Covered bonds in 2015: Victims of their own success?

Dec 19th, 2014

Throughout the sovereign crisis, covered bonds were a remarkably stable asset class that at the same time offered a wide range of investors an attractive investment case, write Crédit Agricole CIB covered bond analysts in their outlook for 2015.

Covered bonds were yieldy enough for asset managers as well as insurance companies, while at the same time often offering higher ratings and less volatility than sovereign or bank senior debt, and bank treasuries could profit from preferential regulatory treatment.

Looking at today’s market, the stability and quality elements are clearly still there, but apart from this one can say covered bonds have become a victim of their own success. With the start of the third covered bond purchase programme (CBPP3), the European Central Bank added buying covered bonds to its policy kit and in doing so has pushed covered bond spreads to levels where the investment abovementioned case simply isn’t there anymore for many investors. The spread rally of the past years seems to have found its bottom for now.

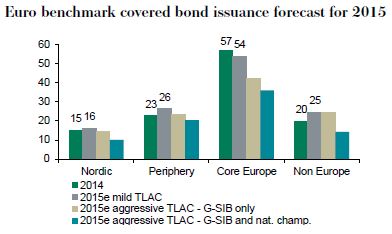

One might think that in times of record low interest rates and spreads issuers will rush to enter the covered bond market and profit from the prevailing conditions. We do not follow this line of argument in our issuance forecast for euro benchmark covered bonds. With forecast euro benchmark covered bond issuance of Eu120bn after Eu114bn this year, we expect only a slight increase.

For covered bond funding volumes to grow substantially, we need loan book growth or very volatile markets. In the absence of this, peripheral issuers will grow slightly as they optimise their funding and replace ECB with market funding, and we will have a handful of new markets such as Poland and Singapore. Many issuers in core European countries may well put their focus on other products that count as loss-absorbing capital, though.

Looking at the Nordics, we expect a slightly higher focus on euro covered bond markets and less US dollar issuance, while at the same time the Finnish weight could grow as Swedish and Danish issuers make use of their Eurozone subsidiaries to access CBPP3 demand.

We also expect more issuers to make use of soft bullet structures. Issuers from the Netherlands, France and Switzerland are these days joining the soft bullet camp. In Nordic countries soft bullets are already widespread, with Norway and Denmark only issuing soft bullets and Finland predominantly making use of this. Even the first Swedish issuers have started to do this and we would expect others to follow.

CBPP3 activity and impact

We’ve mentioned the ECB already at the beginning of this article and the impact it has had on spreads. The biggest problem the CBPP3 has is its danger of crowding out private sector investors and reducing the depth of our market. The ECB mentioned on a number of occasions that it wants to maintain a functioning investor base in covered bonds.

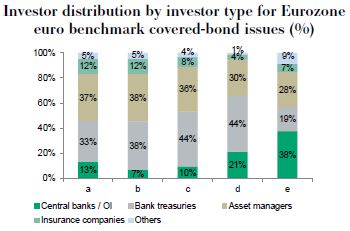

Well, as can be the case with good intentions, it is hard to keep promises in real life. The share of central banks in euro benchmark covered bond new issues from the Eurozone went up in recent weeks at the expense of asset managers and bank treasuries. The latter have predominantly moved to SSA and sovereign debt, while the former have moved on to sovereign debt, corporate bonds and bank senior and sub debt.

In general there are two main themes among investors in the last few days and weeks:

- At these spread levels covered bonds are not an attractive proposition to end-clients, and investors overweight either sovereign debt or go the other way, buying corporates or senior/sub bank debt.

- Given the difficult liquidity situation in the market, net negative issuance and the CBPP3 constantly buying in the secondary market, big accounts in particular are starting to question whether they can in practice maintain the same focus on the asset class as in the past.

The first theme is something that can probably be sorted out by core covered bonds widening 10bp-15bp to get back to around swap flat and Bunds plus 25bp-30bp, which would bring back bank treasuries and asset managers with LCR mandates. In the periphery, moving 20bp-30bp wider to get a little closer to their domestic sovereign debt would probably bring back some of the yield-hungry asset managers and insurance companies.

The second theme, however, is more structural in nature and more worrying, especially when thinking about a potential time after CBPP3.

From our meetings in the last days we can say that much of the covered bond underweight so far has been tactical in nature. With all of the talk about investors moving out of the asset class, at the end of the day it is probably fair to assume that a low double-digit billion amount has changed hands so far. After all, our secondary purchase estimate for the CBPP3 is around Eu16bn so far and the big account on the buying end of this rotation has after all been CBPP3.

However, we are at the year-end and in the coming days and weeks many investors will have their year-end meetings with their end-clients. And one thing that will certainly be discussed is the asset allocation and benchmarks to be used for 2015.

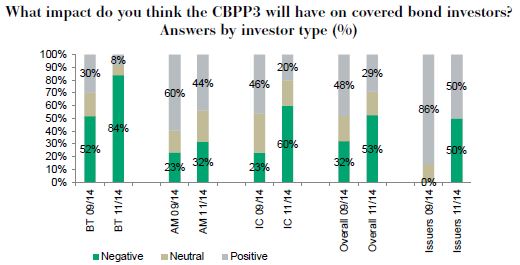

The feedback to our second CBPP3 survey is all pointing in the same direction. Many accounts are frustrated and despite the expectation of further spread tightening eventually, their predominant fear is to be further crowded out while no new investors are expected.

CBPP3 determining our bottom line recommendation

Consequently we have chosen a rather conservative stance in our covered bond outlook. We feel that at the current spread levels there is not sufficient demand to stabilise the market without CBPP3. And given the stable CBPP3 buying, the central banks’ activity is likely sufficient to support covered bonds in the long run and keep volatility levels fairly low, especially when putting covered bonds into the bigger context. The programme is, however, not reactive enough to respond to weaker days with more selling. It thus cannot prevent markets from widening in the shorter term. Accessing today’s market does carry noticeable execution risk for issuers at these spreads, even when factoring in CBPP3 buying. It is tougher for syndicate banks to find 30% private sector demand these days after CBPP3 buys the maximum 70% than it was to find 100% private sector demand three months ago.

The most likely way the market will move in the coming weeks is range-bound trading. Individual accounts that decide to sell in bigger size will trigger widening while the ongoing buying of CBPP3 will push the market back tighter in the following days.

We thus continue to favour a buy-on-dips strategy for investors’ tactical asset allocation, while maintaining a structural underweight of covered bonds versus sovereign debt and the SSA space.

For a healthier market and a more structural shift back to more covered bonds, we would need the ECB to focus on other markets with its buying, which would make covered bonds look more attractive in relative terms. Should the ECB decide to go for this we expect covered-sovereign spreads to widen from both ends of this product pair as investors would certainly question CBPP3’s ongoing commitment. In our view, CBPP3 would, however, continue to buy at an unchanged pace, and at Bund spreads of 30bp covered bonds are LCR-efficient instruments again, adding private sector demand to the ECB’s buying. To us, the sooner QE and this widening comes the better for the covered bond investor base. Staying in this zombie-like range-bound trading mode means we will be bleeding investors week after week.

The positive aspect of these squeezed markets is that for the first time in a long time, fundamental analysis does make sense again. As sectors have compressed substantially, investors don’t have to pay up to move into the better quality. At the beginning of last year one would have still given up carry to move out of French, Belgian or Austrian covered bonds into some strong Nordic programmes. These days, with the CBPP having distorted Eurozone covered bond levels, this move cannot only be done for free but it actually adds carry to portfolios.

Florian Eichert Senior Covered Bond Analyst Stephan Dorner Covered Bond Analyst Crédit Agricole CIB