Nordic investors face frustrations home and away

Oct 18th, 2012

Florian Eichert, Senior Covered Bond Analyst at Crédit Agricole CIB, explores how Nordic investors’ growing readiness to look at peripheral credits could be frustrated by delays in reopening credit lines, while supply from local credits is held back by regulatory noises.

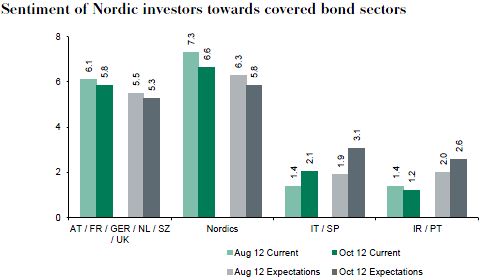

Nordic investors have always been by far the most conservative group in our bi-monthly covered bond market sentiment index (CSI). They have shown a very strong domestic bias as well as a profound dislike of any country exhibiting temperatures noticeably in excess of their own.

In our latest CSI edition in October things have, however, changed slightly. While the Nordics still have the highest sentiment scores for their own markets, they have lost ground compared with August. At the same time, despite still being at significantly lower absolute levels, other sectors have been able to close the gap somewhat, most notably markets from the periphery.

This slight sentiment change was also observable when we saw investors in Helsinki, Stockholm, Oslo and Copenhagen last week. Early this year many Nordic accounts we saw during a similar trip (especially Finnish accounts) didn’t even bother to talk about Italy or Spain and considered France to be part of the periphery. This time around, the main theme was frustration: frustration about low yields, low spreads and low issuance volumes in core sectors. At times we even talked about moving from top Spanish names into second tier names, or discussed OBGs and multi-cédulas.

The feeling we had was that sentiment had turned in Finland and Sweden. Despite still being rather risk averse, they seemed to be opening up to at least the thought of looking south. The Norwegian and Danish accounts we met were frustrated with markets, too, but when it comes to sectors they were still rather unchanged in their views compared with earlier this year (with some exceptions, Danish accounts had, however, already been the most open to risk among Nordic investors).

Credit lines stubborn

Discussions are one thing, but whether investors have the flexibility to act on their convictions is another. A lack of flexibility had been a major issue in recent months as credit departments had been cutting lines and thus concentrating investors into an ever smaller universe of still investable sectors and issuers.

To find out more about this, we asked investors at the beginning of October whether they are still restricted in what they can do, or whether they have regained some of the ground they had lost. Looking at the overall results we feel that we haven’t really turned the corner yet when it comes to credit lines. There are some investors who have managed to get more flexibility and especially for UK asset managers credit lines have never really restricted them. However, more than half of the investors we asked are still facing the same restrictions as a year ago.

Looking at Nordic investors in this context, the results are even more sobering as 80% came back to us stating that their credit lines have not changed, while a small minority have even experienced further cuts. So while sentiment is certainly changing, many Nordic investors are still trapped in low risk but also low yield and low spread markets. This is obviously good news for Nordic issuers as demand is only slowly trickling down to the more higher yielding areas of the covered bond world.

If anything, Nordic investors are looking back to their domestic currency markets. Danish accounts in particular have started to move back some of their euro holdings into Danish krone covered bonds. The currency basis is adding badly needed basis points and while euro covered bonds have been grinding tighter, Danish krone markets have widened slightly.

Encumbrance talk points to senior

The feedback from Nordic investors and their statements about credit lines are supportive for Nordic issuers. This can certainly be seen in their CSI scores, which are among the best and certainly the most stable out there.

While investor demand continues to be supportive for Nordic issuers, they are facing headwinds from another angle. Swedish as well as Norwegian regulators have publicly started discussions about the usage of covered bonds and asset encumbrance.

While the Norwegian FSA as well as Swedish FSA and Swedish Riksbank have clearly highlighted the benefits of covered bonds in recent months, they have also focused on the fact that issuers have encumbered more assets on their balance sheets.

In Sweden the Riksbank and Finansinspektionen recently called for issuers to be more transparent in this regards after they pointed to the potential risks of high encumbrance levels.

The Norwegian FSA has even taken this discussion a step further this week, not just asking for more transparency but seemingly also intent on acting on too much encumbrance.

In this regard the press release talks about even potentially introducing covered bond issuance limits at some point, which have been a very popular tool among new covered bond markets but never before in already established markets.

From our perspective, there are a number of possible arguments against focusing too much on encumbrance and especially against singling out covered bonds as the main target of any rules. By far the most important source of balance sheet encumbrance lately has been central bank funding in many cases and not covered bonds, and stable long term funding reduces the probability of default at the same time as it increases the loss given default.

And while the Norwegian FSA stated that cheap mortgage covered bond funding leads to an overallocation of bank lending to the housing sector away from corporate loans, we would argue that institutions with a significant presence in the covered bond markets profit from this funding source for their unsecured funding cost, too, thereby also lowering the cost of funding for other types of loan. In addition to this, a bank’s decision with respect to a loan product mainly depends on their overall margin expectations, not just the funding cost.

For Swedish issuers, the encumbrance discussions seem to be at a fairly early stage. Looking at Norway, the FSA is more intent on acting but has already acknowledged the fact that it will have a hard time enforcing hard issuance limits in an already existent market.

The more likely initial outcome will be a bit similar to the approach by the UK and Dutch FSAs — the higher the level of covered bond usage and thus asset encumbrance, the more capital the regulator will require issuers to hold. This will happen on a bank by bank basis, though, and some banks will be affected more than others.

In our view, a common theme in all of this is, however, emerging. By bringing up the topic of asset encumbrance, regulators will be pushing many issuers to focus more on senior unsecured markets. This will certainly have a negative impact on covered bond issuance volumes for 2013.

And to come back to the start of the article, frustration about there being too little supply among investors who are still forced to stay in lower risk sectors will continue to be a major topic in the covered bond space. Regaining the flexibility to expand into higher risk sectors among investors is an extremely sticky and slow process.