Aktia changes: implications for bondholders

Oct 4th, 2012

Crédit Agricole CIB Senior Covered Bond Analyst Florian Eichert looks at the possible outcomes for Aktia Real Estate Mortgage Bank covered bondholders in light of the Finnish issuer’s plans to issue through Aktia Bank and a possible liability management exercise.

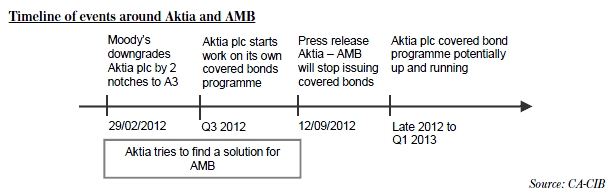

Early in 2012 Moody’s downgraded Aktia plc from A1 to A3. One might expect this not to have a major impact on Aktia Real Estate Mortgage Bank (AMB) given that a weak single-A rating is sufficient to maintain high double-A ratings on its covered bonds.

Because of AMB’s ownership structure, however, Moody’s has always implicitly rated AMB three notches below Aktia, and this is where the problems start. On this basis, the two notch downgrade to Aktia could well mean a A1 rating for AMB’s covered bonds.

Ever since the downgrade Aktia had been trying to find a solution to this problem. The main angle the bank had tried to approach the problem from was to move AMB closer to Aktia plc. Options that were discussed ranged from a change in the ownership structure to capital guarantees and liquidity support. AMB mentioned in an investor conference call last week that some of the owner banks of AMB couldn’t agree on the actual terms and thought the support provided to date was sufficient.

As a result, Aktia has decided to completely reorganise its covered bond market activities. AMB will stop being an active covered bond issuer. The owner banks will stop refinancing their mortgage business via AMB and return to funding it on their own. Aktia plc will in turn take over covered bond issuance going forward and is targeting Q1 2013 for its programme to be up and running.

What does this mean for investors in AMB covered bonds?

The current owners have committed themselves to support the programme in its current form. They will be providing capital and senior funding to AMB and will keep on servicing the cover pool to maintain its high quality. What is currently happening to AMB still has a number of consequences for AMB’s covered bond investors:

- It seems inevitable that Moody’s will lower AMB’s covered bonds from the current Aa1 rating to A1.

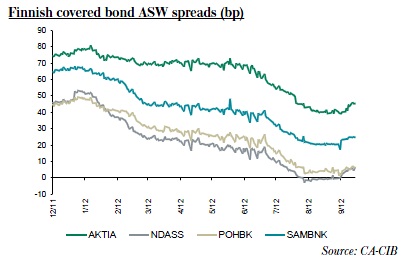

- Investors will end up holding covered bonds for which liquidity will certainly be lower than for still actively used Finnish covered bond programmes, including the Aktia programme once it is up and running.

- This in turn will have to be reflected in spreads, which in our view will not close the gap that has opened up to the other Finnish issuers.

Thoughts on possible liability management exercises between AMB and Aktia

During the conference call last week, AMB mentioned the possibility of liability management exercises involving switches out of AMB covered bonds into the potentially better rated Aktia plc covered bonds. AMB is not the first issuer to approach these transactions in the covered bond space. However, the tricky bit for AMB will be timing and there will probably be constraints on the size the issuer can ultimately do.

Timing: As opposed to, for example, Berlin-Hannoversche Hypothekenbank, it seems unlikely that AMB will be able to offer an exchange to investors before the downgrade has taken place. Aktia plc’s programme will probably not be up and running in time to issue new covered bonds that investors could switch into.

Size considerations because of the other owners: Around half of AMB’s mortgages are originated from the savings and co-operative banks and not from Aktia plc itself. Unless these banks are happy to give up the funding and take back their mortgages, AMB will only be able to switch half of its outstanding covered bonds into new Aktia covered bonds.

Size considerations because of Aktia’s new cover pool: Another constraint will be the immediately available size of Aktia’s cover pool. We would expect the initial size of the cover pool to be in the region of Eu1bn-Eu1.5bn. However, to be able to switch investors out of old bonds into new bonds requires sufficient collateral at the Aktia level. And even though AMB’s IT system has been transferring mortgages between owners and the issuer for a long time, we are not sure whether it would be possible to simultaneously switch investors from one bond to another and transfer the mortgages at the same time.

Size considerations because of AMB’s old covered bonds’ sizes: By thinking about a switch, Aktia is obviously trying to be investor friendly. There will, however, certainly be investors that don’t want to switch or that cannot switch for various reasons. The limited size of AMB’s outstanding covered bonds (they range between Eu250m and Eu600m) means that the old bonds would drop below a minimum benchmark size of Eu500m and drop out of indices rather quickly. AMB will therefore have the difficult task of balancing the interests of both old AMB and potential new Aktia covered bond investors.

The most realistic scenario is therefore that the AMB covered bonds will drop to A1. Aktia could then at some point offer investors the option of switching into newly issued Aktia plc covered bonds once the programme is up and running and the cover pool has grown in size sufficient to accommodate the new bonds.

However, since the issuer apparently plans to introduce the new programme with a standalone new deal before approaching the liability management exercise, investors will probably have to wait for a few months.

Bottom line — what do we think?

The situation around AMB has been dragging on for a number of months now. But the complicated ownership structure combined with Moody’s threat to downgrade the covered bonds to single-A has made it difficult to arrive at a solution. The end result we have now is certainly not one the issuer had wished for, but setting up a standalone programme via Aktia plc is probably the most sensible solution given the circumstances.

Aktia has already announced that it wants to help rating sensitive investors and is thinking about liability management exercises. Investors will, however, in any case see the rating drop to single-A well before the issuer can act with potential switch offers between the old and the new programme. Once we are at that point Aktia will have the delicate task of managing the interests of both old and new investors as well as the AMB owners and the initial size constraints of the new programme.

Assuming fair conditions in any switch offer, we would certainly think it a sensible thing to switch into the new Aktia covered bonds. They will be better rated and even if only a small fraction of investors agrees to switch, the old lower rated benchmark covered bonds could lose their benchmark status and drop out of covered bond indices. In addition to that, the new Aktia cover pool, despite being broadly comparable to the two pools of AMB, could end up being slightly better than the AMB ones. And last but not least, liquidity will always be better in an actively used programme than in one that is in run-down mode.