Is there a larger role for FRN covered bonds?

Apr 10th, 2014

Following the first issuance of a euro covered bond to incorporate fixed and floating rate tranches by UniCredit in January Crédit Agricole CIB analysts explore investor opinions of floating rate notes.

In January, UniCredit (UCGIM) managed to issue the first euro covered bond to incorporate fixed and floating rate tranches, with a Eu500m three year FRN as well as a Eu1bn 10 year fixed rate tranche. This leads again to the question whether floating rate covered bond issuance in euros could make sense. After all, many cover pools have mortgages with predominantly floating rate coupons in them while to date almost all euro issuance takes place with fixed coupons, which creates the need to hedge interest risk for the issuers.

A big factor, however, in UniCredit’s success with the three year floating rate note (FRN) issue was certainly the absolute level of yield the bank was offering, at three month Euribor plus 55bp, and many investors would have very likely bought this bond just as much if it had been issued with a fixed rate coupon. From this angle the deal shouldn’t be taken as a blueprint, as interest was not necessarily driven by the coupon structure.

However, this does not mean that there is no demand for euro-denominated FRN covered bonds. To address this issue — whether there is a broader appeal of the FRN structure that could also be relevant to issuers from core sectors — we asked investors whether they feel FRN covered bonds in euros could play a bigger role in the future and how far they think issuers could venture out along the curve with this coupon structure.

We received feedback from 99 investors, from a wide range of countries and investor types, including many of the biggest asset managers, insurance companies and bank treasury investors active in the euro covered bond markets.

Investor survey

The ongoing discussion about FRN covered bonds is driven by the fact that cover pools are predominantly made up of floating rate assets. The dominant part of covered bond issuance has been in fixed rate format on the euro market, though. As a consequence, we have asked investors if they think that FRN covered bonds in euros will play a bigger role going forward.

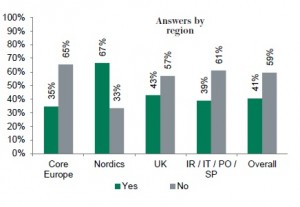

Overall, 59% of the respondents do not believe the current fixed rate-dominated environment in euro benchmark covered bond markets will change materially in the future. This also means, however, that 41% do see a bigger role for FRN covered bonds in euros.

When looking at the results in more detail, significant differences emerge in terms of both the regional preferences for or against FRN issues as well as the preferences by investor type.

- Core European investors, who have to date been the biggest investor base in covered bonds, are the ones with the lowest level of optimism for FRN covered bonds.

- Numbers for Nordic investors, on the other hand, are exactly the opposite, with two-thirds feeling quite upbeat about the prospects for more FRN issuance. Within the Nordic region, Swedish investors stand out as the most positive bunch while Danish investors are a bit more reserved.

- Investors from the UK and peripheral countries are not leaning in either direction, with around 60% not seeing much FRN issuance down the line while around 40% are more optimistic.

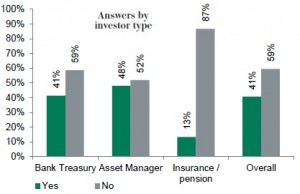

When looking at the answers by investor type, our survey much better matches UniCredit’s distribution.

- Bank treasuries are perfectly in line with the overall survey results, with 41% of respondents seeing a bigger future for FRN covered bonds. Dutch, Swedish and UK treasuries are the most optimistic, while treasuries from the German speaking area aren’t the most enthusiastic.

- Asset managers are surprisingly the most open investor base to FRN covered bonds. Almost every second account sees a bigger future for the market. When looking at the answers more closely, there are no striking trends by region or size of the asset managers. There are as many small German asset managers liking FRN covered bonds as there are big Nordic investors, while there are at the same time accounts from the same regions and sizes with no preference for the format.

- As we had expected, insurance companies are an investor group which will very likely never feature in FRN deals to any great extent. There were only a few insurance sector investors in the three year UniCredit deal and the same thing should stay unchanged in other FRN deals considering the 87% of respondents in our survey who don’t see a big future for FRN covered bonds.

Based on these results we think that there is underlying demand for covered bonds in FRN format. A potential market for FRN covered bonds in euros is, however, decidedly less deep than that of comparable fixed rate bonds.

On a positive note, despite regional differences demand would be fairly broad-based and not centred on one specific investor base, in our view. After all, we had from almost all regions at least some positive answers (with the Nordics standing out positively) and almost all investor types (with mainly insurance companies dropping out).

