Interview: Mihkel Hollo, Estonian Banking Association

Mar 20th, 2015

The Estonian Banking Association (Eesti Pangaliit) is working on a proposal for covered bond legislation that it expects to finalise soon, ahead of submission to the ministry of finance for official drafting. Mihkel Hollo, head of the covered bond working group at the association and project manager at Swedbank in Tallinn, discusses developments in Estonia.

Why do you want to see covered bond legislation introduced in Estonia?

Why do you want to see covered bond legislation introduced in Estonia?

Estonia is one of the few countries in Europe that does not have national covered bond legislation. From the issuer’s perspective it would be good to have a solid legal framework in place, as that would create the possibility to issue covered bonds whenever market conditions are favourable. From the investor’s perspective, there are not many options to take Estonian risk into portfolios as we don’t have government bonds either.

What alternative funding sources do banks in Estonia currently have?

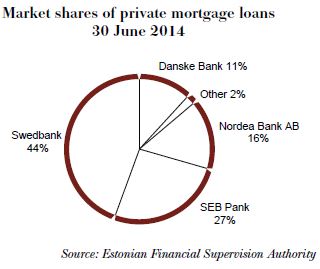

At the moment more than 90% of the Estonian banking market is divided between sound Scandinavian banks whose parent companies’ ability to issue senior unsecured debt at low interest rate is very good. At the same time, the aggregated loan-to-deposit ratio of Estonian banks is close to 100%. This means that potential issuers currently have very limited need for pure Estonian covered bonds. Alternatively, one might also consider including certain local assets to covered bonds issued under the legislation of the Scandinavian country where the parent company is located.

Would the introduction of covered bonds be linked to developments in the Estonian mortgage market?

There are no ongoing or expected changes in the Estonian mortgage market that would make covered bonds substantially more attractive, or a preferred funding instrument. Still, covered bonds could have some stabilising effect on the mortgage market through the cycle.

At what stage is the development of covered bond legislation in Estonia? How long do you think it might take before a framework is in place?

The Estonian Banking Association is preparing a proposal for the legislation that is expected to be finalised by spring 2015. After that it will be sent to the Ministry of Finance as input for creating the official draft. As there are many different stakeholders, we would not speculate on the further timeline. The quality is more important than the speed.

What, if any, obstacles are there to covered bond legislation being introduced in Estonia?

Up to now the work has been carried out mostly in the Estonian Banking Association and we have not met any stakeholder who is directly opposing to the idea of covered bonds as such. Still, as there will be many different opinions, the main time-consuming obstacle is finding consensus in all the details.

How would covered bond legislation in Estonia be likely to compare with that of other countries?

The legislative proposal that is being developed in the Estonian Banking Association is loosely based on German covered bond legislation (Pfandbrief Act) and we highly appreciate the advice that was offered by the vdp (Association of German Pfandbrief Banks), especially by Dr Otmar Stöcker.

There is also the influence of respective Scandinavian practices. Our intention is to find a good balance between the interests of potential investors, issuers and supervisors. And while trying to find that balance, the EBA’s best practices will be taken into account.

Who would be the likely covered bond issuers in Estonia?

Who would be the likely covered bond issuers in Estonia?

There should be the capability and willingness to issue covered bonds. Banks with more high quality assets would most likely have a competitive edge, at least price-wise. The willingness depends on several factors, such as the availability of other funding, its price and stability compared to covered bonds.

Would we see Estonian issuers doing benchmarks of Eu500m?

It is highly unlikely. For example, the aggregated volume of private mortgage portfolios in Estonia is only around Eu6.2bn. And this is divided between several market participants. If you consider also other limitations (LTV criteria, different maturities, etc), it’s only theoretically possible to make a single issue with homogenous cover assets in such amount. Calculating the ticket size is still a bit premature because any issuance at the moment is theoretical.