EBA hearing: Will reports to EC, ESRB lead to changes?

Jun 19th, 2014

On Tuesday of last week (10 June) the European Banking Authority (EBA) held a public hearing on covered bonds where it presented plans for risk weight recommendations to the European Commission as well as covered bond best practice recommendations to the European Systemic Risk Board (ESRB) in front of roughly 50 participants from around Europe.

First of all, it has to be mentioned that this was still a preliminary version as the EBA was seeking market input for its proposed recommendations.

First of all, it has to be mentioned that this was still a preliminary version as the EBA was seeking market input for its proposed recommendations.

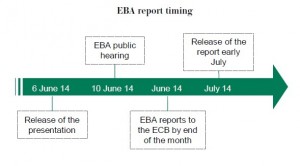

EBA had released the presentation on 6 June and it is basically the short version of a long report it will publish. EBA will now finalise its recommendations and propose them to the EBA board, which will also be able to change the document before publishing it. The report will then be submitted to the Commission by the end of this month. The report will be published early July, according to EBA.

The two work streams, or mandates, contained in the report have a different time-frame as well.

- On risk weights, the Commission has until 31 December 2014 to report to the European Parliament.

- On the ESRB recommendations, we are looking at a fairly long time-line, though. The report talks about initial recommendations, and there will be another interim report in 2 years’ time looking at the evolution in covered bond laws and structures in that time. EBA, however, expects national regulators to take into account its recommendations when changing covered bond laws.

Recommendations on risk weights to the Commission

Let’s start with the more relevant and imminent issue: risk weights. Other than the best practice recommendations to the ESRB further below, the recommendations on risk weights to the Commission are much more relevant in the sense that non-compliance could have a real impact at some point.

The good news here is that EBA in principle feels that preferential risk weights for covered bonds are adequate. EBA merely says that in light of the recent crisis, some shortcomings of current rules have become evident that need to be addressed going forward. After all, the CRD/CRR currently deals mainly with asset eligibility criteria and transparency. Add a few requirements on supervision, structure of the issuer, existence of a covered bond law, dual recourse and collateralisation requirements to the mix coming from UCITS, and you have the picture of what regulation requires of covered bonds these days to be compliant.

EBA now recommends adding further items to CRR Art. 129 covering overcollateralisation (OC), liquidity risk and supervision, and wants to clarify existing transparency requirements:

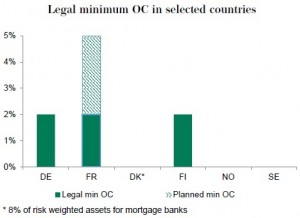

- Legal minimum OC: EBA talked about “over”-collateralisation and didn’t mention a concrete number. In addition to that, it stated that it is fully aware of the different ways OC is calculated and could reflect this in the final recommendations with one minimum OC in nominal terms, a lower one on an NPV basis, and yet a lower one on NPV after stress test basis.

- Liquid asset buffer: In the presentation EBA recommends accepting only liquid assets to mitigate liquidity risk. Soft bullet and conditional pass-through (CPT) structures are not mentioned as the regulator did not yet want to go into that level of detail in the presentation, but it will take them into account in its final report. Nonetheless, EBA stressed multiple times that it wants a more consistent approach to deal with liquidity risk across markets and will require that actual liquid assets be held by issuers. So having extension features does not seem to eliminate the need to hold liquid assets. Depending on the amount required in the end, this could reduce the economic rationale for soft bullets and CPT structures as they are specifically designed to minimise the need to hold costly liquid assets in cover pools. The rating benefit would obviously remain in any case.

- Role of the national authority: There will have to be provisions on covered bond-specific supervision prior to issuance, ongoing supervision prior to as well as post-insolvency of the issuer. Currently, all UCITS calls for is special public supervision without detailing what is actually meant by this.

- Transparency: EBA does not add to the existing requirements in Art. 129 (7) of the CRR, but states that the existing requirements should be clarified via EBA binding technical standards as, for example, “interest rate risk” and “currency risk” leave room for interpretation even though issuers have to report on these.

Should the Commission go with EBA’s current recommendations there would be some countries that have to change their minimum OC levels to a number bigger than zero. For issuers that mostly hold OC levels well in excess of the legal minimum levels, this should not have a major economic impact. The disclosure recommendation doesn’t really change anything for anyone, but merely helps to implement existing rules.

The more crucial and relevant change from an economic perspective is the liquid asset buffer requirement. Holding cash is expensive, especially in times of really low interest rates, as we have them today. And the way we read the recommendations, even issuers with soft bullets or CPT structures would be required to hold some cash if they don’t want to lose preferential risk weight treatment. So depending on the level required in the end, this could increase the cost of running a covered bond programme.

There would also be a large number of countries where regulators have quite a bit of work ahead of them in terms of defining and clarifying what they do and how they do it. And if EBA requires some sort of registration or licencing of already existing covered bond programmes, issuers in a number of countries could be in for quite a bit of work as well as patience as their applications are processed by regulators.

There would also be a large number of countries where regulators have quite a bit of work ahead of them in terms of defining and clarifying what they do and how they do it. And if EBA requires some sort of registration or licencing of already existing covered bond programmes, issuers in a number of countries could be in for quite a bit of work as well as patience as their applications are processed by regulators.

