Exiting CBPP3: Who could suffer most if it stops in 2016?

May 29th, 2015

We know we are not even half way through the CBPP3, so talking about the impact an exit in September next year might have could seem a little premature, to say the least, write Crédit Agricole CIB covered bond and SSA analysts Florian Eichert and Stephan Dorner.

And, to be clear, neither we nor even the ECB expect things to end prematurely. For example, Ulrich Bindseil, director general, market operations, said during his keynote speech at the ICMA & The Covered Bond Report Covered Bond Investor Conference in Frankfurt two weeks ago:

“And I would say there has been a tendency, if anything, over the last years by central banks to make the mistake of overestimating upwards pressure on inflation and phasing out too early. So in view of this experience, I would say the hurdle for discontinuing the programme early is really very, very high.”

However, we have started to have the discussion about the exit with many investors. And in our view this is a very sensible thing to do. After all, unless investors stick to the very short end (let’s say two to three years) – which due to the low level of interest rates is rather uncommon – CBPP3 exit and its potential impact has to be a consideration when investing already today.

From discussions with the Eurosystem itself we also know that the central bankers involved in QE are very actively thinking about the impact their actions have on private sector investors (even though it doesn’t change their current behaviour) and what that could mean for a potential exit strategy.

Consequently we want to have a look at what a full exit in September 2016 might mean for different covered bond sectors as we believe there will be some that will hardly be impacted and some that might feel it a good deal more.

Share of central banks/official institutions and CBPP3 by sector

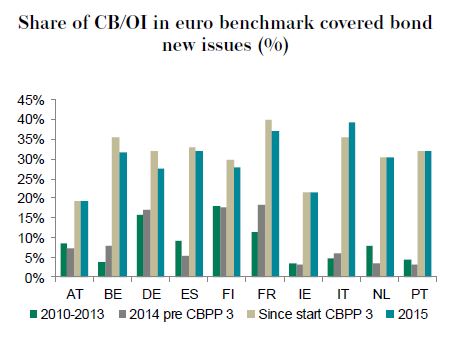

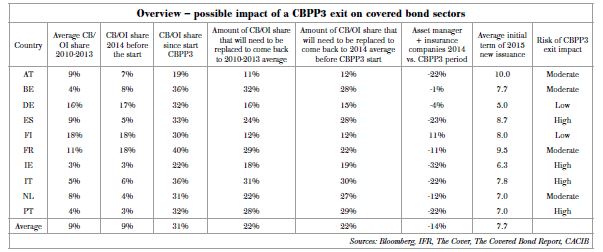

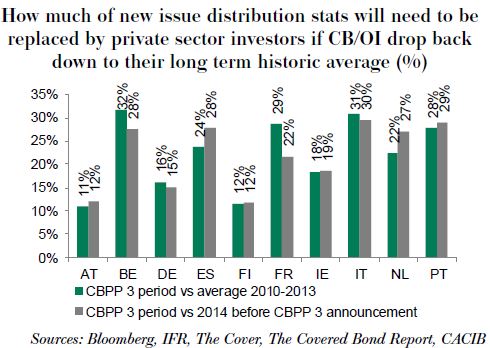

First of all, we want to highlight that an exit from CBPP3 does not mean the Eurosystem will stop buying covered bonds altogether. Central banks/official institutions (CB/OI) have historically been buying covered bonds, around 10% on average. We would expect this share to still be there after the programme ends and the buying will merely move to different portfolios. Consequently the amount that needs to be replaced by private sector investors would not be the entire CBPP3 share but more likely the difference to the previous average.

Nonetheless, we will be faced with a gap that needs to be filled and should the Eurosystem step back in September 2016 those sectors that have been disproportionately benefiting from CBPP3 demand will have to attract more additional private sector demand than those with rather low CBPP3 participation figures.

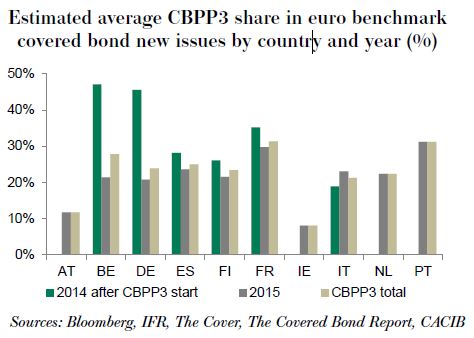

After a very strong start in 2014, the overall level of activity in primary markets by CBPP3 has fallen in 2015. The Eurosystem has tried to limit the degree of distortion it has on the market in this sense. Nonetheless, there are still sectors with higher CBPP3 shares in new issues than others:

- Most peripheral countries have on average had a higher share than most core countries. In Portugal we are talking about close to 31% in 2015, in Spain it was 28% in 2014 and 24% in 2015. The main reason for Italy being below the other two, at 19% in 2014 and 23% in 2015, is that there is a separate buying programme from Cassa Depositi e Prestiti (CDP) that runs in parallel to the buying done by Bank of Italy. Mortgage ACS issues from Ireland have had a very low CBPP3 share, at merely 8% in 2015.

