Eu175bn of benchmarks to return covered to net growth in 2016

Nov 20th, 2015

As always around this time of year, the focus of investors and issuers – as well as analysts – starts to shift towards their expectations for the coming year, writes Florian Eichert, head of covered bond and SSA research at Crédit Agricole CIB.

As in previous years, we want to start this exercise by looking at issuance expectations.

Drivers of benchmark issuance

1: Redemptions

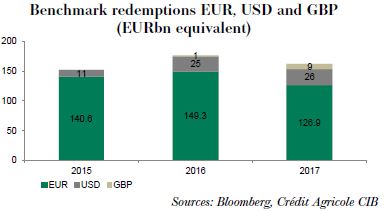

Compared to 2015, 2016 will see an increase in euro, US dollar and sterling benchmark covered bond redemptions, from Eu152bn equivalent to Eu176bn equivalent.

The biggest jump will occur in US dollars, where redemptions will go from $12bn to $28bn (Eu25bn), mostly driven by a substantial increase in Canadian ($3bn to $13bn) and Norwegian (from zero to $5bn) covered bond redemptions. Euro redemptions, on the other hand, will go up by only Eu9bn, while sterling redemptions will still be negligible, at Eu1bn equivalent.

The bottom line on redemptions is that there is probably no huge extra pressure coming from euro benchmark redemptions. We could, however, very well imagine that the substantially higher US dollar redemption figure could also lead to some extra euro issuance.

2: Regulatory pressure/constraints

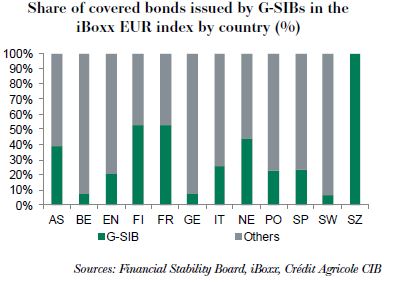

One of the main drivers that has affected covered bond issuance in the past year has certainly been the focus of big issuers in particular on fulfilling higher capital requirements and TLAC/MREL buffers. In 2015 this led to a slightly higher share of second tier banks accessing covered bond markets.

For next year we believe this element will still be a factor, but not everywhere. Wherever we have a low share of G-SIBs and high capital levels we would assume that covered bond funding volumes are not impacted by TLAC/MREL. Sweden would be one example here. Wherever the opposite is true, however, the focus of issuers might still be on generating capital and issuing bail-in-able securities rather than going for covered bonds.

3: Pressure on private placements

In the past issuers in markets such as Germany were able to sell between two-thirds and three-quarters of outstanding volumes as private placements.

The yield evolution of recent years has, however, put a lot of pressure on this segment. The share of private placements has dropped from the high 70s percent region to only around one-third in Q3 this year. Unlike in previous years, benchmark issuance has made up the bulk of German issuers’ funding. We expect this factor to persist in 2016.

4: Pressure on domestic markets

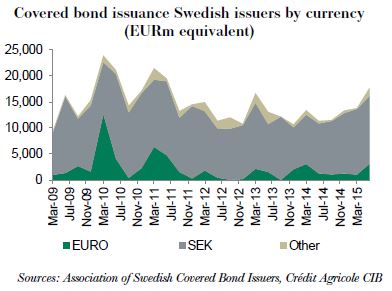

In the covered bond space there are non-Eurozone markets, especially in the Nordics, that rely on their domestic currencies for funding. The euro and other currencies are an important source as well, but they are still only a supplementary source. During the crisis in the last few years, these domestic markets have proven quite resilient, and offered issuers relief from volatile and sometimes closed euro benchmark markets. Troubles in their domestic markets can, however, have the opposite effect and force issuers to become more active in other currencies.

Quarterly Swedish domestic issuance has gone up from Eu8.0bn equivalent in Q3 2013 to Eu13.0bn. To say the Swedish krona issuance has been under pressure would therefore be far from the truth. The Swedish Riksbank has, however, announced that it might change repo rules for Swedish covered bonds next year, tightening the criteria.

While we do not believe this to be a major threat to the Swedish krona market it could still limit issuance activity in Swedish kronor to some extent and lead to more euro issuance in 2016.

Norwegian issuers do not face similar central bank pressure. And they have been more reliant on international markets as their domestic market wasn’t as established and sizable as Sweden’s. Nonetheless, Norwegian issuers, especially the smaller ones, have been able to get their funding from Norwegian krone markets. Looking at the evolution of the currency split between Norwegian kroner and other currencies in the last 12 months it does, however, show that the Norwegian krone portion has come down from above 80% in Q2 2014 to less than 60% this June. If this trend were to continue, we would certainly expect Norwegian issuers to also be more active in euro markets in 2016 than they were in 2015. This element would come on top of the jump in US dollar redemptions.

