Covered Bond Purchase Programmes: Should the ECB sell to ease the squeeze?

Jun 20th, 2013

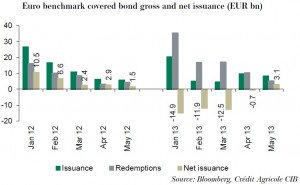

“Squeeze-time” is probably the “it” word of the covered bond world so far in 2013. Issuance has remained subdued, with overall euro benchmark covered bond volumes having just moved above EUR50bn, while redemption volumes have been significantly higher, coming in at EUR85bn in the first five months of the year. As a result, net issuance is deeply negative year-to-date.

This is happening right at a time when the market is shrinking, regulators and politicians are pushing more a nd more investors to at least consider covered bonds by discussing bail-ins, moving depositors ahead of senior unsecured, or the is IMF starting discussions to involve private investors more frequently and at an earlier stage in sovereign debt restructurings.

nd more investors to at least consider covered bonds by discussing bail-ins, moving depositors ahead of senior unsecured, or the is IMF starting discussions to involve private investors more frequently and at an earlier stage in sovereign debt restructurings.

The end result of this constellation is a market that is structurally squeezed. The last two weeks have been a different story, with markets being soft and investors willing to offer exposure, but this weakness doesn’t materially change the structural shortage of paper.

Should the ECB start selling parts of its CBPP holdings to ease the pain?

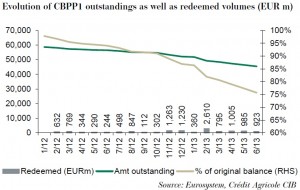

Market participants recently raised the question of whether the ECB should start to sell bonds from its two covered bond purchase programmes (CBPPs) to improve liquidity. After all, the institution still holds EUR61.8bn in addition to its normal portfolio purchases.

The way we see it, the evolution of the CBPP portfolios so far certainly does not suggest anything has been actively sold to date. The shrinking numbers can be attributed to normal redemptions, in our view. Given the fact that the first CBPP1 purchases took place almost four years ago, it is only natural that a portion of these bonds from back then has matured by now.

What is our take?

In our view, we are walking a very thin and dangerous line here without really being sure about the potential benefits.

On the one hand the ECB initially bought the bonds for policy purposes, with the main target being to support bank funding. Holding on to the bonds for the last few basis points of tightening is certainly not the major focus. Instead, improving secondary market liquidity was one of the stated goals of the CBPPs.

So with bank funding being in a much better state than it was at the same time last year, it should be in the Eurosystem’s very interest to focus more on market liquidity and also consider selling positions.

However, we are running a huge risk here that a move from the Eurosystem could be misinterpreted by outside observers. Any move would thus have to be very clearly communicated without leaving any scope for misinterpretation.

In addition to the risk of being misinterpreted, the biggest squeeze is in longer dated paper, which has driven covered bonds even from core sectors very close to or inside their respective sovereign curves. The short end is more lively when it comes to two-way trading. The average maturity of central bank primary market purchases back in 2009 and 2010 was, however, 5.6 and 5.5 years, respectively. The bulk of the portfolio will thus mature in 2014, 2015 and 2016, which means that the vast majority of positions in the CBPP1 and CBPP2 portfolios are by now in the one to three year bucket, while the long end is most certainly under-represented.

What do investors think?

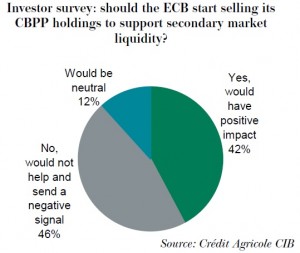

To find out how investors feel about this, we conducted an investor survey in June. What can certainly be said is that there is no consensus, but rather a wide range of opinions out there.

- 42% of the 107 investors feel that it would be a good idea as it would add liquidity to the market.

- Another 46% feel this would pose a danger to the market as it would send the wrong message.

- 12% do not feel it would really make a difference

Breaking down the answers into more detail reveals a bit more than just looking at the overall split:

- The region with the strongest dislike of the idea is at the same time the region with the biggest concentration in high beta covered bonds — Ireland, Italy, Portugal and Spain.

- Investors from core Europe are almost equally in favour (47%) as well as against the idea (42%).

- The investor base with the lowest risk appetite (see the results of our bi-monthly covered bond sentiment index) is at the same time the investor base with the biggest interest in the ECB starting to sell CBPP holdings (48% in favour, 38% against, 14% neutral). Issuance from the Nordics has been fairly low year-to-date so markets are especially squeezed. At the same time, Nordic bank treasuries are still building up covered bond exposure for LCR purposes and have struggled to find sufficient volumes for most parts of this year so far.

When looking at the investor types a somewhat similar theme to the geographic split starts to emerge:

- Asset managers are least open to the idea. At the same time, asset managers are also the first investor group to have come back on peripheral debt last year and they are also the investor group with the highest share of peripheral covered bond investments in the primary market so far this year (close to 40% of their money spent on euro new benchmark covered bond issuance year-to-date).

- 46% of the bank treasuries on the other hand are in favour of adding liquidity to the market via the ECB’s two purchase programmes. Treasuries have been the most conservative investor base so far this year and especially bank treasuries from core countries have been virtually absent in the periphery. Most have instead been trying to build up exposure to highly rated, potentially LCR eligible covered bonds from core sectors and have had trouble finding bonds. Interestingly enough, the bank treasuries that have been most active in peripheral covered bonds (accounts from Italy/Spain) have all come back to us saying they are against the ECB selling exposure.

- Insurance companies are the investor base with the highest share of yes votes (50%). As mentioned above, the biggest squeeze is probably at the long end of the curve and that is exactly where the insurance companies are most active.

Will the ECB act? And what do Nordic markets have to do with it anyway?

How does all of this impact Nordic covered bond markets and Nordic covered bond investors? After all, the only country from up North that is part of the euro-zone and was thus part of the two CBPPs is Finland. So for Swedish as well as Norwegian or Danish covered bonds there would be no direct impact in the first place as none of their bonds are held in the CBPP portfolios.

Well, investors from the Nordic region were the ones most open to the idea of the Eurosystem selling its positions to boost liquidity. Consequently they seem to be the ones faced with the most severe squeeze. If the ECB were to sell parts of its holdings, there should be an impact on, first of all, Finnish covered bonds, causing levels to widen, but also knock-on effects on the other Nordic markets.

Fortunately for both the wider market but also the Nordic covered bond space, we doubt that we will see the Eurosystem focus on covered bond market liquidity through selling positions from its two CBPPs. In our view, the Eurosystem will probably see the risk of being misinterpreted as too high at a time when the market is focussing on every signal they send when it comes to withdrawing from extraordinary measures. In addition to this we think it would be technically challenging, as well as it carrying accounting implications. Besides, the impact could not be as positive in the end as some might hope for simply because the EUR62bn are focussed on the shorter part of the curve while the biggest squeeze is at the long end.

Consequently, squeezed markets up North are likely to remain and with this comes stable spreads. Looking at the weaker markets in recent days, they have certainly held up remarkably well, only being beaten by the ever squeezed Pfandbrief space.

Florian Eichert

Senior Covered Bond Analyst

Crédit Agricole CIB