- In core countries, France (30% in 2015 after 35% in 2014) and Belgium (21% in 2015 after 47% in 2014) have shown the highest CBPP3 shares amongst core countries.

When talking about the impact a CBPP3 exit might have, we cannot only focus on the CBPP3 figures. We have also seen non-Eurosystem central banks buying more covered bonds on the back of the CBPP3. Asian accounts in particular have taken a bigger share since the programme started. Should we come to an end of CBPP3, we would not be surprised if this buying slows down as well.

Consequently we have to look at the figures that also show the overall share of CB/OI in new issues lately for an idea of how much central bank demand would have to be replaced by private sector investors.

- The countries with the largest shares here are Italy, with 39% (mostly Bank of Italy and CDP), and France, with 37% (mostly CBPP3 and Asian accounts).

Assuming the overall share of CB/OI were to fall back to the longer term average and comparing that to the 2015 share, the biggest gap left to be filled with private sector demand is in Italy (35%), followed by Portugal and Belgium (28% each), and France (26%).

Countries such as Finland, Germany but also Austria would not be materially impacted as either their current CB/OI share is below the average (ie, Austria at 19%) or because they have historically enjoyed strong demand from central banks (ie, Finland and Germany with 16% and 18% average CB/OI demand, respectively, between 2010 and 2013).

Impact of exit depends on the investor base – analysis by sector

To get an idea of whether covered bond markets can do without CBPP3 and whether there are sufficient private sector investors out there to fill the gap, one has to look into more detail at what the current private sector investor bases look like for each covered bond market. It is important to identify where the increase of the CB/OI has come from and which investor types have become less relevant. After all, the current actions of CBPP3 affect various investor groups differently and some will be harder to attract back than others:

- Asset managers as well as insurance companies are crowded out to a bigger extent than bank treasuries and it is also harder to incentivise them to come back than bank treasuries. Swiss Re’s recent statement that it has sold all of its euro-denominated covered bonds shows the ongoing trend of asset managers leaving. And for an asset manager that has left the product and reallocated credit lines to other products, it requires time, effort and above all spread to move back, re-change benchmarks, convince their end-clients, look to re-establish credit lines for the product, etc.

- Bank treasuries, on the other hand, are more pragmatic in their decision-making. They have to maintain a certain level of liquid assets and are strongly incentivised to stay within high quality assets by bank regulation. Within this group of assets (mainly government debt, SSA debt and covered bonds), they buy if covered bond spreads to government and SSA debt are sufficient to cover the extra capital cost and LCR haircuts. If it is not, they stay within 0% risk weight assets.

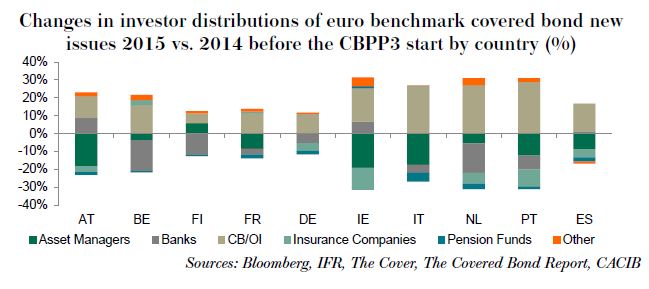

Consequently we would argue that covered bond sectors that have seen CB/OI increase at the expense of mainly asset managers and insurance companies in primary deals should be much more impacted by CBPP3 stepping back in September 2016. Countries where firstly the CB/OI share did not move as much and where the additional demand replaced mainly bank treasuries should be much less impacted.

Look at Germany, for example. In 2015 the share of CB/OI was merely 11% higher than it was in 2014 before CBPP3 started buying. And the additional CB/OI share came at the expense of mainly bank treasuries and insurance companies. As long as Pfandbriefe are in the mid-20s over Bunds and 10bp-15bp over German SSA debt we do not think the fallout from the ECB stepping back would be material and replacing the additional 11% CBPP3 currently buys in new issues should be doable. And, should the Pfandbrief market be squeezed tighter to government/SSA debt in the coming months, all it would need for bank treasuries to buy is a retracement to the above-mentioned levels. A fall-out spread wise from CBPP3 stepping back should thus be limited here.

Even a country such as Belgium, which has seen a major increase in the CB/OI share, has seen this come at the expense of bank treasuries. So for Belgian issuers to re-attract much of this it would essentially take a few basis points of widening to make them attractive versus Belgian government debt. Similar statements can be made for the Netherlands or Finland.

