Large exposure limits and covered bonds Will full exemption be a thing of the past?

Apr 24th, 2014

To limit the risk of a bank default leading to major problems at other institutions, regulators limit the overall money that a bank can lend to another institution. Regulators look at the overall existing exposure, including, for example, bond investments or direct lending.

Rules exist both in Europe, where large exposure limits are part of CRD IV/CRR, as well as at the Basel level.

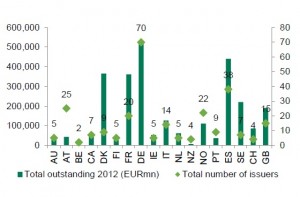

Possible investment limit of covered bonds of one issuer depending on the large exposure limit weighting for Eu100m

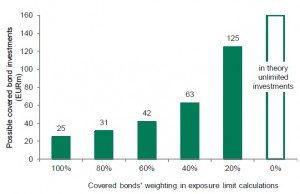

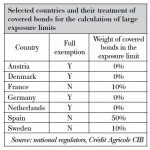

The treatment of covered bonds in this context has to date been a fairly heterogeneous story, with some countries not factoring covered bonds into large exposure limits and others treating the product similar to unsecured debt.

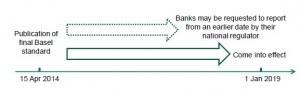

The Basel Committee on Banking Supervision has, however, this month published a new supervisory framework for measuring and controlling large exposures. The framework will come into force on 1 January 2019. National regulators might, however, ask their banks to report based on the new standards before that date to see if the transition could cause any problems. There will, after all, be no grandfathering of old rules, which is also why the start date is only in five years.

While not eliminating national differences in how covered bonds are treated, the proposed framework plans to add eligibility criteria for covered bonds to benefit from preferential treatment and also raises the minimum covered bond weighting in the actual calculation from currently 0% (full exemption of covered bonds from large exposures) to 20%.

If implemented as proposed, this could spell some trouble for a number of countries in the covered bond market. It also fits in with a number of other regulatory initiatives that aim to maintain covered bonds’ preferential treatment but which tighten the eligibility criteria necessary to benefit from this (consider the EBA’s reassessment of preferential risk weights for covered bonds).

If implemented as proposed, this could spell some trouble for a number of countries in the covered bond market. It also fits in with a number of other regulatory initiatives that aim to maintain covered bonds’ preferential treatment but which tighten the eligibility criteria necessary to benefit from this (consider the EBA’s reassessment of preferential risk weights for covered bonds).

Regulators’ stance on covered bonds is still supportive overall. At the same time t securitisation products are starting to receive more positive attention, covered bonds’ preferential treatment is becoming more differentiated.

European large exposure rules

Rules around large exposures in the European Union are dealt with in the CRD IV/CRR. Article 395 limits the maximum exposure one bank can have to another counterparty to currently 25% of that institution’s eligible capital.

The beneficial treatment of covered bonds in this regime comes from the fact that banks don’t have to fully count them towards the 25% limit.

The lower the weighting of covered bonds in this calculation, the higher the investable covered bond volume is per counterparty. Senior unsecured exposure, which has to be fully counted in the large exposure limit calculation, is thus limited at 25% of the bank’s capital, while covered bonds of one issuer can make up a much higher percentage of the investing bank’s capital base (see chart).

Unfortunately the CRD IV/CRR allows for national discretion in how covered bonds can be treated.

- Article 400 Nr. 1 of the CRR states that competent authorities may fully or partially exempt covered bonds compliant with Article 129 (1), (3) and (6).

The range of options can thus go from anywhere between full exemption (0% weighting) to no exemption (100% weighting), as well as any number in between. Finding out how individual countries make use of this option is problematic, to say the least.

We know that, for example, German bank treasuries can use a weighting of 0% for CRD/CRR-compliant covered bonds. At the same time, they have to factor in exposure to non-CRD/CRR-compliant covered bonds with a full 100% of the invested notional. The same 0% weighting can be used in Denmark, Austria and the Netherlands.

In our experience, the current weightings on large exposure limits do not pose a problem for most bank treasuries.

New Basel framework

Similar to the European Union, large exposure limits have existed at the global Basel level as well. They also focussed on the 25% cap of an institution’s capital. As mentioned above, the Basel Committee on Banking Supervision has, however, published a new supervisory framework for measuring and controlling large exposures.

