CSI: Investor sentiment off December lows Issuer index at an all-time high

Feb 20th, 2015

After a fairly ugly December edition of our Covered Bond Sentiment Index (CSI), the first index reading of 2015 (the 25th overall!) looks a little bit better.

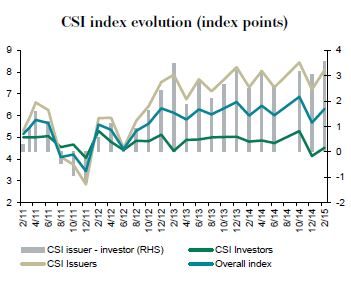

Based on the answers of 85 investors and 25 issuers, the headline index number has again crept back up, to 6.3 from 5.7. In December the index suffered its biggest ever loss, falling by 1.2 index points from the previous all-time high of 6.9 right before CBPP3 started in October.

Sentiment in December was still characterised by covered bonds feeling the CBPP3 pressure and spreads to other markets being pushed very tight. The ECB announcement to go for further asset purchases in January did, however, reverse some of this, with covered-govvie spreads widening again, and this had an overall positive effect on market sentiment in the covered bond space. After all, covered bonds are no longer the only QE-distorted part of the fixed income markets, singled out by the Eurosystem for special treatment. SSA as well as to a lesser extent sovereign bond markets will – and already do to some extent – feel the liquidity squeeze that these asset purchases can cause.

- The CSI investor index has thus risen from 4.1 to 4.5, moving away from the second lowest ever reading in December but still remaining below the long term average of 4.8.

- Interesting to note is also the wide range of answers. For virtually every sector we have answers ranging from 0 to 10.

- Current situation and expectations scores are at the same level, so thanks to the ongoing pressure CBPP3 exerts on the market investors do not expect things to improve from here onwards.

On the issuer side, the ongoing grinding tighter of spreads at the same time as investor distribution stats have looked more normal since the start of the year has driven the index to its third highest ever reading.

- The CSI issuer index jumped by 0.8 index points to 8.2. Issuers expect things to marginally deteriorate, though, as the expectations score is slightly below the current assessment, at 8.0 index points. A look at the evolution of issuer and investor sub-components of our index shows that despite the improvement in investor sentiment we are still clearly talking about an issuer market.

- The difference in sentiment between issuers and investors is at its highest level ever. Issuer sentiment is a full 3.6 index points above that of investors.

Public and private very different

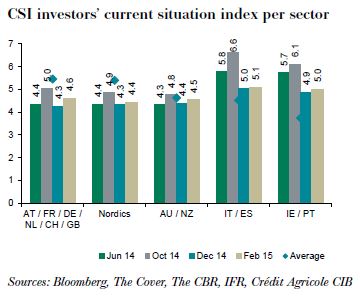

As mentioned above, issuer sentiment is close to its all-time high. Furthermore, issuers from all sectors are feeling the same way. The scores on current assessment as well as expectations are virtually the same across the board.

This positive view is, however, only true for benchmark markets. Regarding private placement markets, the situation looks very different and not in a good way. Because of very low interest rates across the board issuers seem to be finding it much harder to get sufficient private placement demand as they do in public markets.

- Issuers’ sentiment from core continental European countries towards private placement markets is a full 3.2 index points below that of public markets. The difference for Nordic issuers is slightly less pronounced, but at 3.0 index points still the highest it has ever been.

- Peripheral issuers, on the other hand, still see private placement markets in a more positive light. Their sentiment towards private placement markets is 0.4 index points above their public market scores.

Investors less downbeat on extended asset purchases

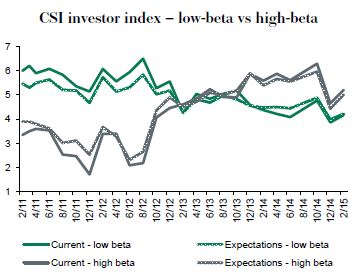

The CSI investor sub-index has recovered somewhat from the very low level in December. This does not, however, mean that investors across the board are happy with how the market looks and feels. The main theme in virtually every investor meeting these days is that the cash that is tied to the market/product is put to work in new issues as they come even if spread levels are extremely tight. After all, getting bonds in secondary markets is a very tough challenge with CBPP3 buying around Eu500m every single day and holding cash has started to cost as non-bank investors are starting to be charged negative interest rates as well.

In this overall cautious stance towards covered bond markets, the expanded asset purchase programme (EAPP) has led to sentiment towards peripheral markets recovering faster than that towards core sectors. Sentiment towards covered bonds from peripheral countries is again one full index point above core sectors.

Carry is king, something that is also helping sentiment towards the less distorted non-Eurozone covered bond sectors, such as Australia or New Zealand. Sentiment is slightly above that of core Eurozone covered bonds as seven year spreads are a good 25bp wider than Pfandbrief levels.

Bottom line

It is telling that we have to highlight other markets looking less attractive after the ECB’s QE announcement to make a better case for covered bonds. In absolute terms covered bond yields are even lower now than they were when we collected feedback in our December edition. Spreads to sovereign debt have widened substantially, however. And in terms of the Eurosystem playing a major role in drying out market after market in its quest to hit the Eu1tr expansion target, it probably takes less to make a frustrated covered bond investor base more positive about the market in relative terms.

The CSI index in February shows exactly that. We have issuer sentiment close to an all-time high, while investor sentiment is slowly creeping up from the second lowest ever index reading of December. Consequently, the difference between issuer and investor sentiment is the highest it has been.

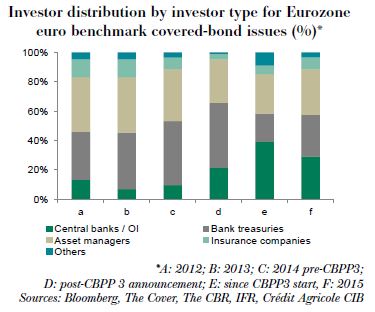

We have nonetheless seen more normal investor distribution stats early this year, with CBPP3 reducing its share of new issues to around one-third from up to 60% at the end of last year. Many investors have used new inflows to buy in covered bond markets in the absence of too many viable alternatives. They have also been using new issues to shift their portfolio allocations, with the secondary market positions eventually finding their way to CBPP3. After all, trying to change a portfolio via secondary markets still is (and will be increasingly more so) heavy going with CBPP3 draining bonds from the market every day.

In terms of sector preference, one can say that the EAPP has revived peripheral appetite after we had some widening towards the end of last year. Sentiment has been going up faster there than it has for core European sectors.

Another area that is still in focus and enjoys slightly higher sentiment scores is the non-Eurozone covered bond space. Covered bonds from, say, Australia yield around 25bp more than Pfandbriefe in seven years while being LCR-eligible. And as peripheral covered bonds of the strongest issuers have reached similar spread levels, investors have been also looking abroad in search of investable alternatives. On top of this additional private sector demand, we have seen unusually high levels of activity in these non-CBPP3 eligible covered bonds from central banks/official institutions, including central banks within the Eurosystem buying on average around 30% in 2015 – the same level as for CBPP3-eligible Eurozone covered bonds this year.

Florian Eichert

Senior Covered Bond Analyst

Stephan Dorner

Covered Bond Analyst

Crédit Agricole CIB