A brave new world: Market reacts to final CBPP3 details

Oct 10th, 2014

Having announced the third covered bond purchase programme (CBPP3) at its last press conference, at the beginning of September, the European Central Bank last Thursday (2 October) followed up with the technical details of CBPP3 — which didn’t disappoint our expectations as the eligibility criteria are very wide.

General modalities: size and duration

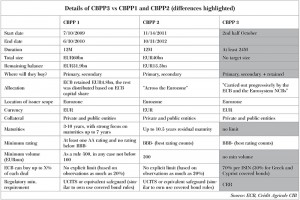

CBPP3 will differ from CBPP1 and CBPP2 in a number of respects.

- First of all, CBPP3 and the ABS programmes will not have a concrete size limit. To us, this is only natural as the required volume of asset purchases will depend directly on the volume of TLTRO take-up.

- Secondly, while the previous two covered bond programmes were both structured as 12 month programmes, CBPP3 will last for at least two years.

Click table to view full size.

Where will the ECB buy? What about retained bonds and issue share limits?

The ECB will purchase bonds in the primary as well as secondary market. Different than during CBPP1 and CBPP2, the central bank will, however, also be able to buy retained bonds directly from issuers.

Ulrich Bindseil, director general, market operations at the ECB, did mention the other day that the ECB would prefer to co-invest and buy new issues in the market, but at least the programme offers the option to go straight to the source should issuance not be as frequent as the ECB would like it to be.

Bindseil also mentioned that the ECB wants to maintain a functioning covered bond market. In that context one would probably have to mention the issue share limit of 70% for covered bonds, other than from Greece and Cyprus (30% in these two cases). In other words, the ECB will not be able to hold more than 70% of any given ISIN. We are not sure if one can call a market with a free float of potentially 30% functioning, especially if much of that “free float” will sit with other buy-and-hold investors. But, for whatever it is worth, it is of course hard to argue against the fact that 30% free float is better than no free float at all.

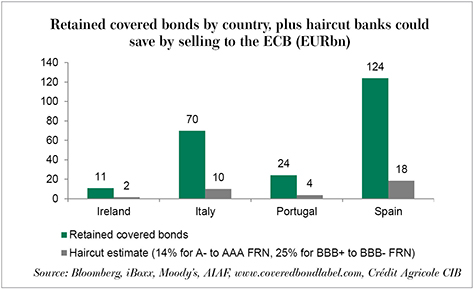

We are still not sure how buying retained bonds works with the overall balance-sheet growth target. Banks that sell their retained deals to the ECB can save the haircut, which can be anywhere between 14% and 25% depending on the rating. Based on the roughly Eu230bn in retained covered bonds from Ireland, Italy, Portugal and Spain, this adds maybe around Eu25bn in extra liquidity (70% of the Eu33bn estimated haircut) and thus balance sheet growth to the ECB. However, if there are external investors buying 30% of the deals, the balance sheet of the ECB would actually shrink by close to Eu70bn.

During the two previous programmes the criteria talked about UCITS-compliance. Compared with UCITS, CRR limits the eligible collateral to mortgages, public sector assets and ship mortgages. While the own-use covered bond rules allow for equivalent legal safeguards to be sufficient as well, the CBPP3 purchase programme eligibility criteria don’t include this option.

At the moment there is nothing outstanding in these sectors, so it’s not a big deal. The only non-CRR-compliant covered bonds that could have hoped to benefit from a UCITS wording are NordLB’s aircraft Pfandbriefe and Lettres de Gages from Luxembourg. Looking to the future, however, the ECB seems to be pushing the responsibility for these alternative collateral asset classes clearly over to the ABS programme. CBPP3 will concentrate on only the most traditional covered bond categories.

As long as we stay in these categories, we shouldn’t run into too much trouble overall with the programme:

- There is no minimum size as far as we can see (even Eu50m Pfandbriefe are repo-eligible, after all).

- There is no maturity limit. The ECB will thus participate in whatever eligible issuance comes to market. If there are only five year deals, they will buy five years; if there are 15 year deals, they will buy 15 years.

- Minimum rating will have to be BBB- (best rating).

- Euro-denominated covered bonds issued by financial institutions located in the Eurozone

- The collateral can be public and private sector-backed.

How has the market reacted to CBPP3?

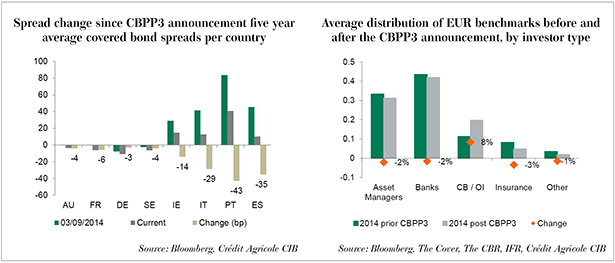

Secondary markets: Since the initial CBPP3 announcement, spreads — especially in the periphery — have tightened quite considerably. Five year Portuguese covered bonds have come in more than 30bp — looking at the ECB’s statements above and the potential duration of the programme, we could very well not be at the end of this, though.

Looking at new issue spread levels, one thing has become clear. Eurozone covered bonds have profited most from CBPP3 as they will be the direct target of CBPP3. Non-Eurozone covered bonds have been dragged along with them, but have lagged. While French covered bonds, for example, still traded at wider levels than strong Nordic covered bonds, this has now reversed. DNB from Norway issued its latest five year deal at mid-swaps minus 3bp while CFF and Commerzbank priced theirs at minus 5bp.

Primary market and investor distributions: One of the fears associated with CBPP3 has been that the ECB could be crowding out investors and reducing the diversity we have managed to get in the past few years.

For the time being, we cannot say that these fears have proven to be true. Following the CBPP3 announcement, issuance has picked up and book volumes have been very healthy. Also, the average number of investors per book has been stable around 100 since the announcement.

There has, however, been a shift in the investor distribution of deals since the CBPP3 announcement. The shares of asset managers and insurance companies have dropped by 2% and 3%, respectively, while central banks and official institutions have nearly doubled in weight (up from 11% to 19%).

Bottom line

The ECB announcement last Thursday was in line with expectations — as was the market reaction. The ECB came out with a very broad programme without size limits or a concrete deadline and the market went tighter.

Looking at the market after the September announcement and the latest details, in core covered bond markets we have reached levels where longer term market funding can certainly compete with TLTRO money on cost grounds. For stronger peripheral issuers we are fast getting there, but for many weaker names TLTRO money is still the better option.

But since the ECB is targeting spread compression and also wants to enable second tier banks to access the market successfully, we believe that we are not at the end of the compression in covered bond markets yet. It will continue at the higher spread end of the market. The tight range across sectors and issuers we have already reached at the short end and when looking at the strongest names in each country will continue to extend out along the curve and increasingly also encompass the weaker issuers in the coming weeks.

At some point when everything is trading in a fairly narrow range we will have reached a new equilibrium where investors grudgingly accept the low spreads and don’t dare go against the ECB. Looking at the planned duration of CBPP3, this state of mind will also be with us for the medium term. Welcome to a brave new world.

Florian Eichert Senior Covered Bond Analyst Stephan Dorner Covered Bond Analyst Crédit Agricole CIB