CPT covered bonds: Playing with maturity structures in the Nordics

Oct 17th, 2013

Nordic covered bond markets have always been at the forefront when it comes to maturity structures. Florian Eichert, senior covered bond analyst at Crédit Agricole CIB, considers the case for conditional pass-through covered bonds in the Nordic region.

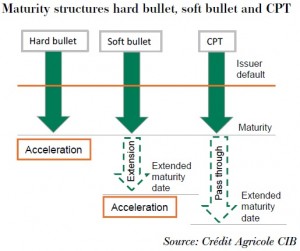

The balance principle and auction system in Denmark have been in existence from the very start of the market. And a maybe less known fact: apart from Sweden, Nordic markets (with Finnish exceptions of the Nordea and old Aktia programmes) use soft bullet maturity structures that typically allow the bank to extend payment by 12 months.

Earlier this month, the Netherlands’ NIBC pushed the boundaries yet further by switching from its 18 month soft bullet programme to a new programme that makes use of a conditional pass-through (CPT) structure.

NIBC’s structure in brief

While this may sound very dramatic, to us there have been bigger innovations in the covered bond space than NIBC’s CPT programme — and in a market driven by very traditional investors and market participants trying to protect the product from regulatory strangeness, we mean this in a positive sense. Commerzbank’s SME-backed structured covered bond was a novelty in many respects; the NIBC issue merely changes one element — maturity structures.

And even that maturity structure doesn’t look as drastic as the name would lead one to believe. Only if the pool doesn’t have sufficient liquidity to repay at maturity does the pass-through structure kick in. At this point, however, every traditional covered bond would become a pass-through security as well since the administrator would be forced to wind down the pool.

The end-result is that investors have a bond that behaves similarly to a traditional covered bond in all but one scenario, and in that scenario (default of the traditional covered bond and pass-through for the NIBC one) the main difference is the timing of the pool liquidation. The administrator of the traditional programme would likely try to liquidate faster than the administrator of the pass-through programme, who has no pressure on timing. Whether it is better to sell quickly and take certain losses or to wait, hoping to achieve full repayment, is not easy to say, though, especially when looking at it from a net present value angle.

Looking at the regulatory treatment of CPTs, at least in the Netherlands there are no differences to the already existing Dutch programmes. The bonds are Dutch regulated covered bonds, as such UCITS and CRD compliant, they are index and ECB repo-eligible, and should also get the same treatment in bail-ins as the traditional programmes.

Why are issuers doing it and what should investors look out for?

There are two main arguments for CPTs from the issuer side and they are quite powerful — higher possible rating uplift and more stable ratings, as well as less overcollateralisation being required for a given rating.

The CPT structure allows rating agencies (at least S&P and Fitch) to rate CPTs delinked from the issuer rating. The NIBC covered bonds are a stable AAA from S&P and Fitch while the issuer is rated BBB-.

One of the biggest concerns agencies usually have is the risk of having sufficient cash to repay bullet maturities. Passing this risk on to investors in the form of extension risk relaxes agencies’ views on the absolute achievable rating level as well as the required OC. Refinancing risk is by far the biggest driver of OC requirements by agencies and eliminating this can generate substantial OC savings.

This already leads us to two disadvantages investors have to think about:

- Liquidity risk for the issuer is transformed into extension risk for investors.

- Rating agencies require less OC for CPT programmes so issuers can operate with lower levels than for their traditional programmes.

The first of these two bullet points is not as dramatic as it sounds as we’ve explained above. Investors have to pay close attention to the second point, though.

For us, the biggest disadvantage of CPT is the following:

- If structures are able to better survive on a stand-alone basis, the probability of external support is lower. Yet, survival in this case doesn’t mean investors couldn’t face losses on a NPV basis as payments are possibly extended well into the future.

NIBC’s programme can realistically default only because of over-indebtedness of the cover pool on the back of credit-related losses. Liquidity risk is covered by the CPT structure. Authorities therefore have less incentive to support a programme should the issuer default. It is much easier to move it to a bad bank and let payments to investors potentially extend into the future. A hard bullet programme would very likely be supported by transferring it to a stronger entity or by providing liquidity lines, in order to avoid covered bond defaults, which could have wider systemic implications for the banking sector.

