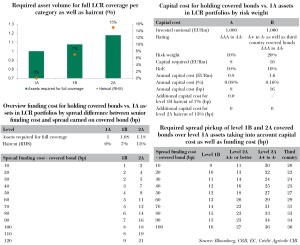

Being able to buy covered bonds for liquidity portfolios is one thing. Having the possibility to buy covered bonds does not, however, mean that one has to and will actually buy them. Economic considerations play an important role and if covered bonds are too expensive, bank treasuries can go for 1A assets.

For covered bonds to find their way into LCR portfolios they have to offer an attractive pick-up versus Level 1A assets as they are treated worse in terms of haircuts and have higher risk weights:

- Capital cost: Banks have to earn the extra capital cost of holding covered bonds.

- Funding cost: And since they have to hold more of them to get to the same LCR result, they have to also factor in costs for funding the haircut via deposits or senior unsecured. Since the additional assets also generate extra income, we have to look at the spread difference between a bank’s funding and the spread offered by the covered bond.

Click charts to view full sized

We are thus talking about a required spread pick-up for covered bonds versus sovereign debt of slightly below 10bp (for Level 1B covered bonds held by very strong banks that can fund the extra covered bonds needed at very cheap levels) to close to 40bp (for Level 2A covered bonds held by weak banks with high funding costs relative to the investment returns from the covered bonds).

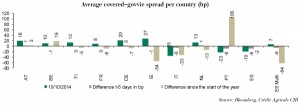

Looking at the current covered-govvie spreads across countries, it becomes clear that we are in many cases inside or just above these levels, making Level 1A assets more interesting for bank treasuries for the time being.

Click thumbnail to view full sized

Bottom line

Compared with other regions around the globe as well as Basel rules, the Delegated Act on the LCR from the European Commission is good news for covered bond markets. Covered bonds can be part of Levels 1B, 2A and 2B, while at the global level we are only talking about 2A.

Most of the detailed eligibility criteria had been leaked beforehand so they shouldn’t come as a surprise (with the main exception being the Level 2B eligibility). The EC is taking a more open and less traditional approach to eligibility than the ECB in its CBPP3 programme rules. CRR-ineligible cover assets (aircraft mortgages, potentially SME loans) can be eligible, too. This fits with the EC’s push for a better functioning market for the long term refinancing of the European economy. The ECB limits its focus to the most traditional categories only.

What is still annoying is that the final act doesn’t answer everything and even raises new questions. The discussion about the legal minimum OC is not exactly intuitive when reading the actual text. And irrespective of what the EC might have meant when wording this part of the Delegated Act, in the absence of a clear statement from their end we wouldn’t even rule out the risk of a national regulator interpreting it their own ay. And having contradictory statements on Level 2B ratings (“unrated” in the FAQ versus no rating requirement in the act) makes it hard to judge if lower rated Italian and Portuguese covered bonds could be eligible after all. We would welcome some sort of a clarification here to eliminate any residual uncertainty.

Florian Eichert Senior Covered Bond Analyst Stephan Dorner Covered Bond Analyst Crédit Agricole CIB