Covered bonds and the LCR: Level 1B, lower minimum rating on the cards

May 16th, 2014

The delegated Act on the LCR, or rather a DG Market Staff Paper on the matter was leaked this week. It is important to stress that this is not yet the final version.

We would be surprised if the final version differs materially from this, but it is certainly too early to open bottles of champagne across Europe.

How are covered bonds treated in general?

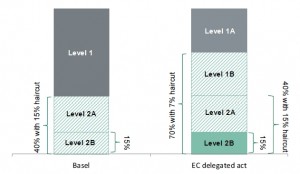

In general, European rules seem to be a lot more generous on covered bonds than Basel rules are. Under Basel rules, covered bonds had been allowed for up to 40% of liquidity portfolios as long as they were rated AA-. Under the European rules, however, covered bonds seem to be allowed for up to 70% of total LCR portfolios, and the lowest possible rating to be eligible in some way or another is A-, or one full credit step lower.

To start with some similarities, the level 2A and 2B are essentially similar size-wise to under the Basel rules. Another thing that will be the same as under Basel rules is haircuts in Level 2, which will be 15%. However, level 2A requirements are less stringent in the Act than they are in Basel (a lower minimum rating of A-) and, on top of that, under European rules the delegated Act allows for covered bonds to be part of Level 1 as well. Essentially the Act is introducing a Level 1B that can comprise up to 70% of overall LCR portfolios with a haircut of 7%.

LCR rules: Basel vs. Europe

These are the concrete requirements to be eligible for Level 1B:

- CRD/CRR-compliant

- Minimum rating AA-

- Minimum size Eu500m or equivalent in other currencies

- Subject to mandatory overcollateralisation levels as well as minimum LTVs

And these are the requirements for level 2A:

- CRD/CRR compliant

- Minimum rating A-

- Minimum size Eu250m or equivalent in other currencies

- Subject to mandatory overcollateralisation levels as well as minimum LTVs

What about currency matching?

For many Nordic markets, a big concern is how closely they have to match currencies of cash inflows and outflows. In Sweden, banks have to, for example, calculate separate LCRs for non-Swedish krona currencies.

In this context, the leaked document merely requires that banks ensure that the currency denomination of their liquid assets is broadly consistent with the outflows. In essence this would mean that banks from the Eurozone can use also non-euro assets. Or Swedish banks would be able to use non-krona assets. The text does not specify what broadly consistent means, though. For sovereign and SSA issuers, the document requires that non-domestic currency issuance from a specific issuer is not LCR-eligible but doesn’t include covered bonds in this statement. So KfW will only be eligible with its euro bonds but not their issuance in US dollars, while at the same time US Treasuries will have to be US dollar-denominated. This requirement doesn’t apply to covered bonds, though, so Swedish covered bond issuance in euros will be LCR-eligible.

Source: Crédit Agricole CIB

What about SSA and Länder bonds?

We´re not the experts on the SSA space, but the way the document reads, pretty much all SSA issuers can be Level 1 assets, even those not explicitly guaranteed by their sovereign. Also, regions will be Level 1 assets. And even names such as BNG from the Netherlands seem to be fine here. So the risk that, for example, German Länder (which were not mentioned in EBA’s proposals in December) drop out of Level 1 and cause spreads to widen, dragging core covered bond spreads along with them, is off the table.

What is still left open?

One thing that is still unclear is which overcollateralisation and LTV levels will be required to comply. The OC and minimum LTV requirements are not quantified yet. The way it is written in the document is a bit awkward as well. The text talks about a combination of OC and LTV discount below 100% needing to reach a certain level.

There are a number of covered bond laws that only require coverage (in other words OC of 0%) and when reading the text one could get the impression that they could be out. We also don´t know yet whether OC has to be a legal minimum or whether contractual minimum levels are OK as well.

The other issue that is still unclear to us is the treatment of non-EEA covered bonds. We still don´t know how, for example, covered bonds from countries such as Canada or Australia but also Switzerland would be treated. The EBA proposals from last year stated that banks can look at what national regulators do in their country and treat covered bonds accordingly. So if, for example, covered bonds from Canada are Level 2A assets under Canadian LCR rules, European banks can use the same approach. We would strongly expect this to be part of the final rules as well even though we couldn´t find anything in the EC document. We´re still aiming for global harmonisation here and it would be weird if Europe went against that completely.

Who will benefit most?

Let’s start with a very basic statement: the wider rules are positive for covered bonds. The higher overall limit of 70% does not, however, really make much of a difference to most treasurers unless they are Danes. The higher limit will thus not drive flows in euro covered bonds to a big extent. Even the lower haircut will not be a big driver, in our view. Most banks fulfill LCR rules already, anyway. Whether they get slightly more credit for a specific asset and then fulfill the ratio even more will not be a game-changer. We are still talking about very tight spread levels in the core space and if spreads are considered too tight to become active, a somewhat lower haircut will not make treasury investors all of a sudden fall head over heels in love.

What is different, though, is that A- covered bonds will now be eligible for the Level 2A bucket. We’re talking about many issuers from the periphery here. And that doesn’t only include the two big names from Spain and Italy. We don’t think that bank treasuries will make a U-turn and go crazy about these names. However, many are constantly trying to optimise their LCR portfolios to generate more yield. Only holding Bunds is a rather costly exercise in the end. We could thus imagine that some international bank treasuries will at least try to add some peripheral exposure.

For core covered bonds, the rules are neutral. The biggest positive here is that the SSA space is treated quite positively. And as mentioned above, there had still been uncertainty around some unguaranteed SSA issuers, and unpleasant surprises there could have dragged core covered bonds wider as well.

Florian Eichert Senior Covered Bond Analyst Stephan Dorner Covered Bond Analyst Crédit Agricole CIB