NIBC investor distribution vs. core

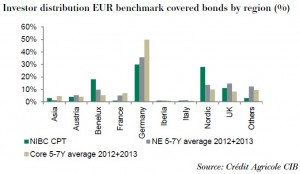

The Eu500m NIBC deal had an order book of Eu1.3bn. When looking at the breakdown by investor type, there is hardly any difference compared with other five year Dutch covered bonds.

The differences start to emerge on the geographic split, though:

- The German share was well below average while French investors were virtually absent from the order book.

- Nordic investors, on the other hand, were more active, buying almost one-third, which is double their normal Dutch average and three times their average in other core covered bonds. The domestic bid was also higher than is usually the case in core covered bonds. Dutch but also some Nordic accounts have a long history in securitisation markets and are thus probably more open to the structure. As far as we are aware, the Nordic portion was also pushed up by bank treasuries who are building up LCR buffers.

Why would Nordic issuers look at CPT?

There has been talk recently about CPT being a topic for Nordic issuers as well. We have listed the rationale behind NIBC’s deal above. Some of these elements that were relevant to NIBC would not be as important to Nordic issuers, though. The question can therefore be asked: why change a system that is offering the banks record low all-in funding costs? Why risk upsetting investors?

While Nordic covered bonds, which are almost exclusively AAA rated products, will not be able to benefit from potential rating uplift, some of the smaller banks in particular could, however, profit from increasing the leeway on existing ratings. There are Nordic banks with only one or even no notches of leeway left on the issuer rating before their covered bond ratings come under pressure. Fast-forward into a bail-in world, and the additional CPT related rating flexibility could become relevant.

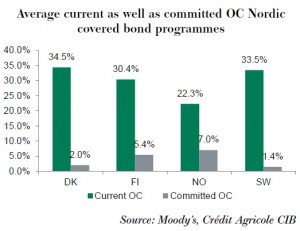

The other more relevant argument at this point would be OC. Moody’s, for example, asks Nordic issuers to hold OC levels in the high single-digit to low double-digit percentage numbers. By introducing CPT, this could certainly fall.

We could also imagine those Nordic issuers still working with hard bullets switching to soft bullets. Swedish issuers as well as Nordea Finland could be candidates here. The OC reduction wouldn’t be as big as for CPTs, but investor acceptance is much higher and it could likely be done with existing programmes without requiring further approval by local regulators.

What do we think Nordics will do?

First of all, to us the CPT structure doesn’t change the way a covered bond behaves as much as one might think. We prefer hard bullet covered bonds with pre-maturity tests or 180 day liquidity rules and higher OC. We also think that a triple-A there is worth more than a triple-A on a CPT.

We understand the motivation for issuers like NIBC, though. For a lower rated issuer it is ultimately more about rating agency methodology arbitrage than anything else. And as long as issuers limit this arbitrage to improving and stabilising the absolute rating level and not to reducing OC levels significantly, we see the benefit the structure can offer to investors. The biggest downside for us lies in the potentially lower level of implicit sovereign support and the risk that programmes are moved to bad banks while extending cashflows leads to NPV-based losses for investors.

Looking at the Nordic issuers, the rating element is not (yet) as obvious. The bigger motivation would thus likely be the reduction of OC. Going for CPT will save more OC compared with the soft bullet option. However, it is the bigger leap for Nordic issuers in our view and one that would require new programmes, too, as well as formal approval by the local regulators. NIBC managed to get this endorsement by the Dutch central bank, but it doesn’t have to always be the case.

Also, investors bought the rating argument of CPT for NIBC while the issuer committed to hold a comparatively high level of OC. It could be a different story with CPT acceptance when it comes to highly rated Nordic banks and their covered bond programmes. Maybe domestic accounts would be more receptive to the idea, but looking at international investors, we don’t think that reducing OC levels would be a good idea at a time when a lot of attention is being placed on Nordic housing markets.

Florian Eichert

Senior Covered Bond Analyst

Crédit Agricole CIB