However, in sectors where the CB/OI has gone up markedly at the expense of asset managers and insurance companies the situation might look different:

- In 2014 asset managers and insurance companies bought around 50% of cédulas and OBG new issues. In Portugal and Ireland it was even closer to 70%. In 2015 we are talking about 53% in Portugal or 43% in Spain. Much of the additional CB/OI buying did come at the expense of exactly those two investor groups, with the most extreme case of this happening in Italy.

Should the ECB step back in September next year many of these accounts will not return should we still trade at current levels versus swaps, but maybe even more importantly versus their underlying sovereign debt. It also looks unrealistic that bank treasuries would be stepping up markedly as long as we are well inside 0% risk weighted assets from their angle.

The spread adjustment from current levels would in that case not be the 10bp-15bp widening we might be talking about for some core sectors. We would essentially talk about a mid to high double-digit basis points number versus their underlying sovereigns in the case of Italy and Spain, for example.

The only reason for covered-govvie spreads in these countries to still be that tight would be a very stressed environment in sovereign bond markets at that point. And in that case it is not impossible that CBPP3 would continue beyond September. After all, the wording of CBPP3 says that it will run at least until September 2016.

Analysis by maturity bucket

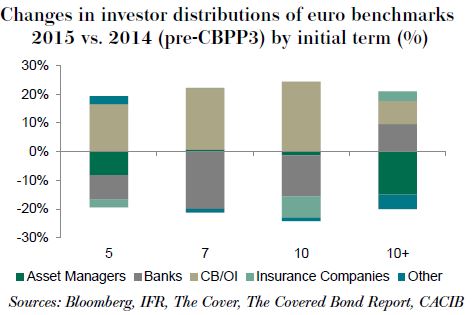

Similarly to the analysis done by sector, we have looked at covered bond investor distributions by maturity bucket. It is hard to see any particular preference by the Eurosystem when it comes to maturities in primary markets. With a few exceptions the share varies between 20% and 30% across the whole curve.

Looking at the breakdown of private sector demand, however, the longer end seems more susceptible to a CBPP3 exit. After all, this is where the biggest increase took place and consequently the biggest replacement with private sector demand will have to happen as well.

In five and especially seven year sectors, we are mainly talking about CB/OI having replaced bank treasury demand. Beyond 10 years, on the other hand, it has been mainly asset managers and insurance companies that have been replaced. Bank treasuries have actually become more active there. This was more a reflection of them being pushed out of the short end by negative rates than an actual desire to go that long. Higher yields now mean they can shorten back to their previous areas of interest and should yields end up being in the same range or slightly higher in September 2016 they would be able to compensate for some of the CB/OI demand.

So for the 10 year and beyond sectors the amount of asset managers and insurance companies that need to be incentivised to buy is certainly larger than in the shorter maturities where bank treasuries can always compensate for a drop in CB/OI demand if spreads are fair versus sovereign debt.

Bottom line

CBPP3 continues to hold the covered bond market tightly in its grip. Purchase volumes have not yet shown any sign of slowing down and the Eurosystem will certainly try to maintain the pace for as long as possible while an early exit in our view is not on the agenda at all.

There has been a lot of concern already about the potential impact an end of CBPP3 could have in September 2016. We will at this point not start to speculate about how the exit might happen, whether there will be tapering or some other form of continuing to support the market (more buying by the non-policy portfolios?) rather than stopping abruptly.

This is something the governing council of the ECB will decide in due course and we would expect this strategy to be uniformly applied to all purchase programmes. All we want to and can do at this point is look at the potential impact a full stop in September 2016 might have on covered bond markets.

As we have shown in this publication, the impact of a sudden stop would likely differ by market and also by maturity bucket. We thus do not think one has to dramatise the impact for all of the covered bond market, as some areas would be hit more than others.

In our view, the most affected sectors would be those that have seen a significant increase in CB/OI share over and above the long term average while at the same time seeing this increase come mainly at the expense of asset managers and insurance companies. Regaining investors from the bank treasury side will be a matter of spread over 0% risk weighted assets. Attracting back asset managers and insurance companies that have left the market will be significantly more difficult.

The exit would thus not have a major impact on, for example, the Pfandbrief market or Finnish covered bonds. The Eurosystem will, however, have to think very seriously about how to exit purchases of peripheral covered bonds and also what its exit might do to the long end of the curve in general, which is where covered bonds’ role as a funding tool is the most important also from a monetary policy and financial stability perspective.

For investors, the analysis in this document should be a reminder that buying peripheral covered bonds deeply through domestic sovereigns is a risky strategy, especially when thinking about September 2016. Central banks have been buying in spite of this, but the natural demand at these levels is continuing to shrink, with investors from the asset management world progressively leaving. Consequently we prefer the sovereign debt from Italy and Spain to the respective covered bonds at the moment.

With regards to maturities, we would expect the long end to be most affected by an exit. And given the higher Bund yields that have pushed most covered bonds back into positive territory, focusing rather on the belly of the curve than the long end is probably a good approach to minimise CBPP3 exit-related risks.