Introducing Junior Covered Bonds

Sep 27th, 2012

Vincent Hoarau, head of financial institutions, covered bond and ABS syndicate at Crédit Agricole CIB, takes a look at Danish Junior Covered Bond issuance.

The history of Danish covered bonds dates back to the Copenhagen Fire of 1795.

For years they have been issued under the so-called balance principle, whereby banks grant mortgages and subsequently tap the covered bond market to refinance the mortgage. Assets match liabilities in both coupon structure and maturity, and the main risk banks take is the credit risk as the refinancing risk is passed on to the borrower. This system contrasts with the euro covered bond system where issuers actively manage a cover pool, naturally assuming some mismatches between pool and outstanding bonds issued.

The Danish system could have gone on like this had European regulation not been introduced requiring that issuers regularly revalue mortgage LTVs for the purpose of cover pool eligibility. In the event of decreasing house prices and increasing LTVs some loans can over time lose full cover pool eligibility. However, what would be normal practice for a euro covered bond issuer and can be remedied by adding collateral to the cover pool poses is a real problem for the Danish balance principle: adding mortgage collateral to the pool only works by tapping an outstanding covered bond. This is the essence of the balance principle, which by definition does not allow for overcollateralisation in excess of the capital that the capital centre holds. What the Danes needed as a result to comply with European regulation was a way to add cover assets that did not come from the mortgage market and a way to fund them.

Junior Covered Bonds (JCBs) do exactly that. They allow Danish mortgage institutions to manage their cover pool more efficiently in a context where the Capital Requirements Directive (CRD) and its implementation into Danish law imposes a continuous compliance with LTV limits for classical senior covered bonds. Today the market exceeds Dkr55bn equivalent, with Nykredit Realkredit being by far the most active issuer. Since Mortgage Credit Institutions do not have access to deposit funding, issuance of JCBs is an efficient way to proactively manage the cover pool and to keep the senior covered bonds CRD compliant.

Danish senior covered bonds have a primary claim against all assets in the capital centre in case of insolvency of the mortgage bank, while JCBs have a secondary claim against this segregated pool but also a residual claim against the mortgage bank. This residual claim ranks pari passu with other senior unsecured creditors. Therefore, the pricing of JCBs is closer to that of traditional senior unsecured bonds. The tighter credit spread paid by JCBs over senior unsecured debt reflects a minimised risk for investors.

This comes from the balance principle, the strict placing requirements and use of proceeds, but also the mandatory OC. Indeed, JCB proceeds cannot be used to fund loans in the cover pool and may only be issued in order to comply continuously with LTV limits. The proceeds of JCBs can only be placed in assets defined by law, including mortgages on real property, government bonds and claims against credit institutions. When JCBs are issued, those additional assets are added to the cover pool of the capital centre. But the main similarity to senior covered bonds is in the dual recourse feature.

JCBs are issued under the legal framework of the Danish Mortgage-Credit Loans & Mortgage-Credit Bonds Act (the Danish covered bond law), section 33.

Nykredit Realkredit, the biggest mortgage lender in Denmark and only active issuer in JCB euro benchmark format, priced a Eu500m five year deal at mid-swaps plus 200bp in May. It came far closer to senior than covered bond levels at a time when the senior market was closed. Nykredit issues little euro senior paper, but a five year deal would have come 20bp-30bp wider.

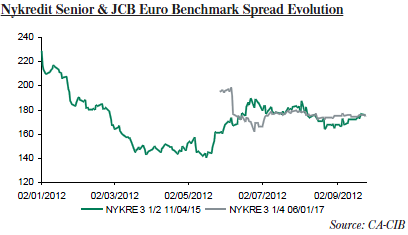

At the moment, November 2015 Nykredit Bank senior unsecured paper is trading z-spread 175bp bid in the secondary market while Nykredit Realkredit June 2017 JCBs are indicated at the same level, confirming a spread differential of roughly 25bp between the two curves. The JCB deal sits between senior and covered bonds and is a good substitute when access to the senior market is challenging. Elsewhere, Nykredit offers rare euro exposure to investors. Issued through VP Lux, Nykredit’s JCBs are repo-eligible with the ECB in liquidity category 4 and repo-eligible with the Danish Central Bank, but subject to a haircut of 3%. Nevertheless, JCBs carry a risk weight of 20%.

S&P rated the JCBs A+, the same as the issuer’s senior rating. JCBs rank pari passu with senior unsecured debt in case of default and S&P does not value the JCBs’ subordinate claim on the cover pool. In that context, any change of the senior unsecured rating will be reflected in the JCB rating.