ECB changes repo haircuts: What’s the impact on Nordic names?

Aug 15th, 2013

Updating its collateral framework is something the ECB does on a regular basis.

The central bank adjusts the parameters to reflect current market conditions and sometimes also to achieve a certain policy objective. Given the important role covered bonds play at the central bank as both collateral but also as part of the transmission mechanism between central bank policy and the real economy, they receive a lot of attention. Adjusting the collateral framework at the beginning of the year to make covered bonds with external ABS tranches in the cover pool repo-ineligible was one example of this. Another was the change to the minimum criteria for acceptable own issued covered bonds from UCITS compliance to CRD compliance.

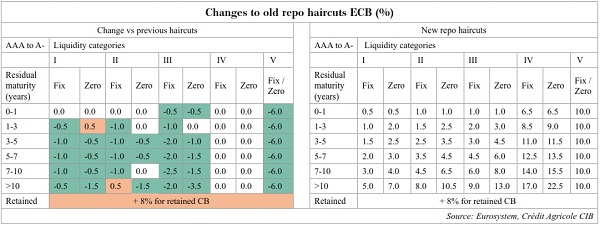

On 17 July, the ECB once more adjusted the parameters by slightly changing haircuts across its two haircut tables. The most important changes were:

- An additional haircut for retained covered bonds of 8% for ratings of at least A- by one rating agency and 12% for those rated between BBB+ and BBB-.

- A somewhat more subtle change is the reduction in the haircut difference between jumbo and non-jumbo covered bonds.

Increase of retained haircuts

At the moment, there are many banks that still have a high level of central bank funding, especially from southern Europe. At the same time, many of these banks are still in the process of re-pricing their deposit and loan books in an attempt to maximise their interest rate margins. Funding in the market at much higher levels than what can be achieved via the ECB doesn’t fit into that picture.

As we get closer to the first LTRO redemptions in December next year, however, we think that this focus will shift towards restructuring and terming out their funding. Central banks will certainly try to avoid everyone having to refinance at the same time and together with regulators will start increasing the pressure. At this point in time however we have yet to come across an issuer that has been asked to do so.

In our view, the additional haircuts for retained covered bonds could be seen as a first step by the ECB to incentivise covered bond issuers to replace central bank funding with market funding.

Reduced haircut differences between liquidity category 3 and 2

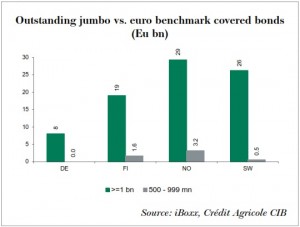

The other covered-bond-specific change worth noting in our view is the fact that the ECB has reduced the difference in haircuts between jumbo and non-jumbo covered bonds. The category II, which includes jumbo covered bonds, has been a category in the ECB collateral framework that has not changed for a long time. However, in recent years the concept of jumbo covered bonds has lost a lot of its relevance as both the inter-dealer market-making concept that was tied to it broke down and the acceptance of Eu500m deals has grown from investors to index providers.

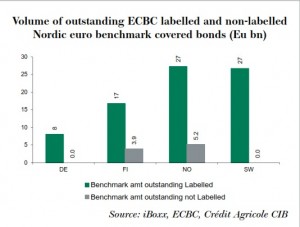

The big question at this point that one could ask oneself is does it make sense to maintain covered bonds in category II in the first place? Or is it worthwhile to replace the jumbo concept with something else in the ECB’s database and maintain covered bonds in both category II and III?

For now the only thing that comes to mind as a potential replacement in category II could be the ECBC’s Covered Bond Label. Since labelled covered bonds as a group at this point don’t yet distinguish themselves from non-labelled ones when it comes to better liquidity or higher spread stability, this would have to be a politically motivated move by the ECB though. They could take the stance that using the label for their collateral database could add an incentive for issuers to add transparency to the covered bond market of both cover pools as well as outstanding covered bonds. There is already a lot of work being done on transparency by many issuers. And, going forward, transparency could even play a decisive role in setting risk weights. The former is however in some cases lacking consistency and timeliness and the latter is not something particularly imminent though. The ECB could try to act as an early catalyst here.

What impact does this have on Nordic covered bonds?

Despite the fact that, with the exception of Finland, all other Nordic countries are not part of the euro-zone and also have their own central banks with their own treatment of covered bonds, all euro benchmark covered bonds issued by Nordic issuers are repo eligible with the ECB. As such repo haircut changes by the ECB impact Nordic covered bond issuers in one way or another.