5: Senior-covered spreads

Senior-covered bond spreads were at very low levels at the start of 2015. In spite of the BRRD being implemented in more countries, many investors continued to focus on the additional yield senior offers in a low yield environment, continuing to compress spreads to covered bonds at the time.

Since Q2 2015 we have, however, been moving wider, a trend that was only partially stopped by covered bonds widening on the back of the huge issuance volumes over the summer.

For 2016 we believe that for issuers without pressure from asset encumbrance or TLAC/MREL angles the economics would favour covered bonds again. At spread levels between the two products of only 20bp-30bp, that statement was simply not valid; at levels of in some cases well above 50bp, it very much is.

Issuance forecast across currencies

We believe that benchmark covered bond issuance can grow next year to reach Eu175bn-Eu180bn equivalent across euros, US dollars and sterling. As of end-October 2015 we stand at Eu153bn. Assuming that we end the year at Eu165bn-Eu170bn, this would mean growth of between 5%-10% overall in 2016 compared with 2015.

We believe euro markets will grow to around Eu150bn in gross new issuance. Ongoing CBPP3 demand will help Eurozone issuers continue to access the market, while the stabilising QE impact on rates should help allow issuers to also go for longer dated issuance. In addition to this, pressure on private placement markets will increase the focus on public benchmarks, and in some cases the focus on capital/TLAC/MREL should shift to minimising funding cost and maximising profitability. Last, but not least, should we see pressure on domestic currency funding markets in the Nordics, euro issuance would certainly be more in focus.

We believe US dollar markets will remain stable or even contract slightly. Asian issuers will continue to be active in the currency but issuers looking for duration will likely be better off in euro markets.

We expect sterling markets to remain fairly stable or even grow slightly. The market has evolved to beyond featuring only UK issuers. The main increase in supply will in our view come in euros, but sterling markets could well be an alternative for non-Eurozone issuers at times of heavy euro supply.

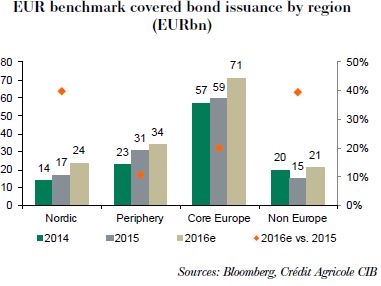

We expect issuance to grow in all regions

A big percentage jump should come from Nordic countries. As we mentioned above, much higher redemptions in Norway coupled with the potential impact of the Riksbank in Sweden could lead to a bigger focus on euro issuance.

In core European markets, low yields’ impact on private placement markets in particular as well as a slightly less extreme focus by some bigger banks on TLAC/MREL-eligible securities, should see covered bond issuance grow.

We expect peripheral issuance to also grow, but at a much slower pace than the others.

Non-European covered bond issuance would in our view be driven by higher redemptions by Canadian issuers. We also expect issuers from Singapore to enter euro markets for the first time.

Net issuance

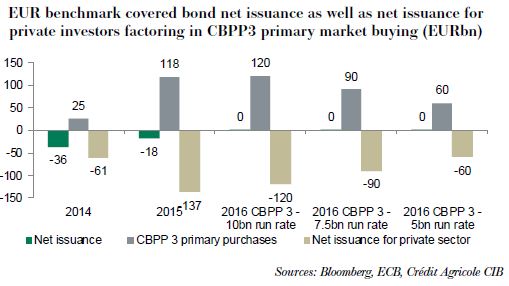

The jump in issuance should push net issuance to a positive level for the first time since 2012. Should our forecast turn out to be accurate, we would just about make it to a positive net issuance of Eu0.3bn.

When factoring Eurosystem buying in and treating CBPP3 purchases as redemptions, we are, however, not talking about net positive but massive net negative issuance for private sector investors.

Bottom line

Covered bond issuance should in our view continue to grow in 2016 – at least in benchmark markets.

Factors favouring covered bond issuance: higher redemptions; growing mortgage markets in a number of countries; slightly less focus by some issuers on TLAC/MREL/capital trades; wider senior-covered spreads; pressure on private placement markets; and potentially on some domestic currency markets.

Factors against more issuance: in some cases central bank money is still the cheapest option; in some cases upgrades of senior ratings to investment grade can open senior markets again for the affected issuers; there is still a focus on bail-in-able debt amongst many covered bond issuers; flat or even shrinking mortgage market growth in some countries.

In our view the volumes shown above should be manageable. The increase versus 2015 will not be concentrated on a single jurisdiction. At current spread levels versus swap and sovereign debt this should be doable.

The fact that we might be talking about net positive issuance in 2016 for the first time in a few years does not scare us. After all, we also expect the ECB to continue to be active in eligible primary issues.

The main challenge in our view will be the timing of the issuance. We have seen this year what primary markets and concentrated issuance can do to spreads. Should we therefore have a repeat of this year’s issuance pattern story, the higher volumes next year could very well lead to – by covered bond standards – ongoing high levels of volatility.