CSI: Nordic style — still looking good

Aug 23rd, 2012

We have been calculating our covered bond market sentiment index 11 times since early 2011. In this period it has become a very useful tool to monitor investor sentiment across Europe and get a feeling for what issuers as well as investors are thinking about different markets. Florian Eichert, Senior Covered Bond Analyst, CA-CIB, investigates.

CSI issuers — how about the Nordics?

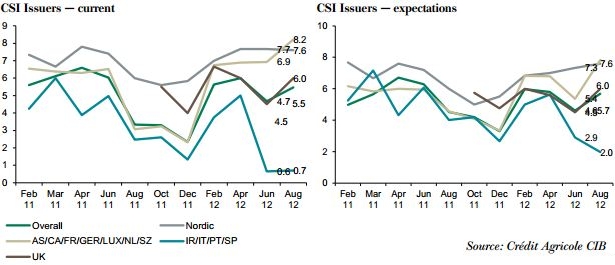

From our first CSI edition onwards, Nordic issuers have been the most optimistic across Europe. They have also been the most consistent in their answers.

While sentiment in Italy or Spain has moved up and down rather erratically, sentiment of Nordic issuers has remained stable at a high level.

CSI investors — how about investors’ view towards Nordic sectors?

It is one thing to be very optimistic as an issuer, but investors have to obviously back up this assessment, too. We have therefore looked at how sentiment towards the Nordic covered bond sectors has evolved over time.

The most optimistic investors towards Nordic covered bonds have been Nordic investors themselves. A strong domestic bias has been a very prominent feature of the covered bond market in recent months in virtually all regions, as investor flows have become much more focused on the respective home region. Having this support is a clear plus; losing it a major negative. Confidence among Spanish/Italian investors towards their domestic sectors had, for example, faded quickly in our June CSI edition. The result was that trading in these sectors, which had been dominated by domestics up to that point, came to an almost full stop in the following weeks. Nordic investors are, on the other hand, still in a good mood when it comes to Nordic covered bonds.

Core European investors who had become very risk averse in recent months have exhibited a similar domestic bias to the Nordic accounts. However, while Nordic investors were a little less open to increasing core European covered bond exposure, core European investors have been very optimistic about Nordic covered bonds.

Even recent headlines about high house price valuations have not had any noticeable impact here. Compared to what is happening in southern Europe, many investors seem to perceive these headlines almost as a luxury problem. Those that are more critical and put more focus on this issue often have no choice as there are hardly any alternatives for risk averse investors willing to reduce their Nordic exposure.

The sentiment among Italian/Spanish as well as Irish/Portuguese investors towards Nordic covered bonds is slightly below that of Nordic and core European investors. For many investors down south, Nordic markets are simply too expensive compared to their own funding costs or viable alternatives. They don’t have the same limitations with regards to peripheral covered bonds as many core European investors, and rather focus there than give up yield.

In addition to breaking our sentiment index down based on geography, we can also do it by investor type. The investors with the highest sentiment scores towards Nordic covered bond markets are bank treasuries. We have talked to many bank treasurers from core Europe, for example, that have very restrictive credit limits and cannot invest in a wide range of sectors anymore. In addition to this, the fact that Nordic issuers often focus on mid maturities (the majority of euro benchmark deals from Nordic issuers this year have been in the five year segment) and are not very active at the long end fits well with bank treasuries’ demand for bonds with maturities of up to five years.

Asset managers’ take on Nordic covered bonds has been very stable at a high level in past months. Many asset managers we have talked to had been building up positions in 2011 to make up for reductions in southern Europe. The first accounts are starting to talk to their end clients about changing portfolio rules to extend their investable universe to Spain and Italy after many issuers from those countries had dropped below current minimum ratings. But this is a tedious and slow process, which will not be felt in the short run.

The investor group with the lowest sentiment relatively speaking has been insurance companies. Very low yields as well as low spreads in Nordic covered bond markets are apparently something that creates slight problems for these investors that have to produce higher yields to match their liability sides than are currently available in low beta markets such as the Nordics.

Going forward — ongoing high?

As we have shown, sentiment towards Nordic covered bonds has been above average for quite some time now. However, we have increasingly had investors asking us about real estate markets in Nordic countries in recent weeks. Combined with tight spreads this has led to some investors starting to feel a bit uneasy about their Nordic covered bond exposure.

However, the fact that we cannot see this in our sentiment index leads us to the conclusion that these concerns are for now clearly overshadowed by problems in the periphery. Many investors seem to perceive the situation in the Nordics as either no problem at all or if they are more critical as a luxury problem in a portfolio that might also contain Portuguese, Irish, Spanish or Italian covered bonds.

We will continue to monitor our CSI for a weakening of the significant support the region has enjoyed since we began our CSI at the start of 2011. For now, however, we seem to still be looking good.