Out of the two main recent changes impacting covered bonds, the additional haircut on retained deals is not a concern for Nordic issuers in our view. Italian as well as Spanish issuers are more affected by this as they have used sizable volumes of retained covered bonds as collateral.

Out of the two main recent changes impacting covered bonds, the additional haircut on retained deals is not a concern for Nordic issuers in our view. Italian as well as Spanish issuers are more affected by this as they have used sizable volumes of retained covered bonds as collateral.

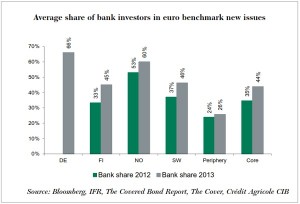

The more relevant issue for Nordic covered bonds is the reduction in haircut between liquidity category 2 and 3. Bank investors play a disproportionately high role in Nordic euro benchmark covered bond primary markets as they still easily fulfil Basel rating guidance on the LCR eligible assets. As a result changes to how bonds can be repo-ed have a disproportionately high relevance for Nordic euro benchmark covered bond markets.

By reducing the difference between the two categories, the ECB is almost entirely taking away the last feasible difference between Eu1bn+ and sub-Eu1bn benchmark covered bonds. The decision by iBoxx to reduce the index entry requirement from Eu1bn to Eu500m was already a very significant move. But with the shrinking of the haircut difference, there is almost no criteria left by which Eu1bn+ deals would be significantly better off than their smaller cousins.

So even if the haircut change is not going to be a spread driver, it could well lead to more benchmark deals below Eu1bn than we have previously seen from the Nordics. The Nordic markets have so far been characterised by a lot of big benchmark deals and for many of the big issuers it still makes sense to go down that route. There are however some mid-sized issuers for which smaller, Eu500m or Eu750m deals would probably be the better fit than stretching themselves to Eu1bn or Eu1.25bn sizes. At this point in Finland only Aktia has been active in the smaller benchmark segment. In Sweden there is only LF Hypotek and in Norway we have had small euro benchmark deals from Sparebanken Vest as well as Eika Boligkreditt, the latter however being also active in Eu1bn+ segment.

So even if the haircut change is not going to be a spread driver, it could well lead to more benchmark deals below Eu1bn than we have previously seen from the Nordics. The Nordic markets have so far been characterised by a lot of big benchmark deals and for many of the big issuers it still makes sense to go down that route. There are however some mid-sized issuers for which smaller, Eu500m or Eu750m deals would probably be the better fit than stretching themselves to Eu1bn or Eu1.25bn sizes. At this point in Finland only Aktia has been active in the smaller benchmark segment. In Sweden there is only LF Hypotek and in Norway we have had small euro benchmark deals from Sparebanken Vest as well as Eika Boligkreditt, the latter however being also active in Eu1bn+ segment.

As mentioned above, we would assume that the ECB is thinking about the future of covered bonds in liquidity categories II in general. One element that could maybe replace the jumbo designation could be the ECBC Covered Bond Label. While Pfandbrief issuers have so far been virtually absent from the ECBC label initiative, most of the Nordic euro benchmark covered bond issuers (all Swedish and Danish euro benchmark covered bond issuers) already have a label.

In Finland, it is merely the old two Aktia Real Estate Mortgage Bank as well as the OP Mortgage covered bond programme that don’t have one. In both cases the programmes are not used for issuance anymore. Issuance in the case of OP Mortgage Bank happens from the Pool B and covered bonds issued out of that programme do have a label. This essentially only leaves Aktia Bank plc “unlabelled” but the issuer only just recently started issuing so it might be a question of when rather than if it opts for the label. Out of Norway, both Eika as well as Sparebanken Vest don’t have a label while the two bigger issuers DNB and Sparebanken 1 have labels.

In Finland, it is merely the old two Aktia Real Estate Mortgage Bank as well as the OP Mortgage covered bond programme that don’t have one. In both cases the programmes are not used for issuance anymore. Issuance in the case of OP Mortgage Bank happens from the Pool B and covered bonds issued out of that programme do have a label. This essentially only leaves Aktia Bank plc “unlabelled” but the issuer only just recently started issuing so it might be a question of when rather than if it opts for the label. Out of Norway, both Eika as well as Sparebanken Vest don’t have a label while the two bigger issuers DNB and Sparebanken 1 have labels.

So, should the ECB go for the ECBC label, Nordic covered bond issuers would be well prepared.

Florian Eichert

Senior Covered Bond Analyst

Crédit Agricole CIB