Principles of best practice recommendations to the ESRB

The principles of best practice are something EBA had to produce for the ESRB. These principles don’t have any short term implication in the sense that non-compliance would lead to any adverse regulatory impact. EBA merely states:

- “As covered bonds issuers can fail, it is of paramount importance that covered bonds frameworks converge towards common standards of safety and robustness in a number of crucial areas.”

- “While the appropriateness of a single EU Regulation covering all aspects of covered bonds is not assessed in the report, the EBA is of the opinion that convergence in several areas of the covered bond framework can be beneficial to the covered bond instrument, an integrated EU covered bond market and financial stability in the EU. Any future considerations about changes to national or EU covered bonds regulation should in the view of the EBA give consideration to these areas.”

This means that there is an undefined time horizon at the moment, but about something that regulators in covered bond markets are asked to take into account when amending their covered bond laws from now on. The principles cover virtually every risk aspect of covered bonds. EBA mentioned that not a single covered bond framework out there currently complies with all recommendations.

It looks like EBA is aiming for all of these best practices to be legal requirements, which in turn means that contractual arrangements and issuers voluntarily complying with them wouldn’t be enough. This is different from some other regulatory documents out there as Basel large exposure limits rules – which will be in effect from 2019, for example – recognise voluntary OC as sufficient to comply with rules.

It looks like EBA is aiming for all of these best practices to be legal requirements, which in turn means that contractual arrangements and issuers voluntarily complying with them wouldn’t be enough. This is different from some other regulatory documents out there as Basel large exposure limits rules – which will be in effect from 2019, for example – recognise voluntary OC as sufficient to comply with rules.

- Segregation of cover assets: EBA asks for either registration in a cover register or transfer to an SPV that is legally binding and enforceable.

- Bankruptcy remoteness of covered bonds: Amongst fairly basic issues EBA also calls for living wills of covered bond issuers focusing on how orderly functioning of the covered bond programme post issuer insolvency could be safeguarded. The French are currently introducing this to their covered bond law.

- Administration of covered bond programmes post issuer insolvency: Calls for an independent administrator to be installed upon the issuer’s default or resolution working only in favour of covered bond investors whose duties and powers are clearly defined. EBA will likely also add extension to the list of events that require an administrator to be automatically installed as in some countries soft bullet extensions don’t lead to an issuer default and it is up to regulators to appoint an administrator, which could take some time.

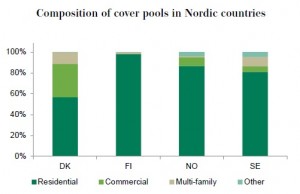

- Composition of cover pools: EBA calls for regulatory limits on how mixed pools are structured. For non-mortgage assets, they recommend prohibiting issuers from mixing assets altogether. CFF is the only issuer actively mixing public sector and mortgage assets, a practice that would be against the recommendation. To be in line, CFF would have to set up a second SCF and split mortgage and public sector assets. For mortgage pools, EBA doesn’t want to prevent issuers from mixing residential and commercial assets. It does want to prevent issuers from turning a residential pool into a commercial one, though, which will most likely mean that there will not be a fixed number or limit on commercial assets and rather be a limit on the extent of changes to existing pools.

- LTV limits: EBA feels that hard LTV limits are good at the time the loan is originated and added to the cover pool, but thereafter EBA is calling for partial recognition of the below 80% LTV with no loan having to drop out of the pool because of LTV migration.

- Indexation/revaluation of LTVs: EBA calls for an at least annual revaluation of both residential and commercial LTVs. Currently the CRD only calls for annual revaluation of commercial mortgages; for residential assets every three years is sufficient. EBA also calls for a party independent of the credit-granting process to do the revaluations. This doesn’t mean the valuation has to come from a party outside the issuer, but there have to be Chinese walls between the loan origination and valuation departments.

- Stress testing: Issuers should regularly stress their coverage requirement taking into account interest rate shifts, currency shifts, and stresses on the credit quality, repayment behaviour and liquidation prices of pool assets. This calculation is independent of the legal minimum OC, but issuers could, however, be required to disclose the results. Only a handful of countries currently stress their OC (Germany and Denmark, for example).

- Disclosure: EBA calls for a doubling of the required disclosure frequency from six months (Art. 129 (7) CRR) to every three months.

Bottom line

In our view, pretty much all of the recommendations by EBA make perfect sense. There are some legal frameworks that have been very innovative and have adjusted to new requirements quickly, but there have been others that haven’t. EBA’s recommendations could be the push needed to speed up the process there.

There are still big question marks as to how EBA will deal with soft bullet and CPT structures and the requirement to hold liquid assets. Also, the regulatory limits on cover pool composition certainly still need some work. And there are a few instances where EBA recommendations need to be aligned with other areas of banking regulation to avoid doubling work for banks.

But overall the work by EBA is good and sensible, even though with regards to covered bonds one could certainly argue that “if it ain’t broke, don’t fix it”, and the statement that not a single covered bond law complies with all the requirements means there could be a lot of work for national regulators on the agenda in the coming months and years.

EBA does not endorse the call for one common covered bond framework in Europe, though. EBA chairperson Andrea Enria said at the very beginning of the meeting that differences in covered bond frameworks have a sound historic background and there is no need for total harmonisation. And EBA also doesn’t put a lot of pressure on frameworks to converge to the recommendations very quickly. In general, this is more of an evolution than a revolution, and in our view it’s a mostly sensible evolution EBA has outlined here.

Florian Eichert Senior Covered Bond Analyst Stephan Dorner Covered Bond Analyst Crédit Agricole CIB Source for charts: Crédit Agricole CIB