Issuers should thus be able to issue this format as long as they don’t target huge books and plan to issue Eu1bn-Eu2bn deals.

What maturities could be achievable?

After a general look at investor demand, the next question is which maturities could be doable. After all, covered bonds are a funding tool that is predominantly used for longer dated issuance. Issuing one, two or three year FRN covered bonds would certainly not be in the interest of most covered bond issuers. They would basically be matching the interest rate structure of the cover pool better but at the same time significantly increasing maturity mismatches.

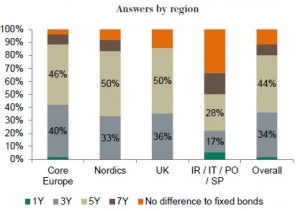

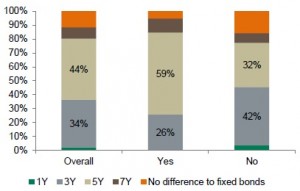

The results of our survey showed that deals that are longer than the three year deal from UniCredit certainly look feasible. In fact 44%, the largest share of respondents, think that five year covered bonds could be doable. A handful of investors think that seven years is doable and some even say there is no difference between FRN and fixed rate covered bonds in terms of the maturities achievable. However, a safe bet here is probably that the biggest demand would be in the three to five year range.

The results by region look fairly similar, with one big exception being investors from peripheral countries. While the majority of investors sees a limit of achievable maturities in the three to five year area, around half of the accounts from the peripheral region see maturities of seven years and longer possible for FRN coupon structures. Given that many of these investors wouldn’t invest heavily into core sectors but stay with their own markets, though, we don’t think these answers carry big weight for the overall market. And even covered bond issuers from the periphery should know that many of the accounts mentioned here are not positive on FRN covered bonds in general and are thus less likely to buy actively.

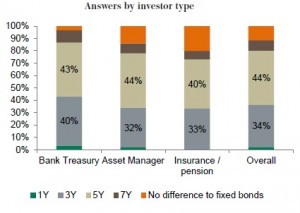

Looking at the answers by investor type in more detail, there are virtually no differences, with the biggest difference probably being the higher share of three year answers by bank treasuries (40% vs. an average of 34%), while more insurance accounts seem to think that there is practically no maturity limit (20% vs. an average of 11%). Insurance accounts are not really interested in the format in general, however, so we wouldn’t put too much weight on this statement.

For exactly this very reason we have divided the answers around maturities into those investors who see a bigger future for FRN covered bonds and are in general more open to the segment than others, and those who are less optimistic. After all, the answers on the achievable maturities by the optimistic accounts should be more relevant to issuers than those of investors who are not interested in the format in the first place.

When breaking the answers down that way, the five year bucket grows in importance.

- Close to two-thirds of investors who are in general positive about FRN covered bonds feel issuers can issue out to this part of the curve.

- Of the investors who don’t really see a bright future for FRN covered bonds, only one-third are that optimistic on five year maturities. The bigger part of this group sees the limit at three years (42%).

Bottom line: No revolution, but evolution certainly possible

FRN covered bonds are a format that must appeal to a wide number of issuers. After all, reducing the need for derivatives in the pool to hedge interest rate risk by better matching assets and liabilities in a more natural way is a strong motivation for FRN covered bond issuance. In addition to this, rating agencies look very favourably at issuers minimising the mismatch that way. Issuing FRN covered bonds can thus ultimately lead to lower overcollateralisation requirements.

The bottleneck would have always been investor demand. And our survey results do confirm that there would be a smaller investor base interested in FRN covered bonds than there is for fixed rate deals at the moment as only around 40% of the investors we asked see a bigger future.

However, apart from insurance accounts not being interested while Nordic accounts show above average interest, investor distributions of FRN covered bonds should be fairly broad-based.

And in terms of achievable maturities, five years certainly seems doable as, in particular, the majority of investors who are positive about the future of the FRN format see the five year mark as the limit for what issuers can do.

After looking at our investor survey results we stick to the statement we had made in our first covered bond focus on FRN covered bonds mid-February:

- We don’t assume that FRN covered bonds in euros will come anywhere close to the weight they play in the sterling market. We could certainly imagine issuers from a wider range of countries thinking about it, though.

Source for charts: Crédit Agricole CIB