In the new rules, the Basel Committee implements a number of changes compared to the current regime:

- For exposures between two G-SIBs, the limit will be reduced to 15%

- Covered bonds’ weighting in the large exposure limit calculation is floored at 20%, meaning the full exemption from exposure limit calculations could be a thing of the past from 2019 onwards

- The Basel Committee details additional requirements covered bonds have to fulfil to be eligible for beneficial treatment in the first place

Many of the items mentioned in the Basel text are fairly similar to what one would find in other regulatory documents that talk about covered bonds. There is a link to UCITS, for example, or the maximum LTVs for commercial and residential mortgages are similar to the CRD IV/CRR. There are, however, differences, too, that could cause some trouble for a number of covered bond products if they are implemented unchanged into European law:

- The set of eligible assets is smaller than in the CRD IV/CRR. Ship mortgages are not mentioned and neither are internal MBS nor French guaranteed home loans

- Minimum OC is not at 0%, as is the case for the CRD IV/CRR, but at 10%

- Valuations used for the LTV calculation have to be adjusted at least annually for all mortgages as opposed to the three year/one year requirement for residential/commercial mortgages in the CRR

On a positive note, it is interesting to see how the Basel text deals with the minimum OC requirement:

- “The value of the pool of assets for this purpose does not need to be that required by the legislative framework.”

- “However, if the legislative framework does not stipulate a requirement of at least 10%, the issuing bank needs to publicly disclose on a regular basis that their cover pool meets the 10% requirement in practice.”

This is the first time we have seen voluntary OC being given explicit credit in a regulatory text. So far, regulation has always been very vague on this point or often merely talked about OC while not determining which OC was meant.

What this statement also does is gives us a hint as to what documents are acceptable for regulators when it comes to proving to them as an investor that certain rules are met. Apparently, minimum standards do not have to be included in covered bond legislation. Rules in covered bond programmes or even issuers voluntarily complying with certain standards seem to be fine as well.

Potential problems part one: increasing the minimum weight on covered bonds to 20%

The Basel text contains a rather problematic aspect as well, however. Similar to the CRD IV/CRR rules, it allows for national discretion. However, other than European rules, it sets the minimum level at 20%.

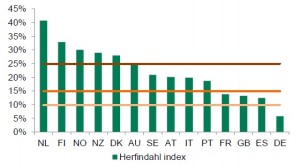

The 20% minimum is clearly above the levels used by virtually all European countries for which we have information on the treatment of covered bonds. Especially in a market with a small number of issuers, such as Denmark, this could become a problem.

Potential problem part two: requiring annual revaluation of collateral

Another item on the list that will be causing a few covered bond issuers to break out in a sweat is the requirement to revalue LTVs at least annually.

Issuers from Anglo-Saxon countries with monthly Asset Coverage Tests that index their LTVs should be in good shape here.

However, the CRD currently requires only revaluation every three years for residential mortgage collateral. Consequently, for a number of countries the Basel rule on large exposures would certainly require changes to how they run their programmes (after all, no legal basis is needed for the 10% minimum OC to be accepted) or ideally through the underlying covered bond laws.

Potential problem part three: tighter cover asset eligibility criteria than the CRD IV/CRR

At the moment, the asset eligibility criteria of the Basel text exclude a number of countries, ranging from French OH issuers to covered bonds backed by shipping mortgages.

A big reason for this in our view is the fact that the abovementioned asset types are very specific to their countries and Basel simply doesn’t go into that level of detail. There will be a European implementation of these rules at some point and we’d expect the European specificities that are dealt with in the CRD IV/CRR article 129 to be taken into account.

The way forward?

First of all, implementation will be in 2019 onwards and the text still has to be implemented into European law to be binding for European financial institutions. We’ll thus have to see what the final outcome is. After all, despite a push for globally harmonised rules, there are differences between Basel rules and their national implementation.

However, if rules are incorporated in the current form, they could cause a problem for banks in countries that currently enjoy a full exemption for covered bonds while at the same time being large in absolute size, domestically focussed and yet small in number. Denmark would be the first country to spring to mind.

Should, however, the valuation requirement of at least annual revaluation end up becoming mandatory, a number of countries would have to adjust their frameworks, or at least the way the issuers operate.

After all, while moving from a 0% to a 20% weighting is not pleasant, losing beneficial treatment and moving from 0% to 100% would be a disaster for many countries.

In the bigger context, the Basel text highlights one thing for us: covered bonds are still being supported. However, regulators are becoming more differentiated when it comes to who can benefit from regulatory advantages. While investors these days focus on the issuer first and then maybe on the cover pools, the analysis of legal structures and frameworks will become more relevant going forward — not necessarily only for identifying risks, but also anticipating beneficial regulatory treatment and all the positive spread momentum that comes with it.

Florian Eichert Senior Covered Bond Analyst Stephan Dorner Covered Bond Analyst Crédit Agricole CIBSource for charts: Crédit Agricole CIB

* A HHI below 10% indicates a highly competitive market, 10-15% indicates an unconcentrated market, 15-25% stands for moderate concentration while above 25% indicates high market concentration. Source: ECBC, Moody’s investor reports, Crédit Agricole CIB